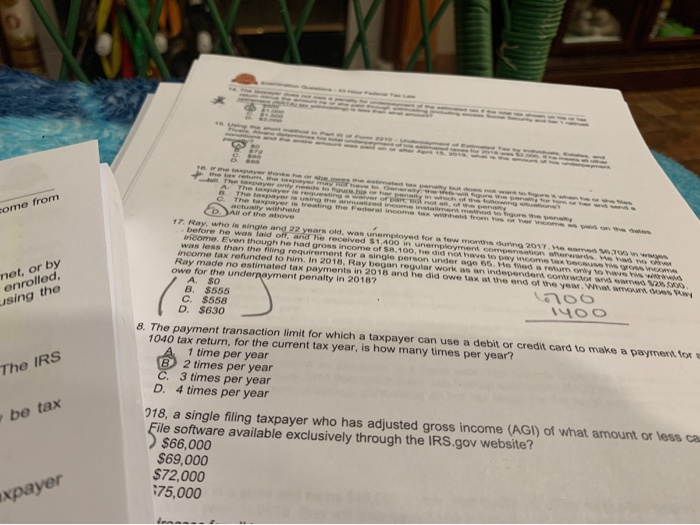

Question: ome from net, or by enrolled, using the we The layer is brother women who D AN of the above 17. Ray, who is single

ome from net, or by enrolled, using the we The layer is brother women who D AN of the above 17. Ray, who is single and 2 years old, was unemployed for a few months before he was laid off, and he received $1.400 in unemployment compensation w 2017. s A cor Fven though he had gross income of 50, 100, tre did not have a was less than the fining requirement for single person under age 66. He ed a remek ve income tax refunded to him. In 2018, Ray began regular work as a dependent E R A S Ray made no estimated tax payments in 2016 and he did we are the end of you owe for the underpayment penalty in 2018? A SO 100 B. $555 1400 C. $558 D. $630 8. The payment transaction limit for which a taxpayer can use a debitor credit card to make a o r 1040 tax return, for the current tax year, is how many times per year? A 1 time per year B 2 times per year C. 3 times per year D. 4 times per year 018, a single filing taxpayer who has adjusted gross income (AGI) of what amount or less File software available exclusively through the IRS.gov website? > $66,000 $69,000 $72,000 175,000 The IRS be tax xpayer ome from net, or by enrolled, using the we The layer is brother women who D AN of the above 17. Ray, who is single and 2 years old, was unemployed for a few months before he was laid off, and he received $1.400 in unemployment compensation w 2017. s A cor Fven though he had gross income of 50, 100, tre did not have a was less than the fining requirement for single person under age 66. He ed a remek ve income tax refunded to him. In 2018, Ray began regular work as a dependent E R A S Ray made no estimated tax payments in 2016 and he did we are the end of you owe for the underpayment penalty in 2018? A SO 100 B. $555 1400 C. $558 D. $630 8. The payment transaction limit for which a taxpayer can use a debitor credit card to make a o r 1040 tax return, for the current tax year, is how many times per year? A 1 time per year B 2 times per year C. 3 times per year D. 4 times per year 018, a single filing taxpayer who has adjusted gross income (AGI) of what amount or less File software available exclusively through the IRS.gov website? > $66,000 $69,000 $72,000 175,000 The IRS be tax xpayer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts