Question: ome ?? ?? ?? ???? ?? ??? ?? ?? eagj%? 14% ?6?6???6:44:48 a Chapter 12 Search Textbook Solutions | C x ? Oezio.mbeducation.com hm.tpx Exercise

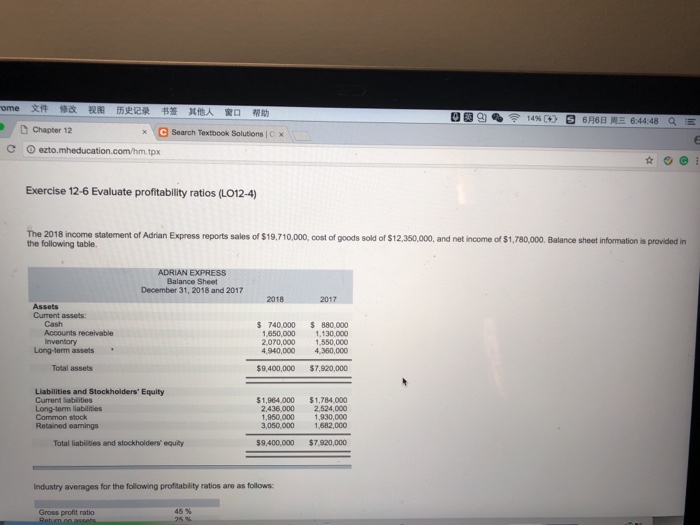

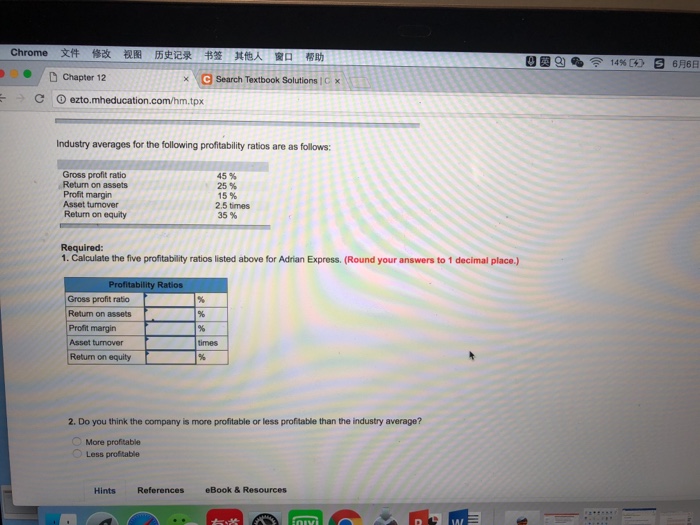

ome ?? ?? ?? ???? ?? ??? ?? ?? eagj%? 14% ?6?6???6:44:48 a Chapter 12 Search Textbook Solutions | C x ? Oezio.mbeducation.com hm.tpx Exercise 12-6 Evaluate profitability ratios (LO12-4) The 2018 income statement of Adrian Express reports sales of $19,710,000, cost of goods sold of $12,350,000, and net income of $1,780,000. Balance sheet information is provided an the following table. ADRIAN EXPRESS Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Current assets: Cash $ 740,000 880,000 Accounts receivable Inventory ,650,000 1,130,000 1,550,000 2,070,000 4,940,000 Long-term assets 4,360,000 Total assets $9,400,000 $7,920,000 Liabilities and Stockholders' Equity Current liablities Long-term liabilties Common stock Retained earnings $1,964,000 $1,784,000 2.436.000 2,524,000 1,950,000 1930,000 3,050,000 1,682,000 Total liabilities and stockholders equity $9.400,000 $7,920,000 Industry averages for the following proftability ratios are as follows: Gross profit ratio 45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts