On December 1, 2017, Sizzler Foods, a U.S. company, purchased merchandise from a Hong Kong supplier at

Question:

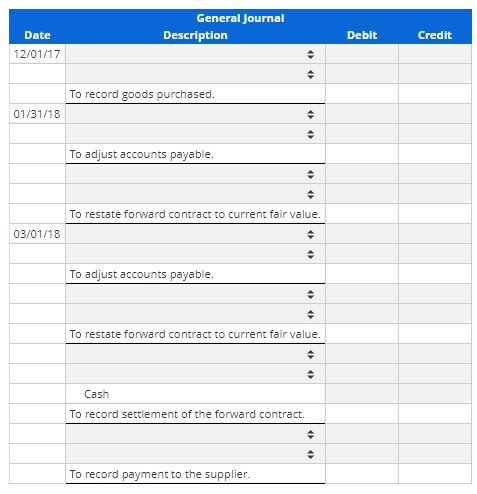

On December 1, 2017, Sizzler Foods, a U.S. company, purchased merchandise from a Hong Kong supplier at a price of HK$18,000,000, payable in three months in Hong Kong dollars. To hedge its exposed liability position, Sizzler entered a forward contract for purchase of HK$18,000,000 on March 1, 2018. On March 1, Sizzler closed the forward contract and used the Hong Kong dollars to pay its supplier. Sizzler's accounting year ends January 31.

Exchange rates ($/HK$) are as follows:

| Spot rate | Forward rate for delivery March 1, 2018 | |

|---|---|---|

| December 1, 2017 | $0.1291 | $0.1295 |

| January 31, 2018 | 0.1301 | 0.1306 |

| March 1, 2018 | 0.1305 | -- |

Prepare the journal entries Sizzler Foods made on December 1, 2017 and March 1, 2018 to record the above transactions, as well as its end-of-year adjusting entries on January 31, 2018.

Account titles from drop down:

Investment in forward contract

Inventory

Accounts Payable

Exchange loss

Exchange gain

Foreign currency

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso