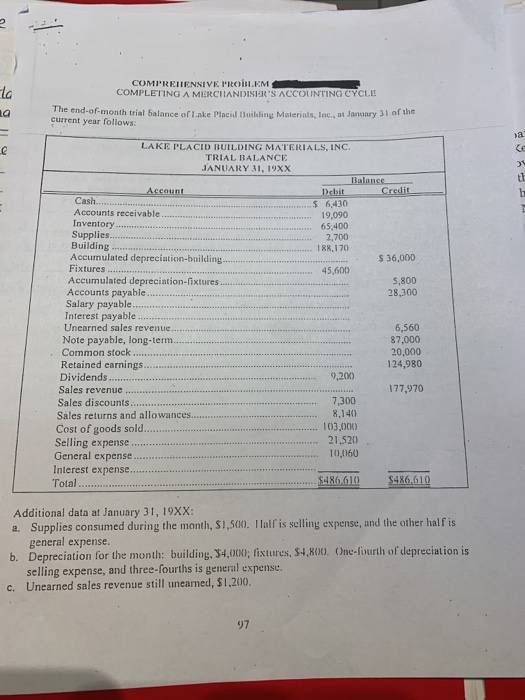

Question: ON COMPUTER!!! COMPREHENSIVE PROBLEM COMPLETING A MERCHANDISER'S ACCOUNTING CYCLE The end-of-month trial balance of Lake Placid Building Materials, Inc., current year follows: January 3l of

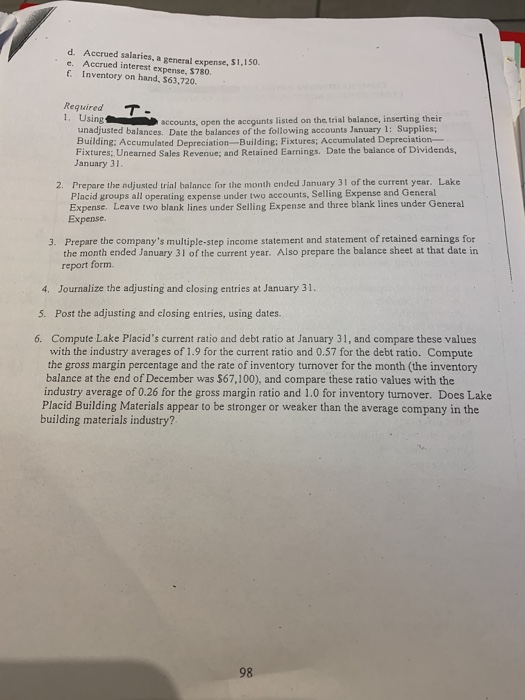

COMPREHENSIVE PROBLEM COMPLETING A MERCHANDISER'S ACCOUNTING CYCLE The end-of-month trial balance of Lake Placid Building Materials, Inc., current year follows: January 3l of the TY Inventory 45.600 LAKE PLACID BUILDING MATERIALS, INC. TRIAL BALANCE JANUARY 31, 19XX Balance Account Debit Credit Cash $ 6,430 Accounts receivable 19.090 65,400 Supplies.... 2.700 Building ................. . 188,170 Accumulated depreciation building.... $ 36,000 Fixtures ..... Accumulated depreciation-lixtures 5,800 Accounts payable...................... 28,300 Salary payable............................ Interest payable................. Unearned sales revenue......... 6,560 Note payable, long-term...... 87,000 Common stock .... 20,000 Retained carnings..... . 124,980 Dividends. 9,200 Sales revenue ... 177,970 Sales discounts... 7,300 Sales returns and allowances.... 8,140 Cost of goods sold.... 103,000 Selling expense ................. 21,520) General expense....... 10,060 Interest expense................... Total $486610 $486.610 Additional data at January 31, 19XX: a. Supplies consumed during the month, $1,500. Tall is selling expense, and the other half is general expense. b. Depreciation for the month: building, $4,000; fixtures, $4,800. One-fourth of depreciation is selling expense, and three-fourths is general expense. c. Unearned sales revenue still unearned, $1.200. d. Accrued salaries, a general expense, $1,150. e Accrued interest expense. 5780. f Inventory on hand. 563,720. Required 1. Using T. accounts, open the accounts listed on the trial balance, inserting their unadjusted balances Date the balances of the following accounts January 1: Supplies; Building: Accumulated Depreciation Building Fixtures; Accumulated Depreciation Fixtures: Unearned Sales Revenue and Retained Earnings. Date the balance of Dividends, January 31 2. Prepare the ndjusted trial balance for the month ended January 31 of the current year. Lake Placid groups all operating expense under two accounts, Selling Expense and General Expense. Leave two blank lines under Selling Expense and three blank lines under General Expense. 3. Prepare the company's multiple-step income statement and statement of retained earnings for the month ended January 31 of the current year. Also prepare the balance sheet at that date in report form. 4. Journalize the adjusting and closing entries at January 31. 5. Post the adjusting and closing entries, using dates. 6. Compute Lake Placid's current ratio and debt ratio at January 31, and compare these values with the industry averages of 1.9 for the current ratio and 0.57 for the debt ratio. Compute the gross margin percentage and the rate of inventory turnover for the month (the inventory balance at the end of December was 567,100), and compare these ratio values with the industry average of 0.26 for the gross margin ratio and 1.0 for inventory turnover. Does Lake Placid Building Materials appear to be stronger or weaker than the average company in the building materials industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts