Question: QUESTION 1 if 1) the expected return for Arlington Bakery stock is 9.5 percent: 2) the dividend is expected to be so in one year,

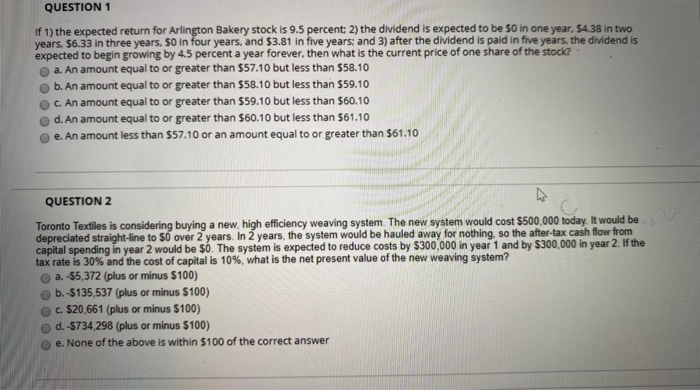

QUESTION 1 if 1) the expected return for Arlington Bakery stock is 9.5 percent: 2) the dividend is expected to be so in one year, 54.38 in two years, 56.33 in three years. $0 in four years, and $3.81 in five years, and 3) after the dividend is paid in five years, the dividend is expected to begin growing by 4.5 percent a year forever, then what is the current price of one share of the stock a. An amount equal to or greater than $57.10 but less than $58.10 b. An amount equal to or greater than $58.10 but less than $59.10 C. An amount equal to or greater than $59.10 but less than $60.10 d. An amount equal to or greater than $60.10 but less than $61.10 e. An amount less than $57.10 or an amount equal to or greater than $61.10 QUESTION 2 Toronto Textiles is considering buying a new, high efficiency weaving system. The new system would cost $500,000 today. It would be depreciated straight-line to 50 over 2 years. In 2 years, the system would be hauled away for nothing, so the after-tax cash flow from capital spending in year 2 would be so. The system is expected to reduce costs by $300,000 in year 1 and by $300,000 in year 2. If the tax rate is 30% and the cost of capital is 10%, what is the net present value of the new weaving system? a. -$5,372 (plus or minus $100) b.-S135,537 (plus or minus $100) c. $20,661 (plus or minus $100) d. -$734,298 (plus or minus $100) e. None of the above is within $100 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts