Question: On 1 1 / 5 / 2 0 1 5 , in an interview with law enforcement, Alex, President of Acme Construction Company ( ACME

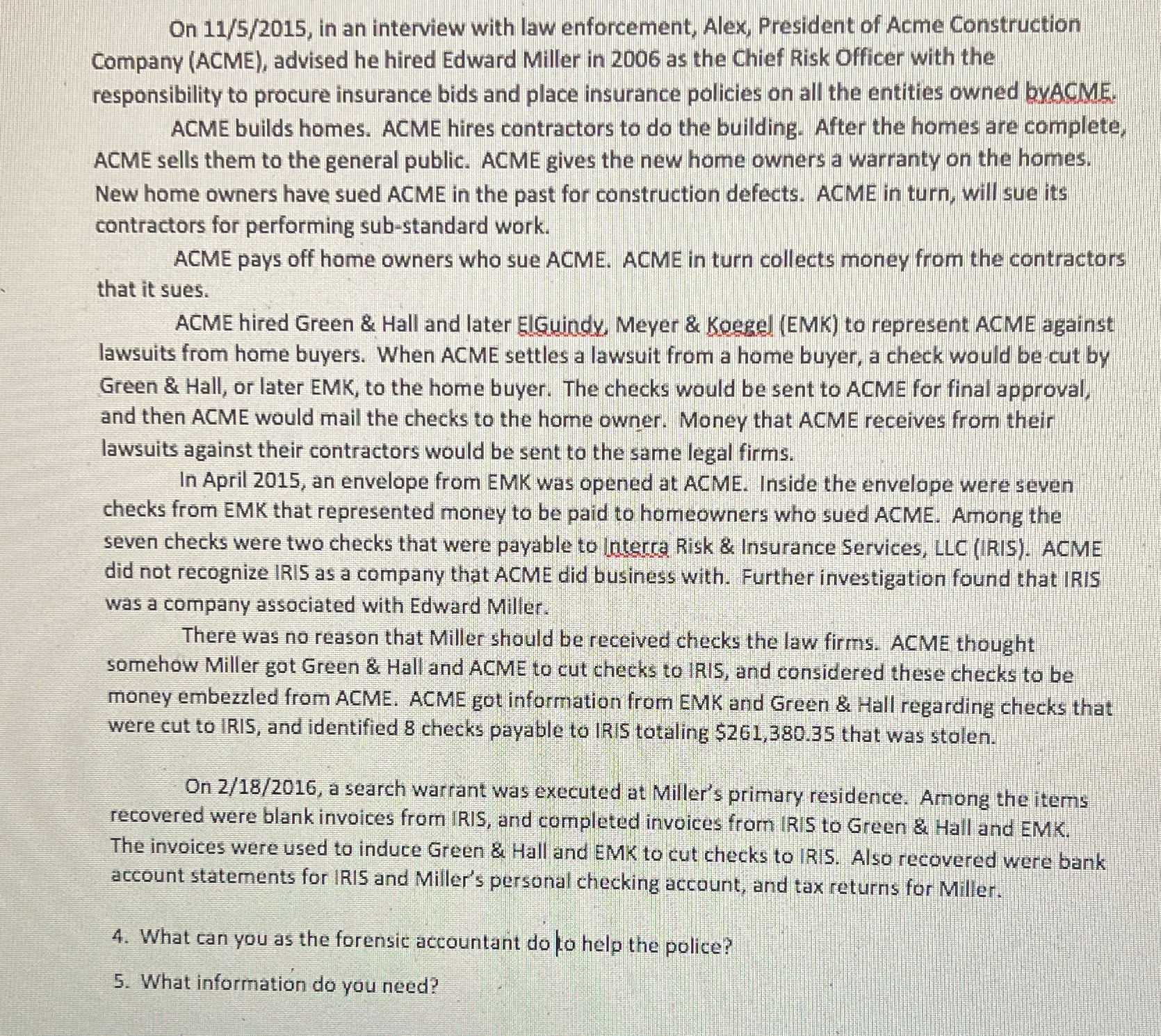

On in an interview with law enforcement, Alex, President of Acme Construction Company ACME advised he hired Edward Miller in as the Chief Risk Officer with the responsibility to procure insurance bids and place insurance policies on all the entities owned byACME.

ACME builds homes. ACME hires contractors to do the building. After the homes are complete, ACME sells them to the general public. ACME gives the new home owners a warranty on the homes. New home owners have sued ACME in the past for construction defects. ACME in turn, will sue its contractors for performing substandard work.

ACME pays off home owners who sue ACME. ACME in turn collects money from the contractors that it sues.

ACME hired Green & Hall and later ElGuindy Meyer & Koegel EMK to represent ACME against lawsuits from home buyers. When ACME settles a lawsuit from a home buyer, a check would be cut by Green & Hall, or later EMK, to the home buyer. The checks would be sent to ACME for final approval, and then ACME would mail the checks to the home owner. Money that ACME receives from their lawsuits against their contractors would be sent to the same legal firms.

In April an envelope from EMK was opened at ACME. Inside the envelope were seven checks from EMK that represented money to be paid to homeowners who sued ACME. Among the seven checks were two checks that were payable to laterra Risk & Insurance Services, LLC IRIS ACME did not recognize IRIS as a company that ACME did business with. Further investigation found that IRIS was a company associated with Edward Miller.

There was no reason that Miller should be received checks the law firms. ACME thought somehow Miller got Green & Hall and ACME to cut checks to IRIS, and considered these checks to be money embezzled from ACME. ACME got information from EMK and Green & Hall regarding checks that were cut to IRIS, and identified checks payable to IRIS totaling $ that was stolen.

On a search warrant was executed at Miller's primary residence. Among the items recovered were blank invoices from IRIS, and completed invoices from IRIS to Green & Hall and EMK. The invoices were used to induce Green & Hall and EMK to cut checks to IRIS. Also recovered were bank account statements for IRIS and Miller's personal checking account, and tax returns for Miller.

What can you as the forensic accountant do to help the police?

What information do you need?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock