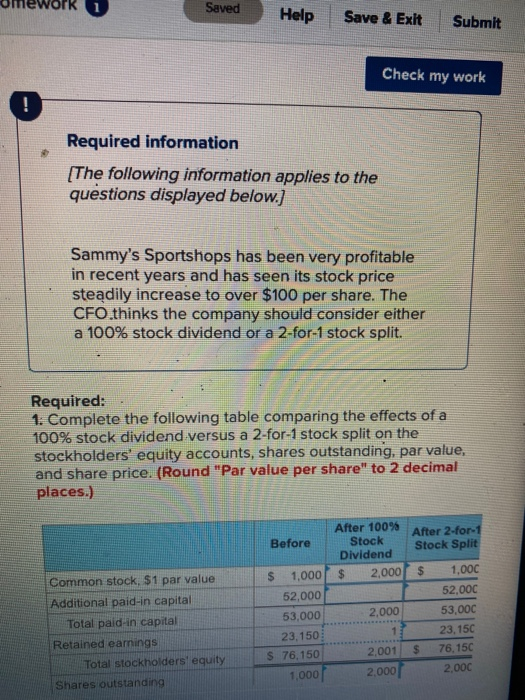

Question: Omework 1 Saved Help Save & Exit Submit Check my work Required information [The following information applies to the questions displayed below.) Sammy's Sportshops has

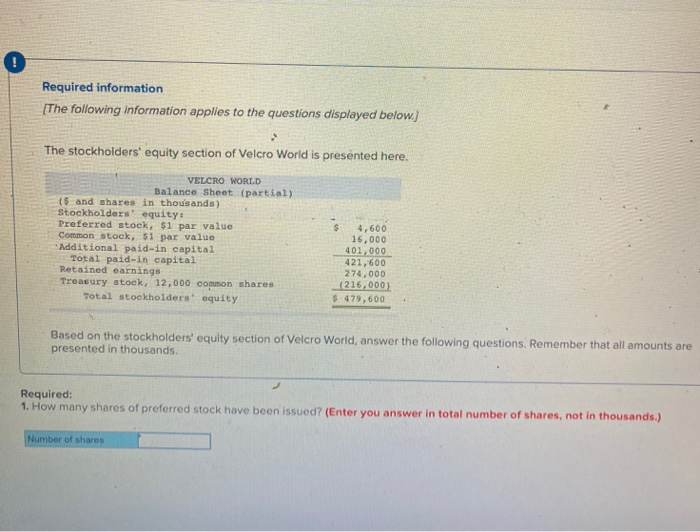

Omework 1 Saved Help Save & Exit Submit Check my work Required information [The following information applies to the questions displayed below.) Sammy's Sportshops has been very profitable in recent years and has seen its stock price steadily increase to over $100 per share. The CFO.thinks the company should consider either a 100% stock dividend or a 2-for-1 stock split. Required: 1: Complete the following table comparing the effects of a 100% stock dividend versus a 2-for-1 stock split on the stockholders' equity accounts, shares outstanding, par value, and share price. (Round "Par value per share" to 2 decimal places.) After 100% Stock After 2-for-1 Before Stock Split Dividend $ 2,000 $ Common stock, $1 par value Additional paid-in capital Total paid-in capital Retained eamings Total stockholders' equity Shares outstanding $ 1.000 52,000 53,000 23,150 S 76.150 1,000 2,000 1 2,001 2,000 1,00C 52,00C 53,000 23,150 76,15C 2,000 $ Required information [The following information applies to the questions displayed below.) The stockholders' equity section of Velcro World is presented here. VELCRO WORLD Balance Sheet (partial) ($ and shares in thousands) Stockholders' equity! Preferred stock, $1 par value Common stock, 51 par value Additional paid-in capital Total paid-in capital Retained earnings Treasury stock, 12,000 common shares Total stockholders' equity 4,600 16.000 401,000 421,600 274,000 (216,000) $ 479,600 Based on the stockholders' equity section of Velcro World, answer the following questions. Remember that all amounts are presented in thousands Required: 1. How many shares of preferred stock have been issued? (Enter you answer in total number of shares, not in thousands) Number of shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts