Question: On December 3 1 , 2 0 2 4 , capital balances of the partners in Susan Charters are C . Charlie (

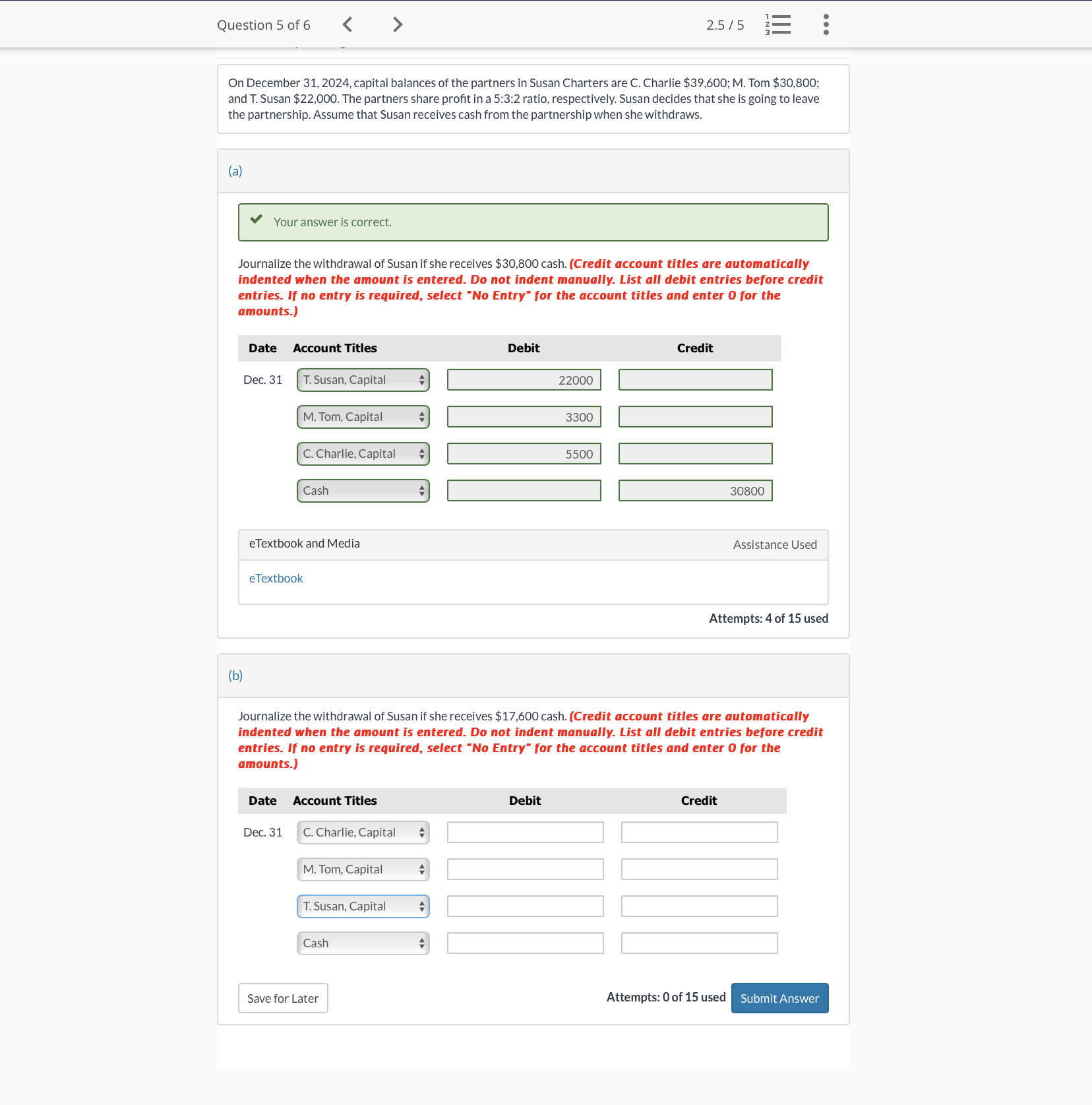

On December capital balances of the partners in Susan Charters are C Charlie $ ; M Tom $ ; and T Susan $ The partners share profit in a :: ratio, respectively. Susan decides that she is going to leave the partnership. Assume that Susan receives cash from the partnership when she withdraws.

a

Your answer is correct.

Journalize the withdrawal of Susan if she receives $ cash. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select No Entry" for the account titles and enter for the amounts.

Attempts: of used

b

Journalize the withdrawal of Susan if she receives $ cash. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select No Entry" for the account titles and enter for the amounts.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock