Question: Please help with the wrong answers, thanks a lot! On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for

Please help with the wrong answers, thanks a lot!

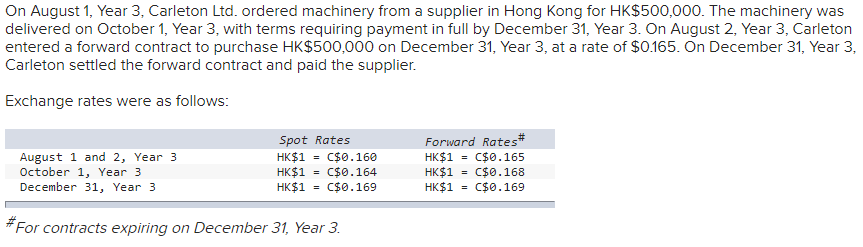

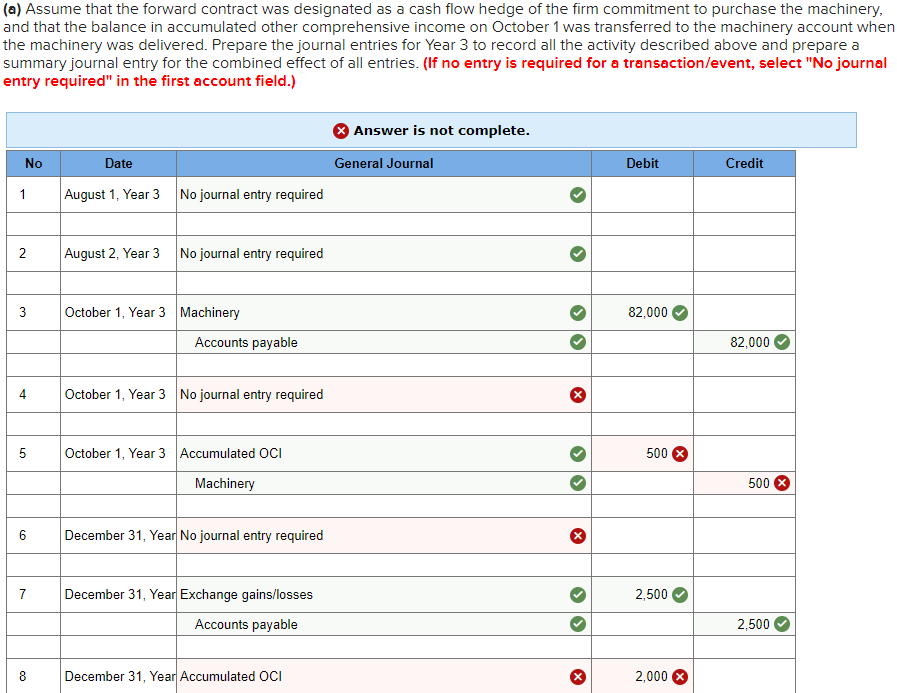

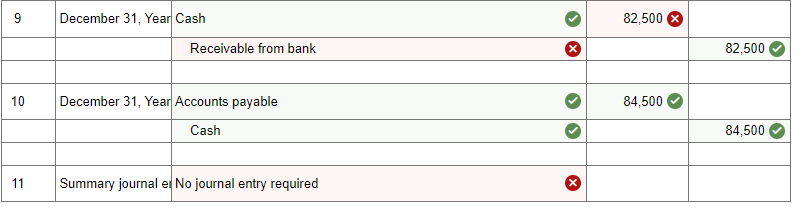

On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK $500,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forward contract to purchase HK$500,000 on December 31 , Year 3 , at a rate of $0.165. On December 31 , Year 3 , Carleton settled the forward contract and paid the supplier. Exchange rates were as follows: \#For contracts expiring on December 31 , Year 3. (a) Assume that the forward contract was designated as a cash flow hedge of the firm commitment to purchase the machinery, and that the balance in accumulated other comprehensive income on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK $500,000. The machinery was delivered on October 1, Year 3, with terms requiring payment in full by December 31, Year 3. On August 2, Year 3, Carleton entered a forward contract to purchase HK$500,000 on December 31 , Year 3 , at a rate of $0.165. On December 31 , Year 3 , Carleton settled the forward contract and paid the supplier. Exchange rates were as follows: \#For contracts expiring on December 31 , Year 3. (a) Assume that the forward contract was designated as a cash flow hedge of the firm commitment to purchase the machinery, and that the balance in accumulated other comprehensive income on October 1 was transferred to the machinery account when the machinery was delivered. Prepare the journal entries for Year 3 to record all the activity described above and prepare a summary journal entry for the combined effect of all entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts