Question: Luke Skywalker Luke Skywalker worked 4 0 hours at $ 1 1 / hour. According to the employee s declaration, the code for the federal

Luke Skywalker

Luke Skywalker worked hours at $ hour.

According to the employees declaration, the code for the federal tax is CC and the code for the provincial tax is A

The employers contribution for the Employment Insurance is times the employee deduction.

The employers rate for the contribution to the Health Service Fund is

The company is a dairy farm code for CSST classification

The employee has worked for the company for seven years.

Calculate and journalize the payroll for Luke. Use separate accounts for Canada and Quebec payables.

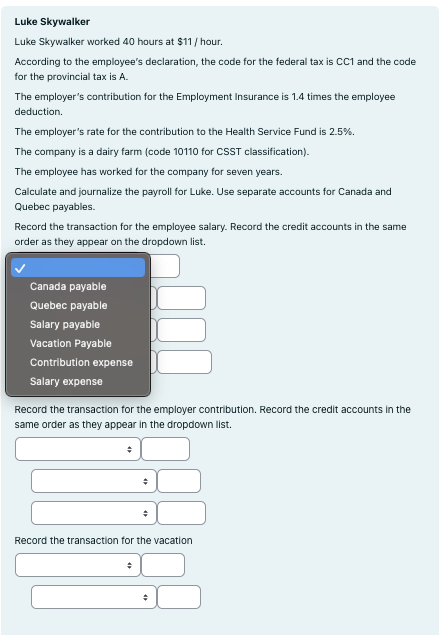

Record the transaction for the employee salary. Record the credit accounts in the same order as they appear on the dropdown list.

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Record the transaction for the employer contribution.Record the credit accounts in the same order as they appear in the dropdown list.

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Record the transaction for the vacation

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question

Answer Question Canada payableQuebec payableSalary payableVacation PayableContribution expenseSalary expenseAnswer Question Luke Skywalker

Luke Skywalker worked hours at $ hour.

According to the employee's declaration, the code for the federal tax is CC and the code for the provincial tax is A

The employer's contribution for the Employment Insurance is times the employee deduction.

The employer's rate for the contribution to the Health Service Fund is

The company is a dairy farm code for CSST classification

The employee has worked for the company for seven years.

Calculate and journalize the payroll for Luke. Use separate accounts for Canada and Quebec payables.

Record the transaction for the employee salary. Record the credit accounts in the same order as they appear on the dropdown list.

Record the transaction for the employer contribution. Record the credit accounts in the same order as they appear in the dropdown list.

Record the transaction for the vacation Luke Skywalker

Luke Skywalker worked hours at $ hour.

According to the employee's declaration, the code for the federal tax is CC and the code for the provincial tax is A

The employer's contribution for the Employment Insurance is times the employee deduction.

The employer's rate for the contribution to the Health Service Fund is

The company is a dairy farm code for CSST classification

The employee has worked for the company for seven years.

Calculate and journalize the payroll for Luke. Use separate accounts for Canada and Quebec payables.

Record the transaction for the employee salary. Record the credit accounts in the same order as they appear on the dropdown list.

Canada payable

Quebec payable

Salary payable

Vacation Payable

Contribution expense

Salary expense

Record the transaction for the employer contribution. Record the credit accounts in the same order as they appear in the dropdown list.

Record the transaction for the vacation Luke Skywalker

Luke Skywalker worked hours at $ hour.

According to the employee's declaration, the code for the federal tax is CC and the code for the provincial tax is A

The employer's contribution for the Employment Insurance is times the employee deduction.

The employer's rate for the contribution to the Health Service Fund is

The company is a dairy farm code for CSST classification

The employee has worked for the company for seven years.

Calculate and journalize the payroll for Luke. Use separate accounts for Canada and Quebec payables.

Record the transaction for the employee salary. Record the credit accounts in the same order as they appear on the dropdown list.

Record the transaction for the employer contribution. Record the credit accounts in the same order as they appear in the dropdown list.

Record the transaction for the vacation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock