Question: Old MathJax webview Solve only b part solution of first is attached Solve only b Solutions of first is following Please show formulas in excel

Old MathJax webview

Solve only b part solution of first is attached

Solve only b Solutions of first is following

Please show formulas in excel do it asap

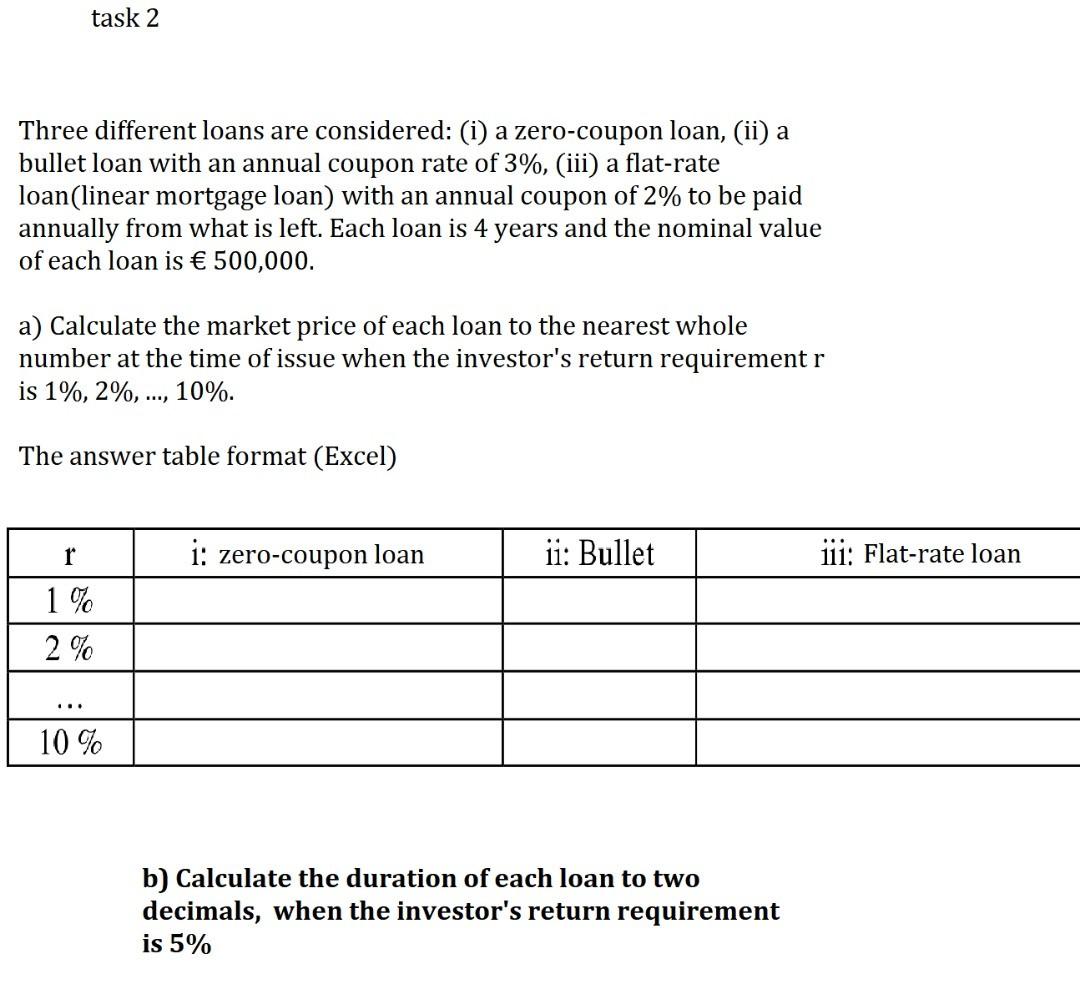

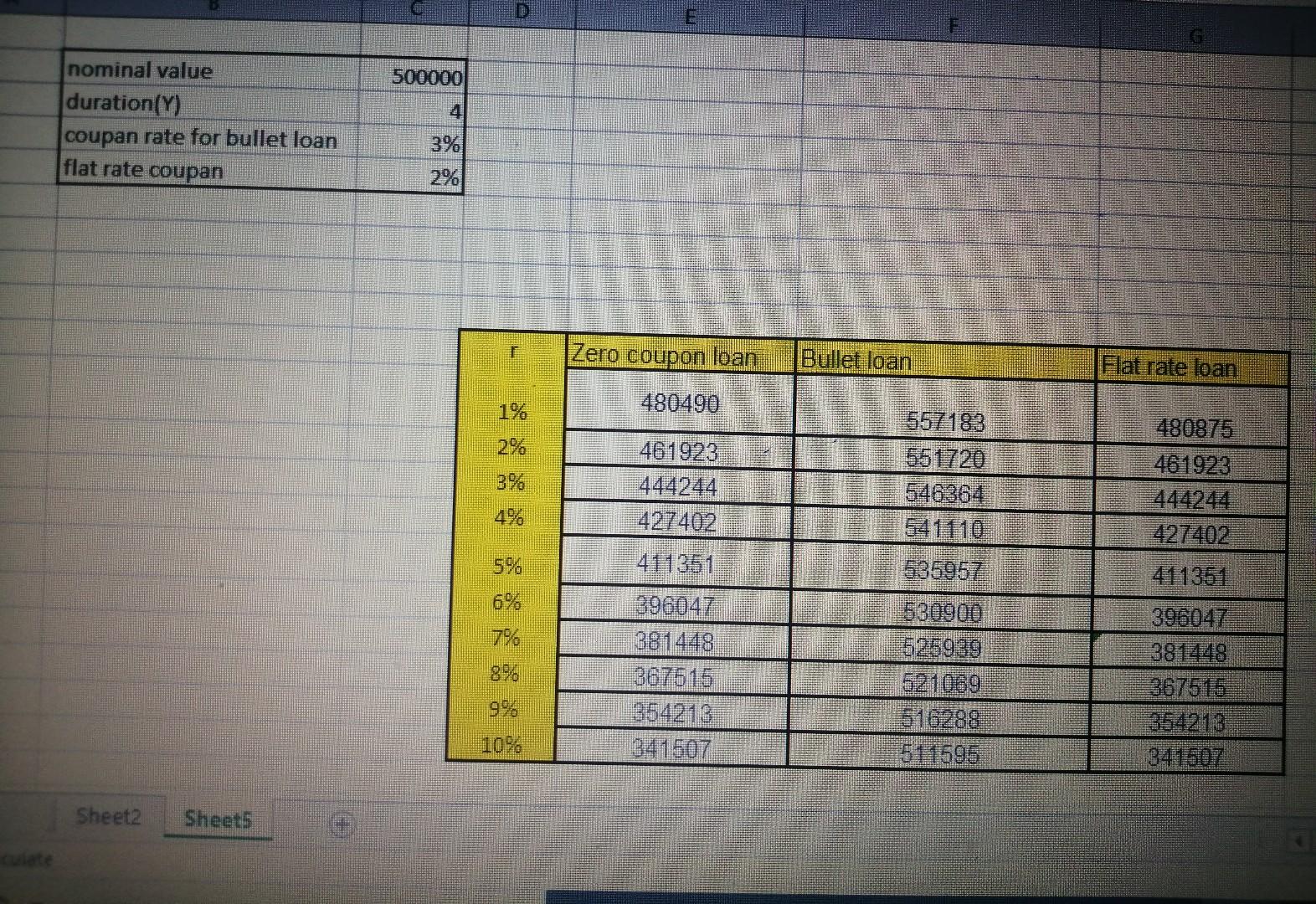

task 2 Three different loans are considered: (i) a zero-coupon loan, (ii) a bullet loan with an annual coupon rate of 3%, (iii) a flat-rate loan(linear mortgage loan) with an annual coupon of 2% to be paid annually from what is left. Each loan is 4 years and the nominal value of each loan is 500,000. a) Calculate the market price of each loan to the nearest whole number at the time of issue when the investor's return requirement r is 1%, 2%, ..., 10%. The answer table format (Excel) r i: zero-coupon loan ii: Bullet iii: Flat-rate loan 1 % 2 % ... 10 % b) Calculate the duration of each loan to two decimals, when the investor's return requirement is 5% D 500000 nominal value duration(Y) coupan rate for bullet loan flat rate coupan 2% Zero coupon loan. Bullet loan Flat rate loan 1% 480490 2% 461923 444244 427402 557183 551720 546364 541110 535957 480875 461923 444244 427402 4% 5% 411351 411351 6% 7% 896 396047 381448 367515 354213 341507 530900 525989 621089 516288 511595 396047 381448 367515 354213 341607 9% 10% Sheet2 Sheets task 2 Three different loans are considered: (i) a zero-coupon loan, (ii) a bullet loan with an annual coupon rate of 3%, (iii) a flat-rate loan(linear mortgage loan) with an annual coupon of 2% to be paid annually from what is left. Each loan is 4 years and the nominal value of each loan is 500,000. a) Calculate the market price of each loan to the nearest whole number at the time of issue when the investor's return requirement r is 1%, 2%, ..., 10%. The answer table format (Excel) r i: zero-coupon loan ii: Bullet iii: Flat-rate loan 1 % 2 % ... 10 % b) Calculate the duration of each loan to two decimals, when the investor's return requirement is 5% D 500000 nominal value duration(Y) coupan rate for bullet loan flat rate coupan 2% Zero coupon loan. Bullet loan Flat rate loan 1% 480490 2% 461923 444244 427402 557183 551720 546364 541110 535957 480875 461923 444244 427402 4% 5% 411351 411351 6% 7% 896 396047 381448 367515 354213 341507 530900 525989 621089 516288 511595 396047 381448 367515 354213 341607 9% 10% Sheet2 Sheets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts