Question: Old MathJax webview Tax project I need help with my tax project. Anyway that you can help, I would be glad. I have highlighted 2020

Old MathJax webview

Tax project

I need help with my tax project. Anyway that you can help, I would be glad. I have highlighted 2020 on one of the images it's supposed to say 2021.

Please I'm failing this class, help me rescue myself.

Please if you can group the information, on the start with what you know worksheet. Then I can do the rest with excel.

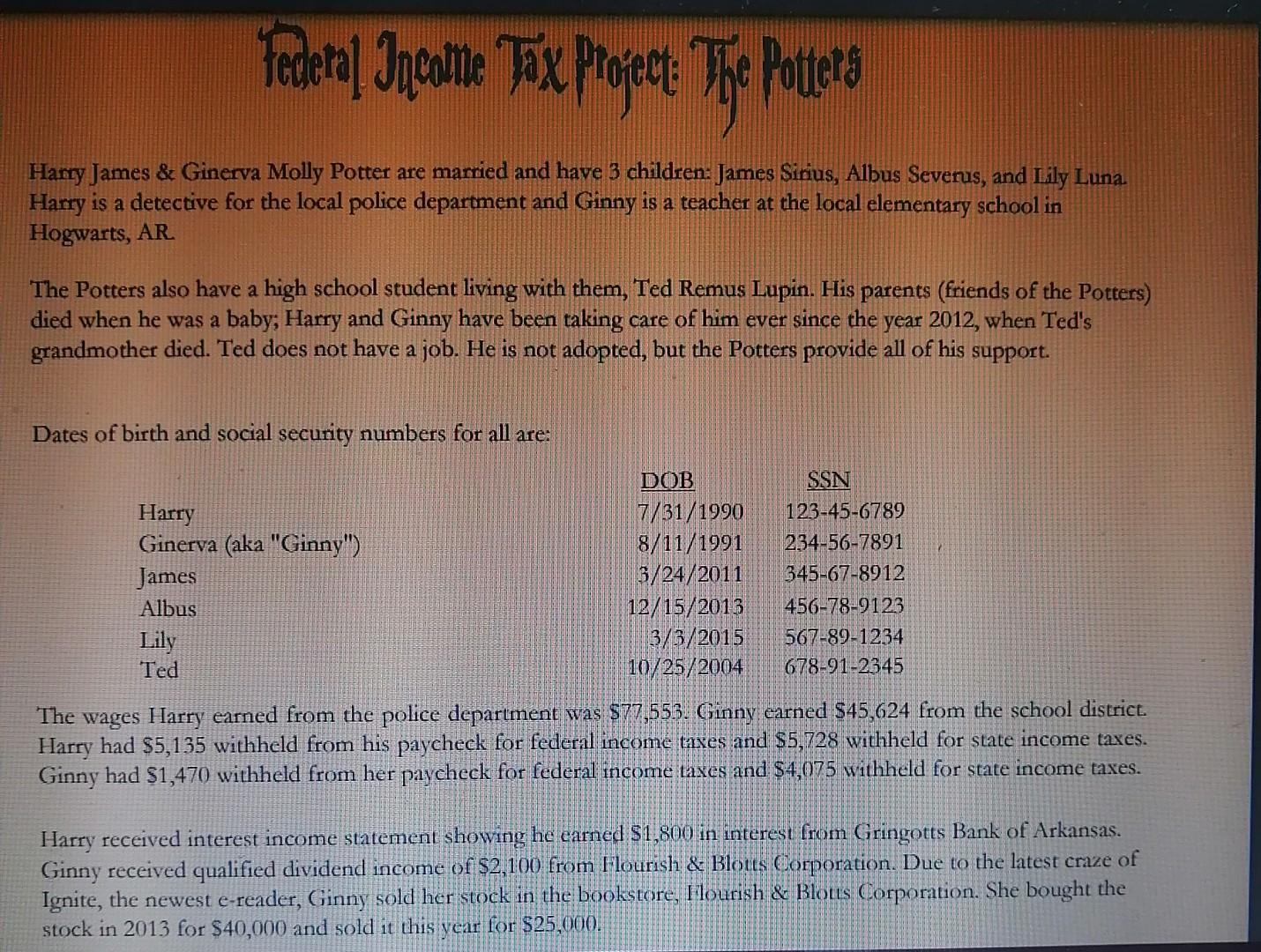

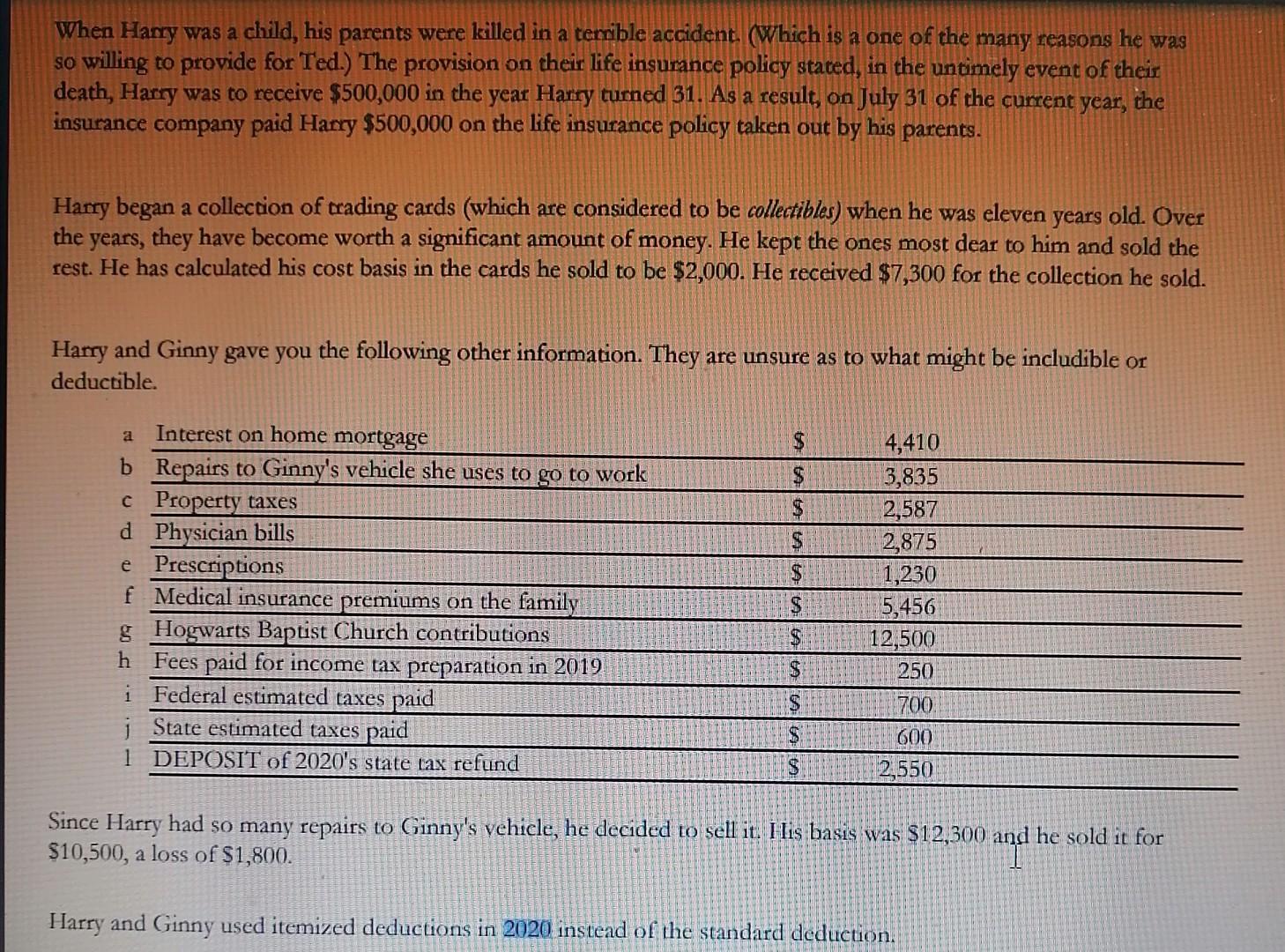

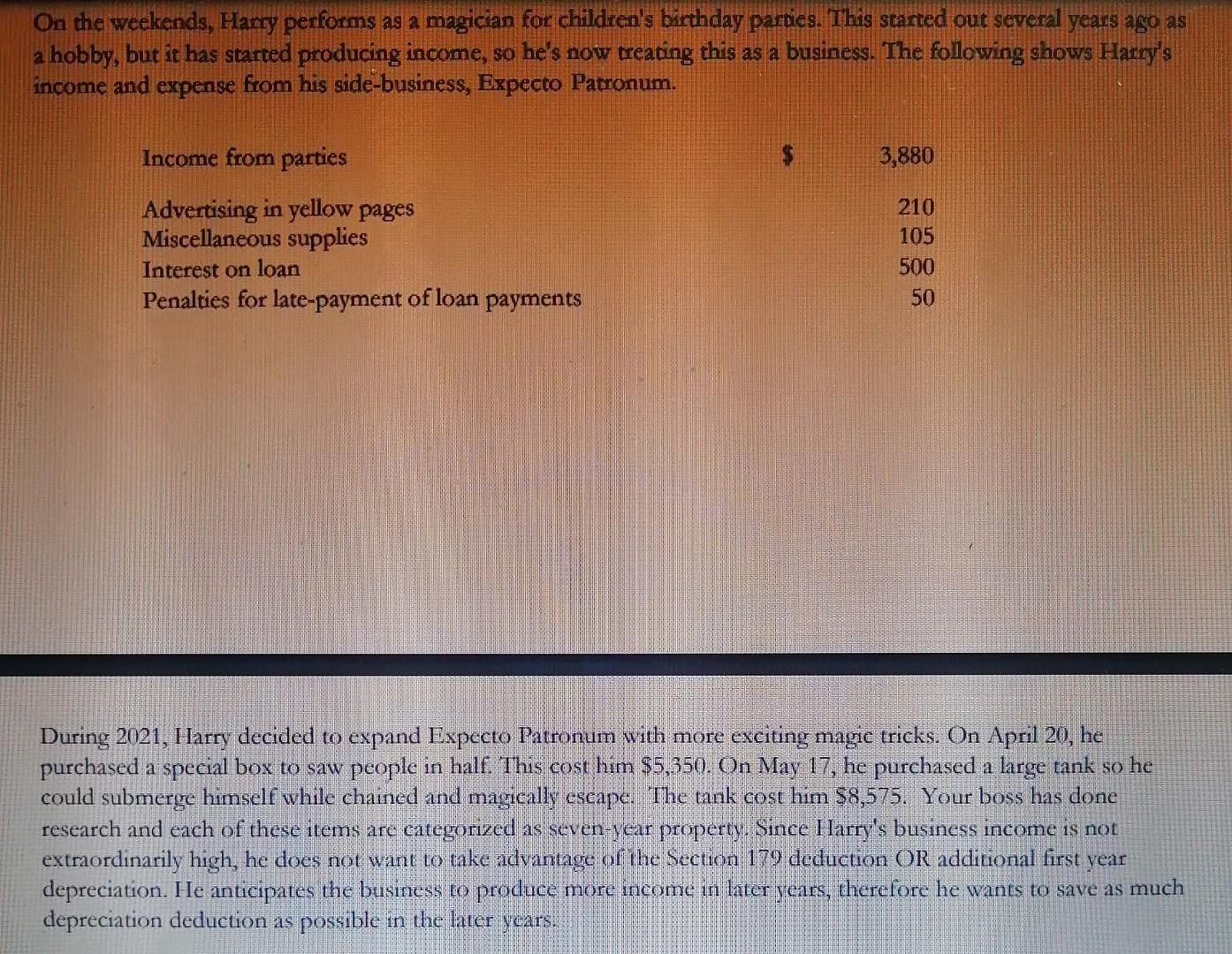

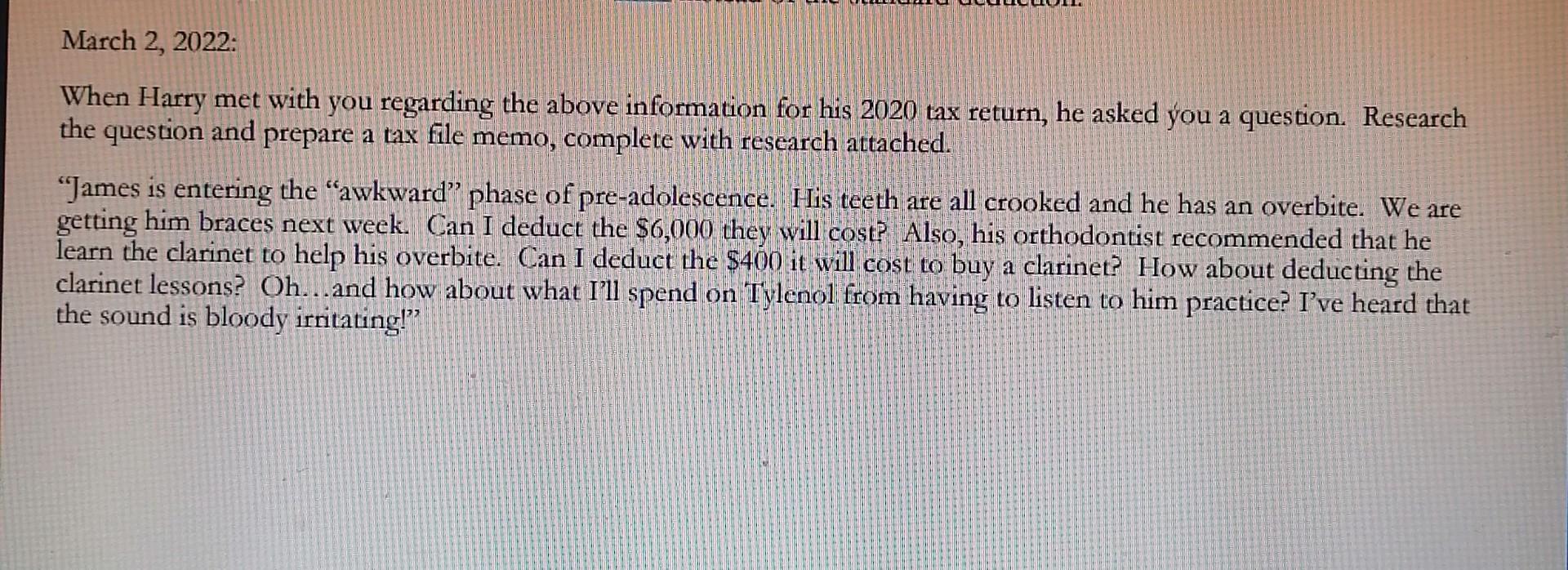

federal Sponte Tax Project : The Pottera Harry James & Ginerva Molly Potter are married and have 3 children: James Sirius, Albus Severus, and Lily Luna. Harry is a detective for the local police department and Ginny is a teacher at the local elementary school in Hogwarts, AR The Potters also have a high school student living with them, Ted Remus Lupin. His parents (friends of the Potters) died when he was a baby, Harry and Ginny have been taking care of him ever since the year 2012, when Ted's grandmother died. Ted does not have a job. He is not adopted, but the Potters provide all of his support. Dates of birth and social security numbers for all are: Harry Ginerva (aka "Ginny") James Albus Lily Ted DOB 7/31/1990 8/11/1991 3/24/2011 12/15/2013 3/3/2015 10/25/2004 SSN 123-45-6789 234-56-7891 345-67-8912 456-78-9123 567-89-1234 678-91-2345 The wages Harry earned from the police department was $77 553. Ginny earned $45,624 from the school district Harry had $5,135 withheld from his paycheck for federal income taxes and $5,728 withheld for state income taxes. Ginny had $1,470 withheld from her paycheck for federal income taxes and $4,075 withheld for state income taxes. Harry received interest income statement showing he carned $1,800 in interest from Gringotts Bank of Arkansas. Ginny received qualified dividend income of $2,100 from Flourish & Blous Corporation. Due to the latest craze of Ignite, the newest e-reader, Ginny sold her stock in the bookstore, Hourish & Blotts Corporation. She bought the stock in 2013 for $40,000 and sold it this year for $25,000. When Harry was a child, his parents were killed in a terrible accident (Which is a one of the many reasons he was so willing to provide for Ted.) The provision on their life insurance policy stated in the untimely event of their death, Harry was to receive $500,000 in the year Harry turned 31. As a result, on July 31 of the current year, the insurance company paid Harry $500,000 on the life insurance policy taken out by his parents. Harry began a collection of trading cards (which are considered to be collectibles) when he was eleven years old. Over the years, they have become worth a significant amount of money. He kept the ones most dear to him and sold the rest. He has calculated his cost basis in the cards he sold to be $2,000. He received $7,300 for the collection he sold. Harry and Ginny gave you the following other information. They are unsure as to what might be includible or deductible. $ $ S $ a Interest on home mortgage b Repairs to Ginny's vehicle she uses to go to work C Property taxes d Physician bills e Prescriptions f Medical insurance premiums on the family g Hogwarts Baptist Church contributions h Fees paid for income tax preparation in 2019 i Federal estimated taxes paid State estimated taxes paid 1 DEPOSIT of 2020's state tax refund TATAAAA A A 4,410 3,835 2,587 2,875 1,230 5,456 12,500 250 700 600 2,550 $ Since Harry had so many repairs to Ginny's vehicle, he decided to sell it. His basis was $12,300 and he sold it for $10,500, a loss of $1,800. and Harry and Ginny used itemized deductions in 2020 instead of the standard deduction, On the weekends, Harry performs as a magician for children's birthday parties. This started out several years ago as a hobby, but it has started producing income, so he's now treating this as a business. The following shows Harry's income and expense from his side-business, Expecto Patronum. Income from parties 3,880 Advertising in yellow pages Miscellaneous supplies Interest on loan Penalties for late-payment of loan payments 210 105 500 50 During 2021, Harry decided to expand Expecto Patronum with more exciting magic tricks. On April 20, he purchased a special box to saw people in half. This cost him $5,350. On May 17, he purchased a large tank so he could submerge himself while chained and magically escape. The tank cost him $8,575. Your boss has done research and each of these items are categorized as seven-year property. Since Harry's business income is not extraordinarily high, he does not want to take advantage of the Section 179 deduction OR additional first year depreciation. He anticipates the business to produce more income in later years, therefore he wants to save as much depreciation deduction as possible in the later ycars. March 2, 2022 When Harry met with you regarding the above information for his 2020 tax return, he asked you a question. Research the question and prepare a tax file memo, complete with research attached. "James is entering the 'awkward phase of pre-adolescence. His teeth are all crooked and he has an overbite. We are getting him braces next week. Can I deduct the $6,000 they will cost? Also, his orthodontist recommended that he learn the clarinet to help his overbite. Can I deduct the $400 it will cost to buy a clarinet? How about deducting the clarinet lessons? Oh...and how about what I'll spend on Tylenol from having to listen to him practice? I've heard that the sound is bloody irritating! Start With What You Know... Filing Status/Dependents FROMAGIDeductions Income Credits and Withheld Amounts FOR AGI Deductions Non-Deductible Items federal Sponte Tax Project : The Pottera Harry James & Ginerva Molly Potter are married and have 3 children: James Sirius, Albus Severus, and Lily Luna. Harry is a detective for the local police department and Ginny is a teacher at the local elementary school in Hogwarts, AR The Potters also have a high school student living with them, Ted Remus Lupin. His parents (friends of the Potters) died when he was a baby, Harry and Ginny have been taking care of him ever since the year 2012, when Ted's grandmother died. Ted does not have a job. He is not adopted, but the Potters provide all of his support. Dates of birth and social security numbers for all are: Harry Ginerva (aka "Ginny") James Albus Lily Ted DOB 7/31/1990 8/11/1991 3/24/2011 12/15/2013 3/3/2015 10/25/2004 SSN 123-45-6789 234-56-7891 345-67-8912 456-78-9123 567-89-1234 678-91-2345 The wages Harry earned from the police department was $77 553. Ginny earned $45,624 from the school district Harry had $5,135 withheld from his paycheck for federal income taxes and $5,728 withheld for state income taxes. Ginny had $1,470 withheld from her paycheck for federal income taxes and $4,075 withheld for state income taxes. Harry received interest income statement showing he carned $1,800 in interest from Gringotts Bank of Arkansas. Ginny received qualified dividend income of $2,100 from Flourish & Blous Corporation. Due to the latest craze of Ignite, the newest e-reader, Ginny sold her stock in the bookstore, Hourish & Blotts Corporation. She bought the stock in 2013 for $40,000 and sold it this year for $25,000. When Harry was a child, his parents were killed in a terrible accident (Which is a one of the many reasons he was so willing to provide for Ted.) The provision on their life insurance policy stated in the untimely event of their death, Harry was to receive $500,000 in the year Harry turned 31. As a result, on July 31 of the current year, the insurance company paid Harry $500,000 on the life insurance policy taken out by his parents. Harry began a collection of trading cards (which are considered to be collectibles) when he was eleven years old. Over the years, they have become worth a significant amount of money. He kept the ones most dear to him and sold the rest. He has calculated his cost basis in the cards he sold to be $2,000. He received $7,300 for the collection he sold. Harry and Ginny gave you the following other information. They are unsure as to what might be includible or deductible. $ $ S $ a Interest on home mortgage b Repairs to Ginny's vehicle she uses to go to work C Property taxes d Physician bills e Prescriptions f Medical insurance premiums on the family g Hogwarts Baptist Church contributions h Fees paid for income tax preparation in 2019 i Federal estimated taxes paid State estimated taxes paid 1 DEPOSIT of 2020's state tax refund TATAAAA A A 4,410 3,835 2,587 2,875 1,230 5,456 12,500 250 700 600 2,550 $ Since Harry had so many repairs to Ginny's vehicle, he decided to sell it. His basis was $12,300 and he sold it for $10,500, a loss of $1,800. and Harry and Ginny used itemized deductions in 2020 instead of the standard deduction, On the weekends, Harry performs as a magician for children's birthday parties. This started out several years ago as a hobby, but it has started producing income, so he's now treating this as a business. The following shows Harry's income and expense from his side-business, Expecto Patronum. Income from parties 3,880 Advertising in yellow pages Miscellaneous supplies Interest on loan Penalties for late-payment of loan payments 210 105 500 50 During 2021, Harry decided to expand Expecto Patronum with more exciting magic tricks. On April 20, he purchased a special box to saw people in half. This cost him $5,350. On May 17, he purchased a large tank so he could submerge himself while chained and magically escape. The tank cost him $8,575. Your boss has done research and each of these items are categorized as seven-year property. Since Harry's business income is not extraordinarily high, he does not want to take advantage of the Section 179 deduction OR additional first year depreciation. He anticipates the business to produce more income in later years, therefore he wants to save as much depreciation deduction as possible in the later ycars. March 2, 2022 When Harry met with you regarding the above information for his 2020 tax return, he asked you a question. Research the question and prepare a tax file memo, complete with research attached. "James is entering the 'awkward phase of pre-adolescence. His teeth are all crooked and he has an overbite. We are getting him braces next week. Can I deduct the $6,000 they will cost? Also, his orthodontist recommended that he learn the clarinet to help his overbite. Can I deduct the $400 it will cost to buy a clarinet? How about deducting the clarinet lessons? Oh...and how about what I'll spend on Tylenol from having to listen to him practice? I've heard that the sound is bloody irritating! Start With What You Know... Filing Status/Dependents FROMAGIDeductions Income Credits and Withheld Amounts FOR AGI Deductions Non-Deductible Items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts