Question: Old MathJax webview Which statement about the cost recovery method is correct? O A. This method defers any profit until the contract is completed. O

Old MathJax webview

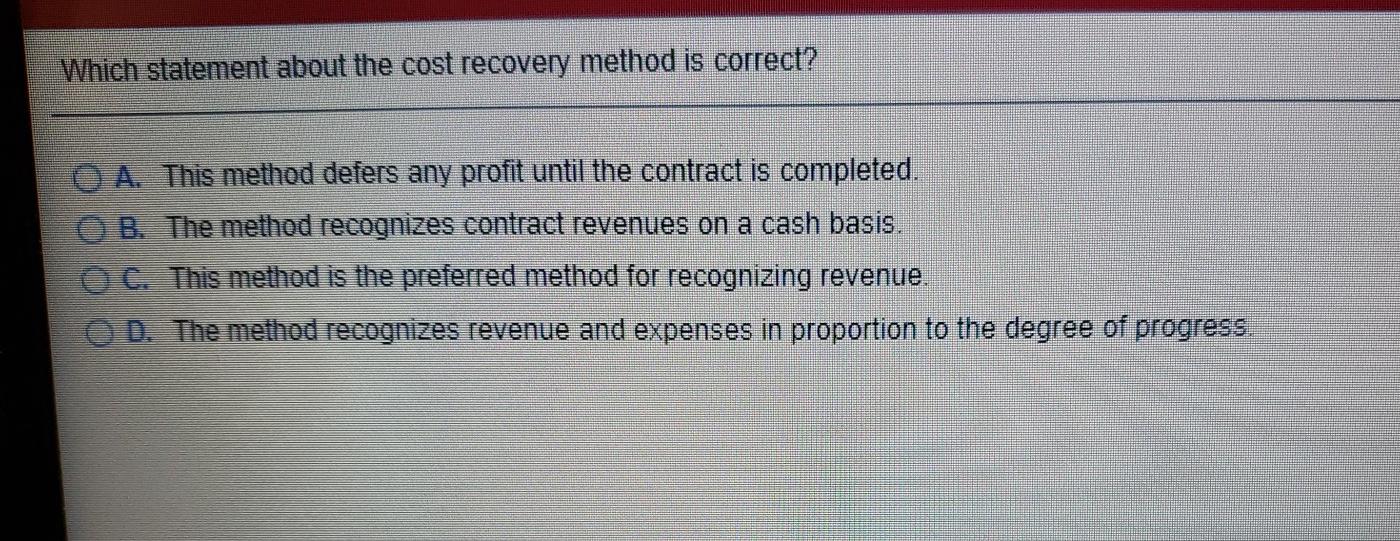

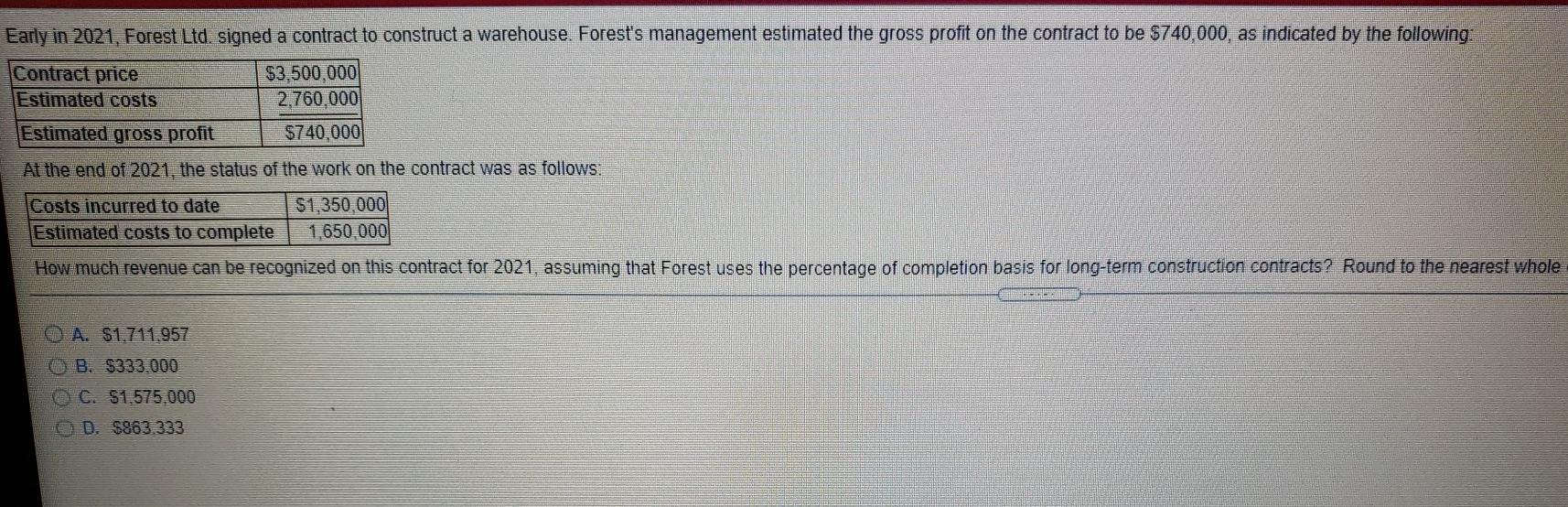

Which statement about the cost recovery method is correct? O A. This method defers any profit until the contract is completed. O B. The method recognizes contract revenues on a cash basis. OC. This method is the preferred method for recognizing revenue. O D. The method recognizes revenue and expenses in proportion to the degree of progress Early in 2021, Forest Ltd. signed a contract to construct a warehouse. Forest's management estimated the gross profit on the contract to be $740,000, as indicated by the following: Contract price $3,500,000 Estimated costs 2,760.000 Estimated gross profit $740,000 At the end of 2021, the status of the work on the contract was as follows: Costs incurred to date $1,350,000 Estimated costs to complete 1,650 000 How much revenue can be recognized on this contract for 2021, assuming that Forest uses the percentage of completion basis for long-term construction contracts? Round to the nearest whole BEL A. $1.711.957 0 B. $333,000 C. $1.575.000 D. $863.333

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts