Question: On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK$420,000. The machinery was delivered on October 1, Year

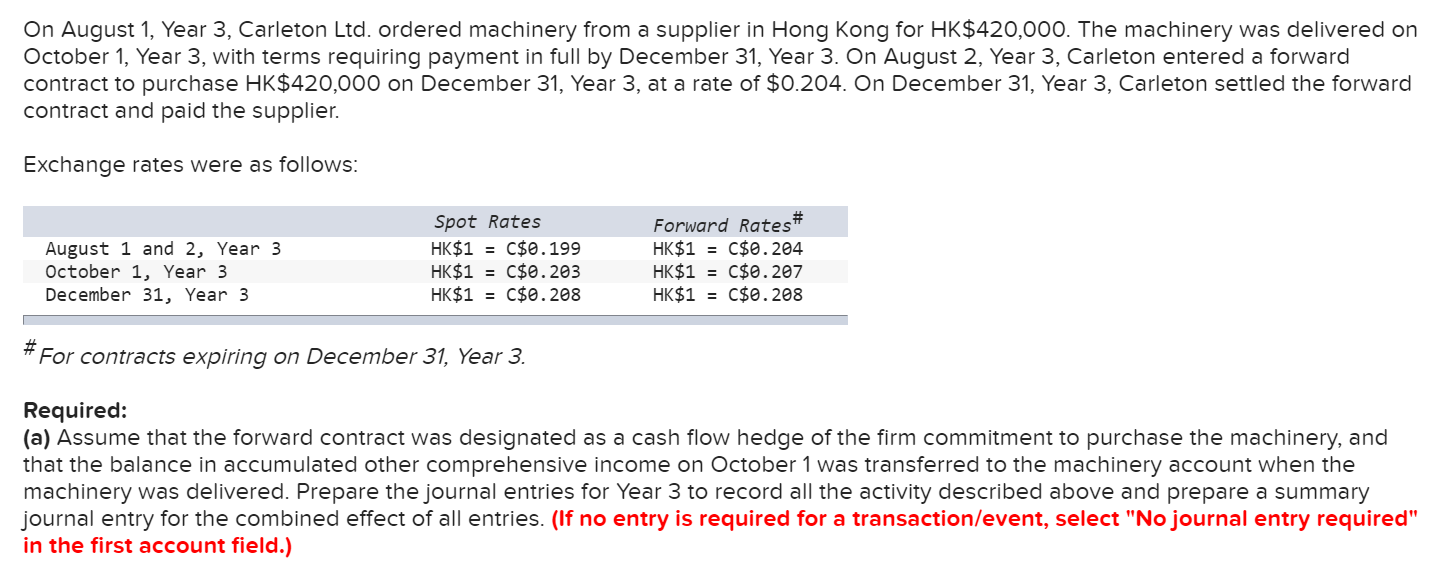

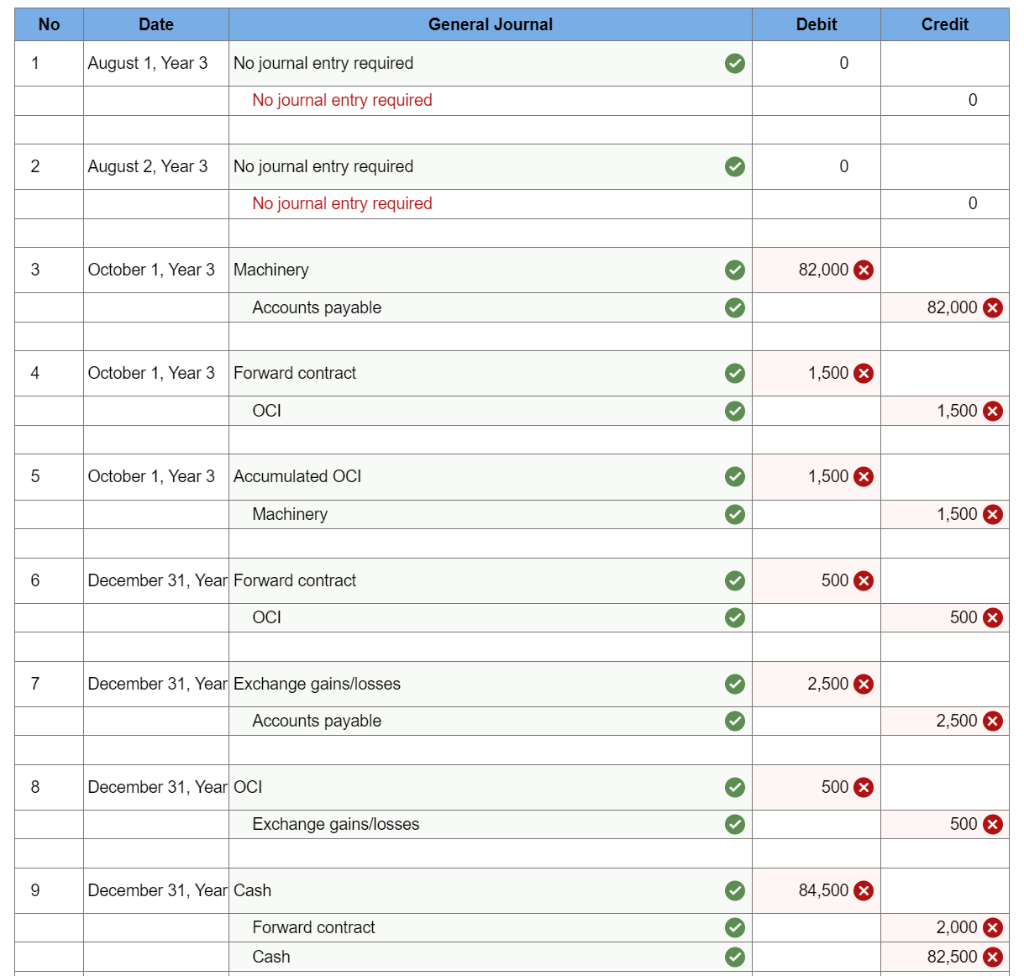

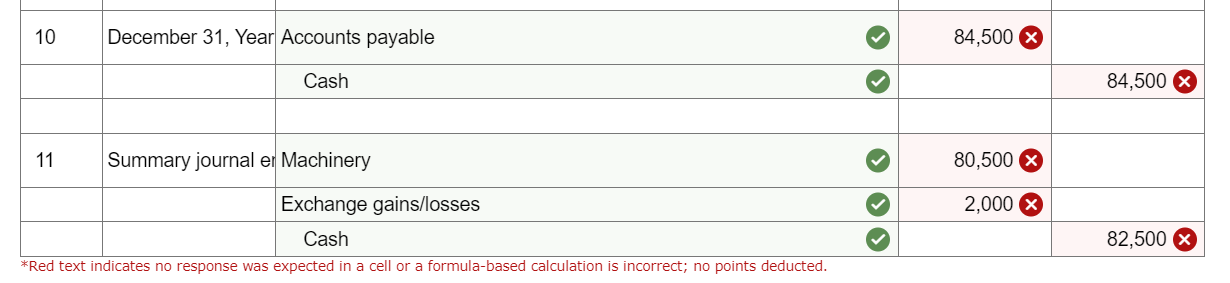

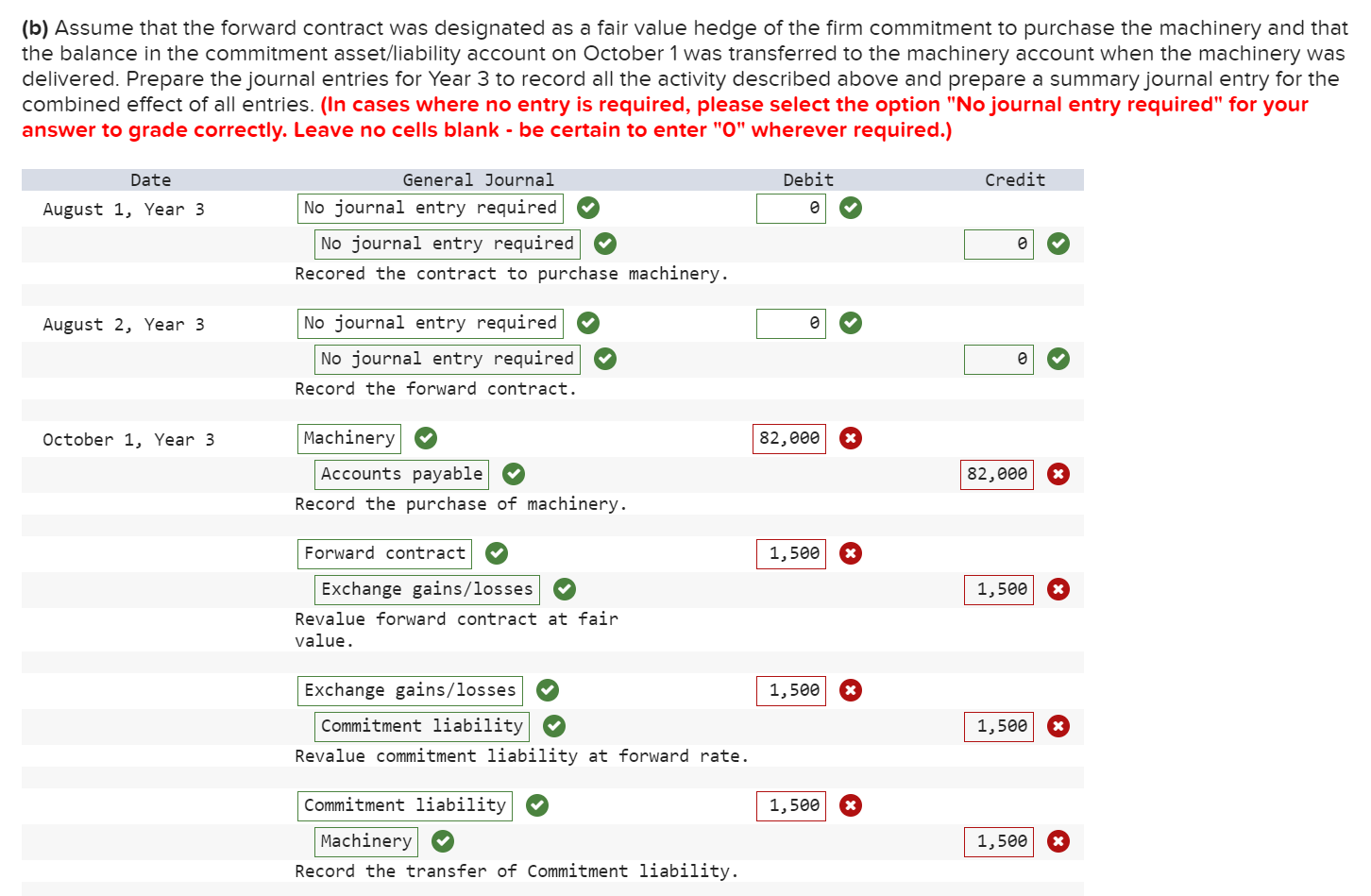

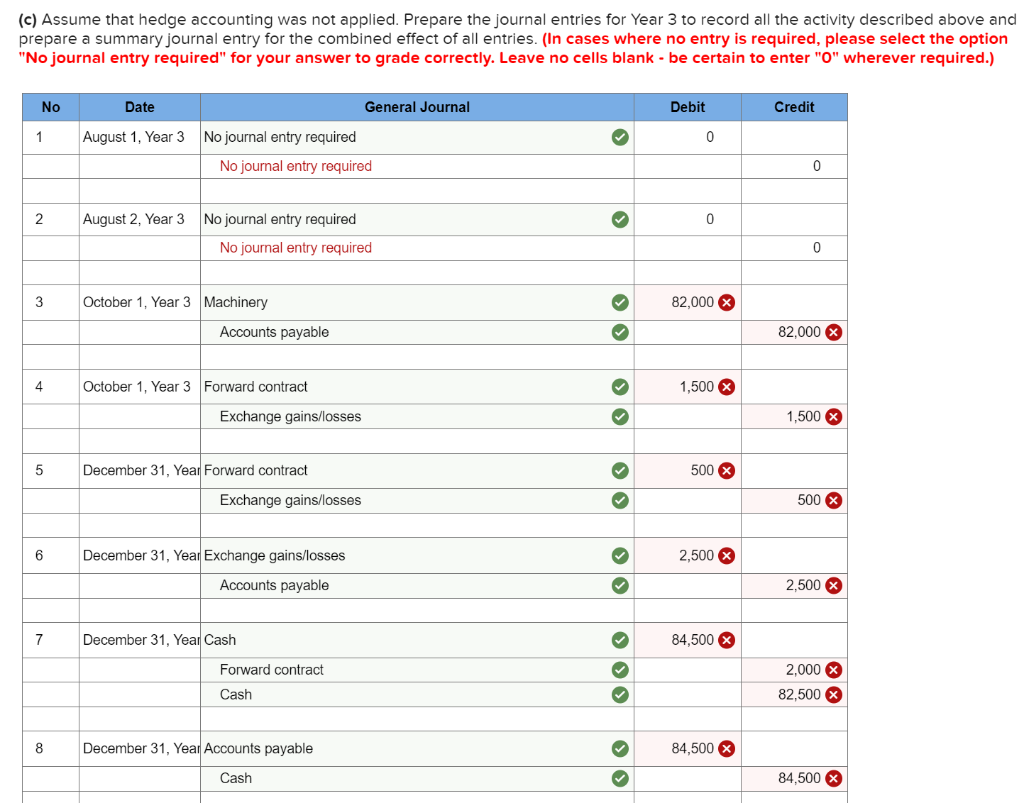

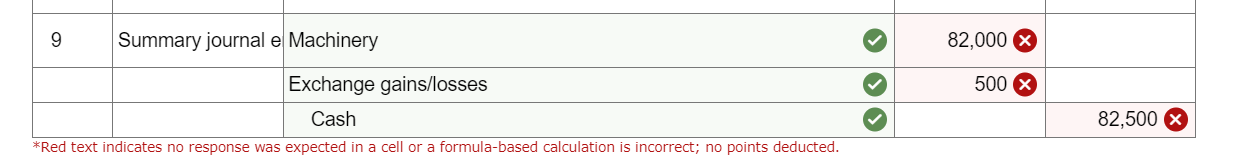

On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK$420,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forward contract to purchase HK\$420,000 on December 31, Year 3, at a rate of $0.204. On December 31, Year 3, Carleton settled the forward contract and paid the supplier. Exchange rates were as follows: \# For contracts expiring on December 31, Year 3. Required: (a) Assume that the forward contract was designated as a cash flow hedge of the firm commitment to purchase the machinery, and that the balance in accumulated other comprehensive income on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. (b) Assume that the forward contract was designated as a fair value hedge of the firm commitment to purchase the machinery and that the balance in the commitment asset/liability account on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (In cases where no entry is required, please select the option "No journal entry required" for your answer to qrade correctly. Leave no cells blank - be certain to enter "0" wherever required.) December 31, Year 3 Revalue forward contract at fair value. Revalue accounts payable at fair value. Record the cash received from bank. Record payment of accounts payable. Summary journal entry Record summary entry for all entries combined. (c) Assume that hedge accounting was not applied. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (In cases where no entry is required, please select the option "A wherever required.) On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK$420,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forward contract to purchase HK\$420,000 on December 31, Year 3, at a rate of $0.204. On December 31, Year 3, Carleton settled the forward contract and paid the supplier. Exchange rates were as follows: \# For contracts expiring on December 31, Year 3. Required: (a) Assume that the forward contract was designated as a cash flow hedge of the firm commitment to purchase the machinery, and that the balance in accumulated other comprehensive income on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. (b) Assume that the forward contract was designated as a fair value hedge of the firm commitment to purchase the machinery and that the balance in the commitment asset/liability account on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (In cases where no entry is required, please select the option "No journal entry required" for your answer to qrade correctly. Leave no cells blank - be certain to enter "0" wherever required.) December 31, Year 3 Revalue forward contract at fair value. Revalue accounts payable at fair value. Record the cash received from bank. Record payment of accounts payable. Summary journal entry Record summary entry for all entries combined. (c) Assume that hedge accounting was not applied. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (In cases where no entry is required, please select the option "A wherever required.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts