Question: Old MathJax webview t 284 10 QUESTIONS AND PROBLEMS 1. Assume that you expect that the average return on a security in various markets is

Old MathJax webview

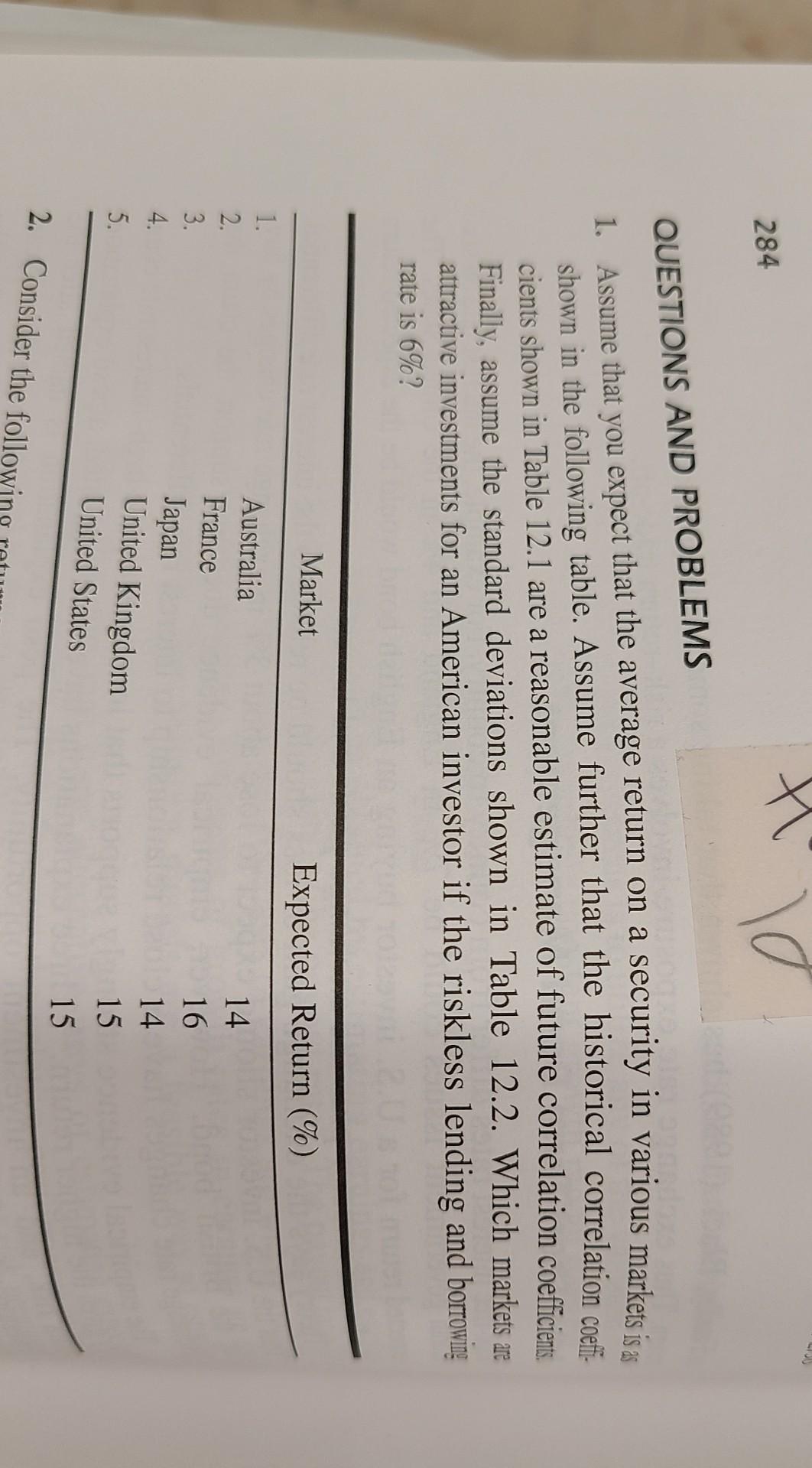

t 284 10 QUESTIONS AND PROBLEMS 1. Assume that you expect that the average return on a security in various markets is a shown in the following table. Assume further that the historical correlation coeti. cients shown in Table 12.1 are a reasonable estimate of future correlation coefficients Finally, assume the standard deviations shown in Table 12.2. Which markets are attractive investments for an American investor if the riskless lending and borrowing rate is 6%? Market Expected Return (%) 1. 2. 3. 4. 5. Australia France Japan United Kingdom United States 14 16 14 15 15 2. Consider the following 10 out Question 1 Refer to the text, Chapter 12 Problem 1. t 284 10 QUESTIONS AND PROBLEMS 1. Assume that you expect that the average return on a security in various markets is a shown in the following table. Assume further that the historical correlation coeti. cients shown in Table 12.1 are a reasonable estimate of future correlation coefficients Finally, assume the standard deviations shown in Table 12.2. Which markets are attractive investments for an American investor if the riskless lending and borrowing rate is 6%? Market Expected Return (%) 1. 2. 3. 4. 5. Australia France Japan United Kingdom United States 14 16 14 15 15 2. Consider the following 10 out Question 1 Refer to the text, Chapter 12 Problem 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts