Question: Old Tom Morrison Golf Inc. is evaluating a new product: high compression golf balls. The ball is tentatively called the 'Guttie'. The production line

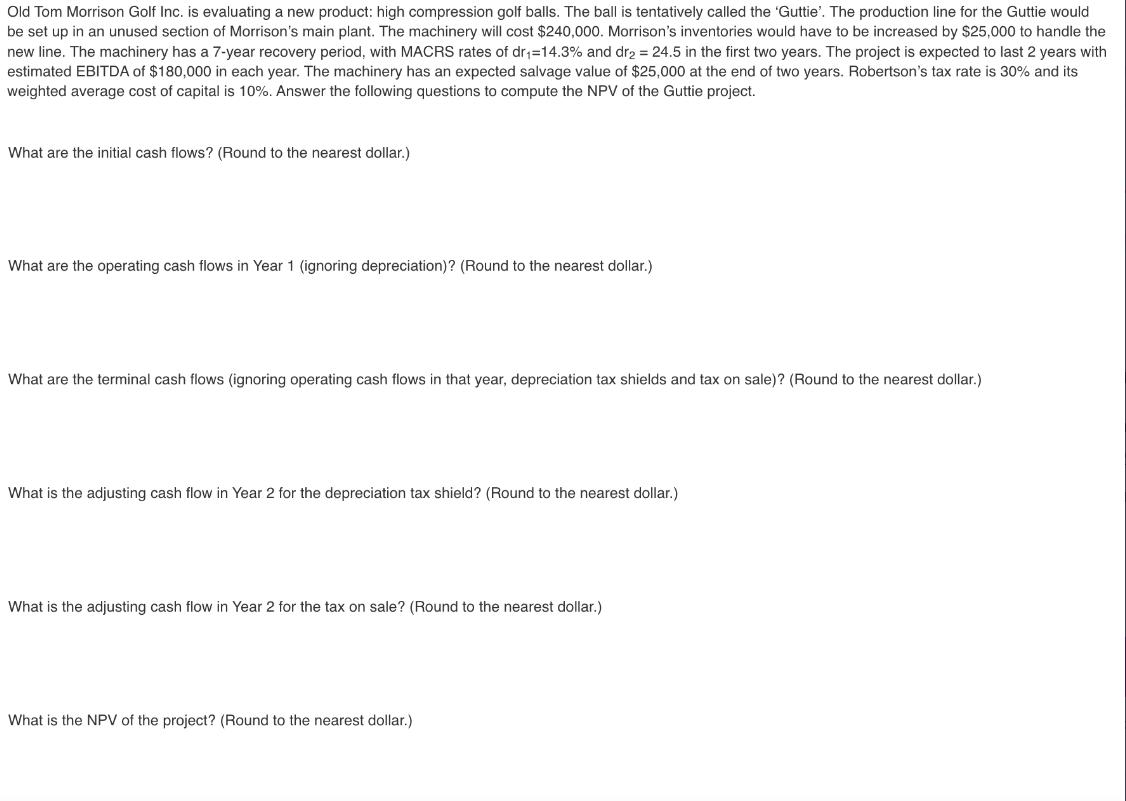

Old Tom Morrison Golf Inc. is evaluating a new product: high compression golf balls. The ball is tentatively called the 'Guttie'. The production line for the Guttie would be set up in an unused section of Morrison's main plant. The machinery will cost $240,000. Morrison's inventories would have to be increased by $25,000 to handle the new line. The machinery has a 7-year recovery period, with MACRS rates of dr=14.3% and dr = 24.5 in the first two years. The project is expected to last 2 years with estimated EBITDA of $180,000 in each year. The machinery has an expected salvage value of $25,000 at the end of two years. Robertson's tax rate is 30% and its weighted average cost of capital is 10%. Answer the following questions to compute the NPV of the Guttie project. What are the initial cash flows? (Round to the nearest dollar.) What are the operating cash flows in Year 1 (ignoring depreciation)? (Round to the nearest dollar.) What are the terminal cash flows (ignoring operating cash flows in that year, depreciation tax shields and tax on sale)? (Round to the nearest dollar.) What is the adjusting cash flow in Year 2 for the depreciation tax shield? (Round to the nearest dollar.) What is the adjusting cash flow in Year 2 for the tax on sale? (Round to the nearest dollar.) What is the NPV of the project? (Round to the nearest dollar.)

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts