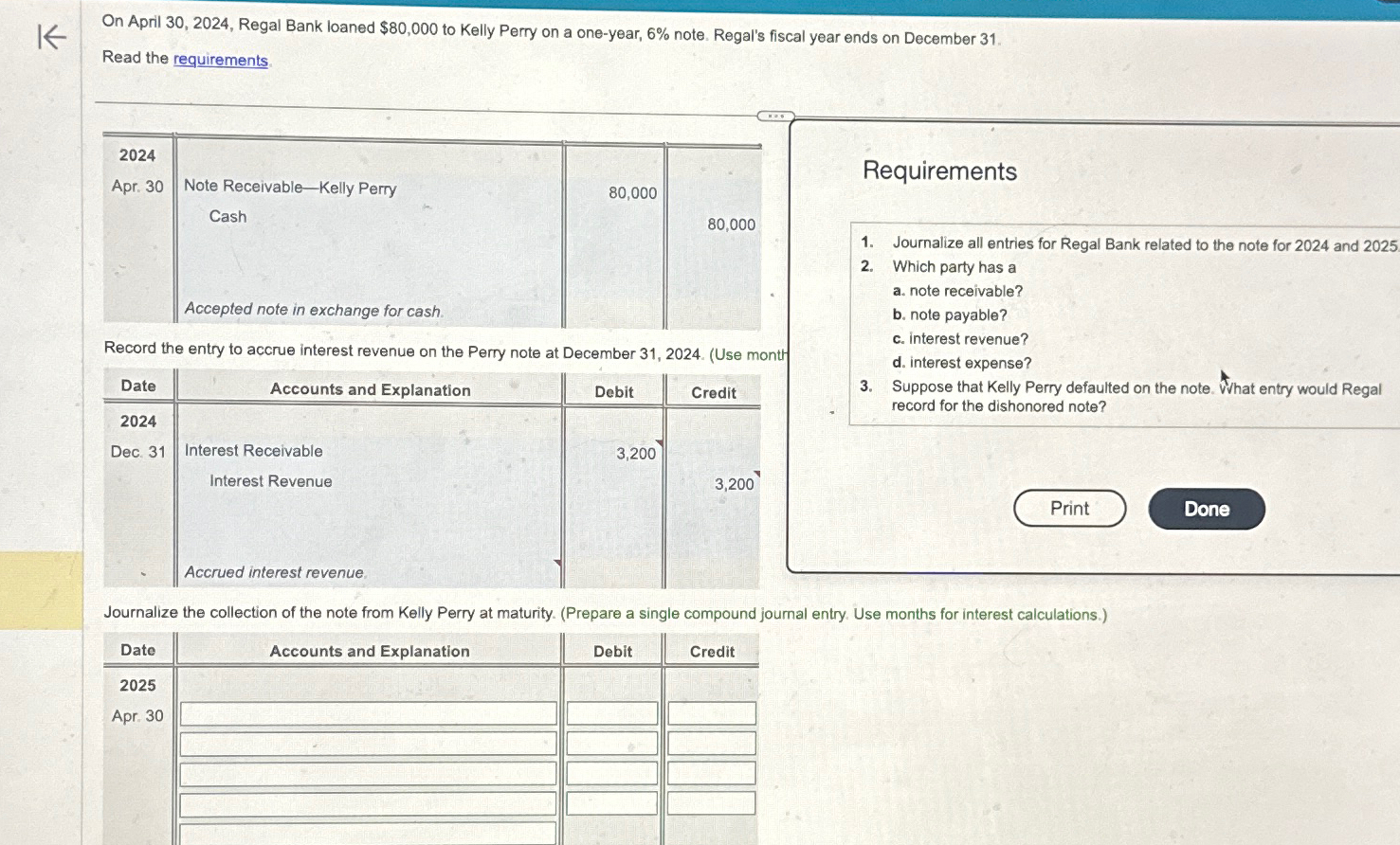

Question: On April 3 0 , 2 0 2 4 , Regal Bank loaned $ 8 0 , 0 0 0 to Kelly Perry on a

On April Regal Bank loaned $ to Kelly Perry on a oneyear, note. Regal's fiscal year ends on December

Read the requirements

Apr.

Note ReceivableKelly Perry

Cash

Accepted note in exchange for cash.

Record the entry to accrue interest revenue on the Perry note at December Use montr

tableDateAccounts and Explanation,Debit,CreditDecInterest Receivable,,Interest Revenue,,,Accrued interest revenue,,,,

Requirements

Journalize all entries for Regal Bank related to the note for and

Which party has a

a note receivable?

b note payable?

c interest revenue?

d interest expense?

Suppose that Kelly Perry defaulted on the note. What entry would Regal record for the dishonored note?

Journalize the collection of the note from Kelly Perry at maturity. Prepare a single compound journal entry. Use months for interest calculations.

tableDateAccounts and Explanation,Debit,CreditApr tat,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock