Question: On 10 December 2018, the company purchases a machine from a European company for 40.000 on account (payable in 10 days). On 10 December 2018,

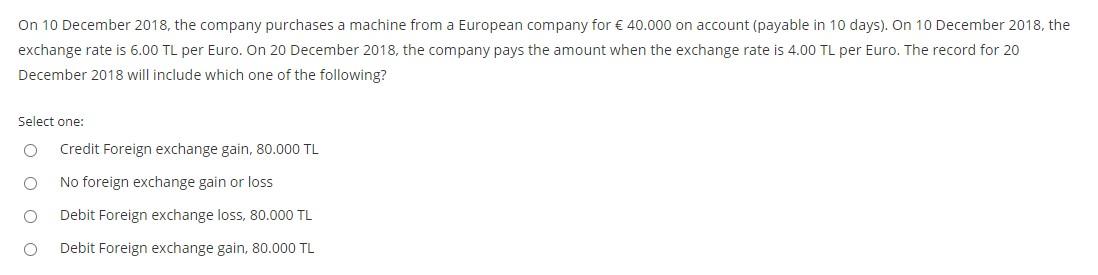

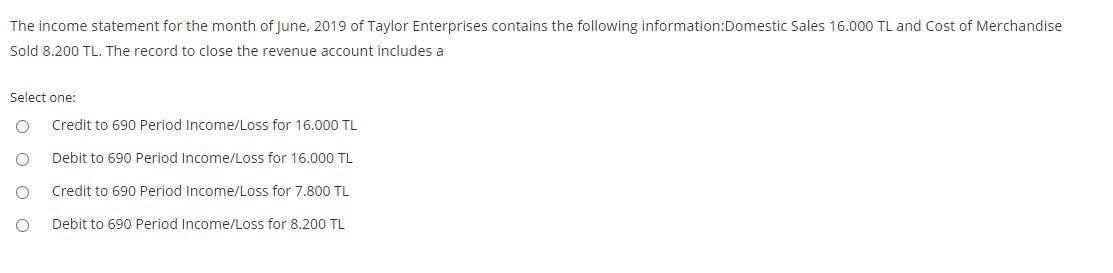

On 10 December 2018, the company purchases a machine from a European company for 40.000 on account (payable in 10 days). On 10 December 2018, the exchange rate is 6.00 TL per Euro. On 20 December 2018, the company pays the amount when the exchange rate is 4.00 TL per Euro. The record for 20 December 2018 will include which one of the following? Select one: O Credit Foreign exchange gain, 80.000 TL O No foreign exchange gain or loss Debit Foreign exchange loss, 80.000 TL Debit Foreign exchange gain, 80.000 TL O The income statement for the month of June, 2019 of Taylor Enterprises contains the following information:Domestic Sales 16.000 TL and Cost of Merchandise Sold 8.200 TL. The record to close the revenue account includes a Select one: Credit to 690 Period Income/Loss for 16.000 TL Debit to 690 Period Income/Loss for 16.000 TL O Credit to 690 Period Income/Loss for 7.800 TL O Debit to 690 Period Income/Loss for 8.200 TL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts