Question: - On 1 August 2021, Lyttleton ordered a brand new Rolls-Royce Phantom at R 1024650 (including VAT). The business will use This passenger vehicle to

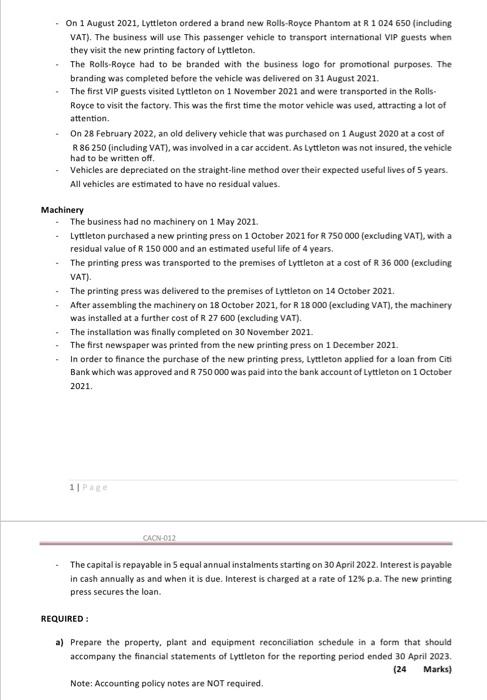

- On 1 August 2021, Lyttleton ordered a brand new Rolls-Royce Phantom at R 1024650 (including VAT). The business will use This passenger vehicle to transport international VIP guests when they visit the new printing factory of Lyttleton. - The Rolls-Royce had to be branded with the business logo for promotional purposes. The branding was completed before the vehicle was delivered on 31 August 2021. - The first VIP guests visited tyttleton on 1 November 2021 and were transported in the Rolls- Royce to visit the factory. This was the first time the motor vehicle was used, attracting a lot of attention. - On 28 February 2022, an old delivery vehicle that was purchased on 1 August 2020 at a cost of R 86250 (including VAT), was involved in a car accident. As tyttleton was not insured, the vehicle had to be written off, - Vehicles are depreciated on the straight-line method over their expected useful lives of 5 years. All vehicles are estimated to have no residual values. Machinery - The business had no machinery on 1 May 2021. - Lyttleton purchased a new printing press on 1 October 2021 for \\( \\$ 750000 \\) (excluding VAT), with a residual value of \\( R 150000 \\) and an estimated useful life of 4 years. - The printing press was transported to the premises of Lyttleton at a cost of \\( \\mathrm{R} 36000 \\) (excluding VAT). - The printing press was delivered to the premises of Lyttleton on 14 October 2021. - After assembling the machinery on 18 October 2021, for R 18000 (excluding VAT), the machinery was installed at a further cost of R 27600 (excluding VAT). - The installation was finally completed on 30 November 2021. - The first newspaper was printed from the new printing press on 1 December 2021. - In order to finance the purchase of the new printing press, Lyttleton applied for a loan from Citi Bank which was approved and \\( R 750000 \\) was paid into the bank account of Lyttleton on 1 October 2021. 11 CACN-012 - The capital is repayable in 5 equal annual instalments starting on 30 April 2022. Interest is payable in cash annually as and when it is due. Interest is charged at a rate of \12 p.a. The new printing press secures the loan. REQUIRED : a) Prepare the property. plant and equipment reconciliation schedule in a form that should accompany the financial statements of Lyttleton for the reporting period ended 30 April 2023. (24 Marks) Note: Accounting policy notes are NOT required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts