Question: On 30 June 2019 Tip Ltd acquired 100 per cent of the issued capital of Top Ltd for $4 000 000. At that date,

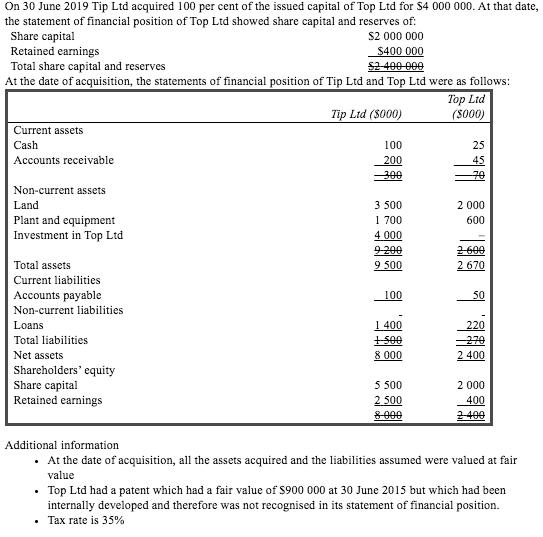

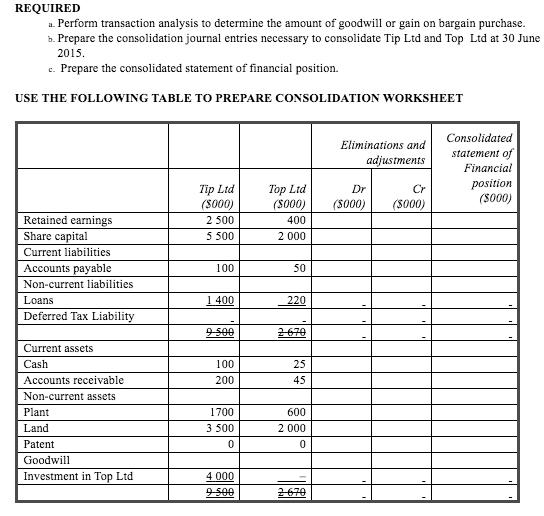

On 30 June 2019 Tip Ltd acquired 100 per cent of the issued capital of Top Ltd for $4 000 000. At that date, the statement of financial position of Top Ltd showed share capital and reserves of: Share capital Retained earnings s2 000 000 $400 000 S2400 000 Total share capital and reserves At the date of acquisition, the statements of financial position of Tip Ltd and Top Ltd were as follows: Top Ltd (S000) Tip Ltd (S000) Current assets Cash 100 25 Accounts receivable 200 300 45 70 Non-current assets Land 3 500 2 000 1 700 4 000 9200 9 500 Plant and equipment Investment in Top Ltd 600 600 2 670 Total assets Current liabilities Accounts payable 100 50 Non-current liabilities 1 400 Loans 220 270 2 400 Total liabilities 1500 Net assets 8 000 Shareholders' equity Share capital Retained earnings 5 500 2 500 8-000 2 000 400 400 Additional information At the date of acquisition, all the assets acquired and the liabilities assumed were valued at fair value Top Ltd had a patent which had a fair value of $900 000 at 30 June 2015 but which had been internally developed and therefore was not recognised in its statement of financial position. Tax rate is 35% REQUIRED a. Perform transaction analysis to determine the amount of goodwill or gain on bargain purchase. b. Prepare the consolidation journal entries necessary to consolidate Tip Ltd and Top Ltd at 30 June 2015. c. Prepare the consolidated statement of financial position. USE THE FOLLOWING TABLE TO PREPARE CONSOLIDATION WORKSHEET Consolidated Eliminations and adjustments statement of Financial Tip Ltd (S000) Top Ltd (S000) position (S000) Dr Cr (S000) (S000) Retained earnings 2 500 400 Share capital 5 500 2 000 Current liabilities Accounts payable 100 50 Non-current liabilities Loans 1 400 220 Deferred Tax Liability 9500 2670 Current assets Cash 100 25 Accounts receivable 200 45 Non-current assets Plant 1700 600 Land 3 500 2 000 Patent Goodwill Investment in Top Ltd 4 000 9500 2670

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

All amounts are in 000 The year is 2019 and not 2015 there is an error in question Part a Computatio... View full answer

Get step-by-step solutions from verified subject matter experts