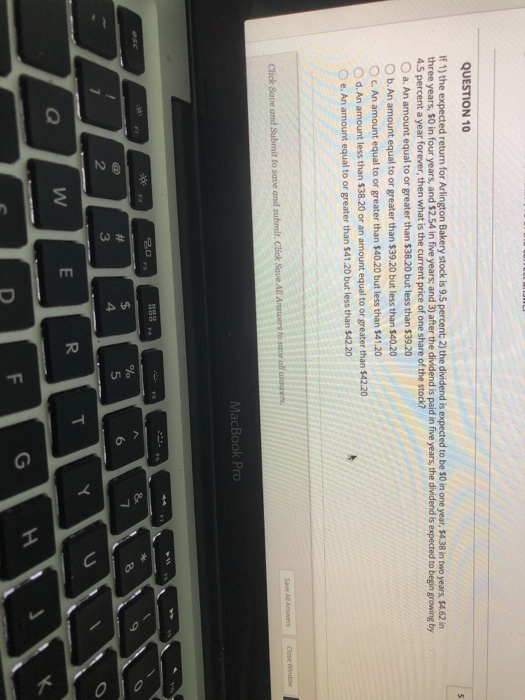

Question: OLULI QUESTION 10 5 If 1) the expected return for Arlington Bakery stock is 9.5 percent; 2) the dividend is expected to be $0 in

OLULI QUESTION 10 5 If 1) the expected return for Arlington Bakery stock is 9.5 percent; 2) the dividend is expected to be $0 in one year, 54.38 in two years. 54.62 in three years, $0 in four years, and $2.54 in five years; and 3) after the dividend is paid in five years, the dividend is expected to begin growing by 4.5 percent a year forever, then what is the current price of one share of the stock? O a. An amount equal to or greater than $38.20 but less than $39.20 O b. An amount equal to or greater than $39.20 but less than $40.20 c. An amount equal to or greater than $40.20 but less than $41.20 d. An amount less than $38.20 or an amount equal to or greater than $42.20 e. An amount equal to or greater than $41.20 but less than $42.20 Save All Anvers Close Window Click Save and Submit to save and submit. Click Save All Answers to sque all answers MacBook Pro FS & 7 # 3 $ 4 % 5 6 0 N C T Y R E w G F H

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts