Question: On December 3 1 , 2 0 2 4 , Ayayai Inc. borrowed $ 8 7 0 , 0 0 0 at 1 2

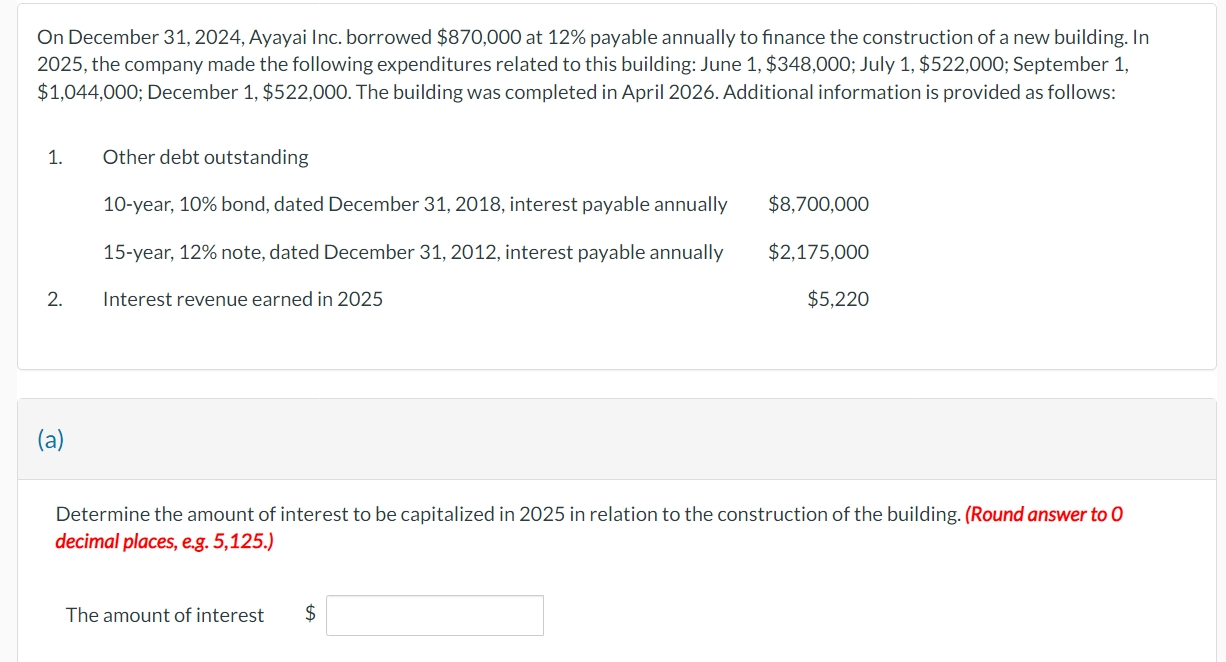

On December Ayayai Inc. borrowed $ at payable annually to finance the construction of a new building. In the company made the following expenditures related to this building: June $; July $; September $ ; December $ The building was completed in April Additional information is provided as follows:

Other debt outstanding

year, bond, dated December interest payable annually $

year, note, dated December interest payable annually $

Interest revenue earned in

$

a

Determine the amount of interest to be capitalized in in relation to the construction of the building. Round answer to decimal places, eg

The amount of interest

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock