Question: On 1 January 20X9, a borrower signed a long-term note, face amount, $1,750,000; time to maturity, three years; stated ra 2%. The effective rate

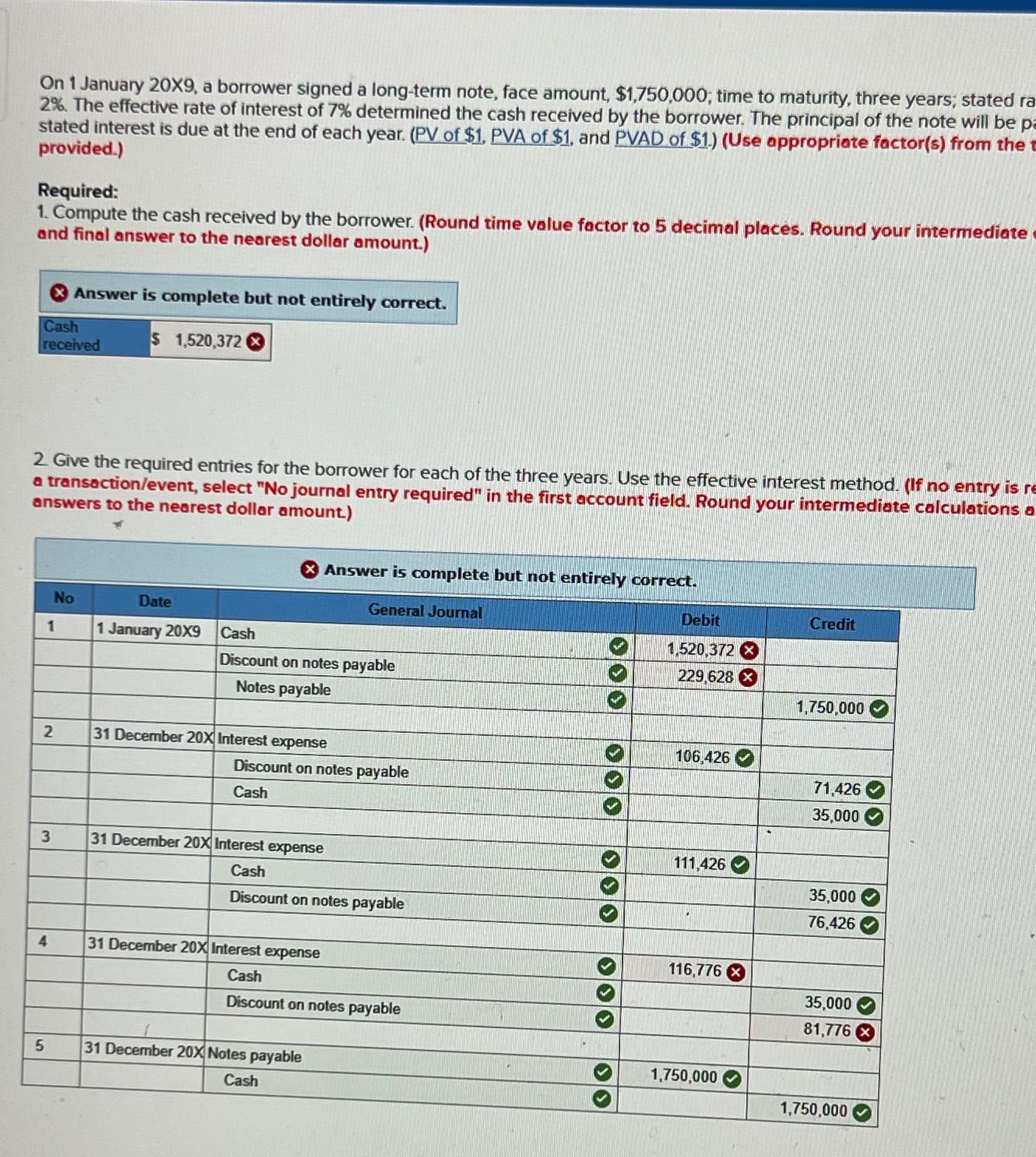

On 1 January 20X9, a borrower signed a long-term note, face amount, $1,750,000; time to maturity, three years; stated ra 2%. The effective rate of interest of 7% determined the cash received by the borrower. The principal of the note will be pa stated interest is due at the end of each year. (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the t provided.) Required: 1. Compute the cash received by the borrower. (Round time value factor to 5 decimal places. Round your intermediate and final answer to the nearest dollar amount.) Cash received 2. Give the required entries for the borrower for each of the three years. Use the effective interest method. (If no entry is re a transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations a answers to the nearest dollar amount.) 1 2 3 Answer is complete but not entirely correct. $ 1,520,372 4 5 No Date 1 January 20X9 Answer is complete but not entirely correct. General Journal Cash Discount on notes payable Notes payable 31 December 20X Interest expense Discount on notes payable Cash 31 December 20X Interest expense Cash Discount on notes payable 31 December 20X Interest expense Cash Discount on notes payable 31 December 20X Notes payable Cash 330 >> Debit 1,520,372 X 229,628 106,426 111,426 116,776 X 1,750,000 Credit 1,750,000 71,426 35,000 35,000 76,426 35,000 81,776 1,750,000

Step by Step Solution

There are 3 Steps involved in it

1 Compute the cash received by the borrower The present value of the note can be calculated using th... View full answer

Get step-by-step solutions from verified subject matter experts