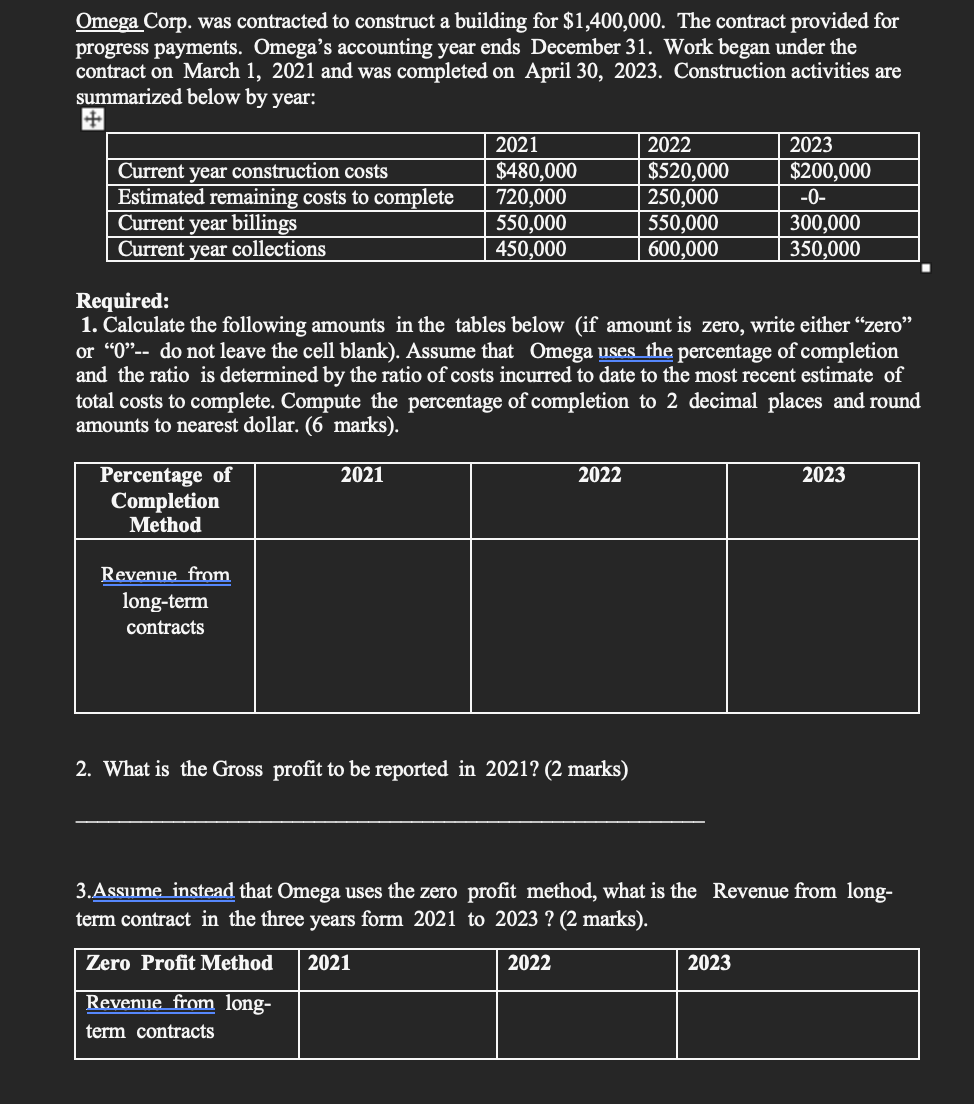

Question: Omega Corp. was contracted to construct a building for $ 1 , 4 0 0 , 0 0 0 . The contract provided for progress

Omega Corp. was contracted to construct a building for $ The contract provided for

progress payments. Omega's accounting year ends December Work began under the

contract on March and was completed on April Construction activities are

summarized below by year:

Required:

Calculate the following amounts in the tables below if amount is zero, write either "zero"

or do not leave the cell blank Assume that Omega uses the percentage of completion

and the ratio is determined by the ratio of costs incurred to date to the most recent estimate of

total costs to complete. Compute the percentage of completion to decimal places and round

What is the Gross profit to be reported in marks

Assume instead that Omega uses the zero profit method, what is the Revenue from long

term contract in the three years form to marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock