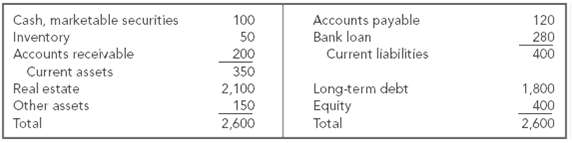

Question: Table 19.2 shows a book balance sheet for the Wishing Well Motel chain. The companys long-term debt is secured by its real estate assets, but

Table 19.2 shows a book balance sheet for the Wishing Well Motel chain. The companys long-term debt is secured by its real estate assets, but it also uses short-term bank financing. It pays 10 percent interest on the bank debt and 9 percent interest on the secured debt. Wishing Well has 10 million shares of stock outstanding, trading at $90 per share. The expected return on Wishing Wells common stock is 18 percent. Calculate Wishing Wells WACC. Assume that the book and market values of Wishing Wells debt are the same. The marginal tax rate is 35 percent.

Cash, marketable securities Accounts payable Bank loan Current liabilities 100 120 280 400 50 Inventory Accounts receivable Current assets Real estate Other assets Total 200 350 2,100 150 2,600 Long-term debt Equity Total 1,800 400 2,600

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

If the bank debt is treated as permanent financing the ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-D-P (57).docx

120 KBs Word File