Question: On December 3 1 , 2 0 1 9 , P company issued 3 0 , 0 0 0 shares of its $ 2 par

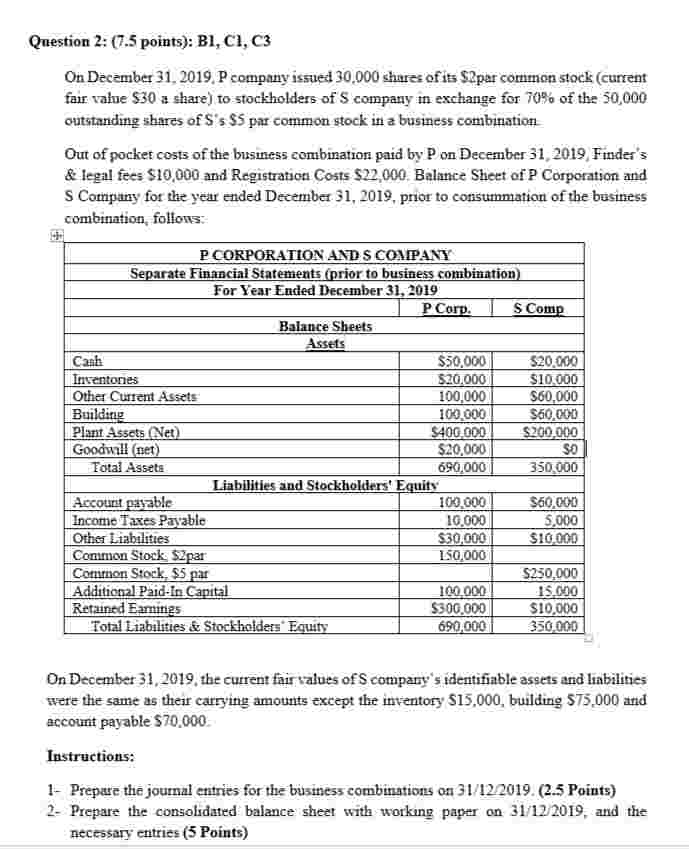

On December P company issued shares of its $par common stock current fair value $ a share to stockholders of S company in exchange for of the outstanding shares of Ss $ par common stock in a business combination.

Out of pocket costs of the business combination paid by P on December Finders & legal fees $ and Registration Costs $ Balance Sheet of P Corporation and S Company for the year ended December prior to consummation of the business combination, follows:

P CORPORATION AND S COMPANY

Separate Financial Statements prior to business combination

For Year Ended December

P Corp.

S Comp

Balance Sheets

Assets

Cash

$

$

Inventories

$

$

Other Current Assets

$

Building

$

Plant Assets Net

$

$

Goodwill net

$

$

Total Assets

Liabilities and Stockholders' Equity

Account payable

$

Income Taxes Payable

Other Liabilities

$

$

Common Stock, $par

Common Stock, $ par

$

Additional PaidIn Capital

Retained Earnings

$

$

Total Liabilities & Stockholders Equity

On December the current fair values of S companys identifiable assets and liabilities were the same as their carrying amounts except the inventory $ building $ and account payable $

Instructions:

Prepare the journal entries for the business combinations on Points

Prepare the consolidated balance sheet with working paper on and the necessary entries Points Question : points: B C C

On December P company issued shares of its $ par common stock current fair value $ a share to stockholders of $ company in exchange for of the outstanding shares of Ss $ par common stock in a business combination

Out of pocket costs of the business combination paid by P on December Finder's & legal fees $ and Registration Costs $ Balance Sheet of P Corporation and S Company for the year ended December prior to consummation of the business combination, follons:

begintabularccc

hline multicolumnlP CORPORATION AND S COMPANY

hline multicolumnlSeparate Financial Statements prior to business combimation

hline multicolumnlFor Year Ended December

hline & P Corp. & S Comp

hline multicolumnlBalance Sheets

hline multicolumnlAssets

hline Canh & $ &

hline Inventories & $ & $

hline Other Current Assets & & $

hline Building & & $

hline Plant AssetNet & $ & $

hline Gooduill net & $ &

hline Total Asseta & &

hline multicolumnlLiabilities and Stockholders' Equity

hline Account payable & & $

hline Income Taxes Payable & &

hline Other Liabilities & $ & $

hline Common Stock $par & &

hline Common Stock, $ par & & $

hline Additional PaidIn Capital & &

hline Retained Eamings & $ & $

hline Total Liabilities & Stockholders Equity & &

hline

endtabular

On December the current fair values of S company's identifiable assets and linbilities were the same as their carrying amounts except the inventory $ building $ and account payable $

Instructions:

Prepare the joumal entries for the business combinations on Points

Prepare the consoldated balance sheet with working paper on and the necessary entries Points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock