Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, Pacific Trading Limited (PTL), a company which reports under IFRS, has two products in its warehouse, Product 1 and Product 2.

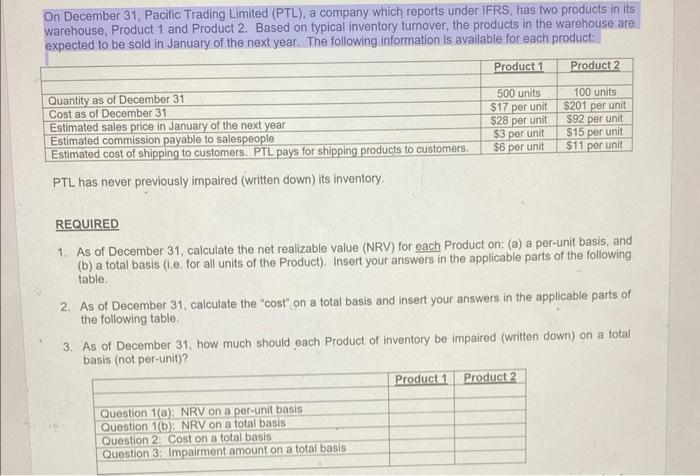

On December 31, Pacific Trading Limited (PTL), a company which reports under IFRS, has two products in its warehouse, Product 1 and Product 2. Based on typical inventory turnover, the products in the warehouse are expected to be sold in January of the next year. The following information is available for each product: Product 1 Quantity as of December 31 Cost as of December 31 Estimated sales price in January of the next year Estimated commission payable to salespeople Estimated cost of shipping to customers. PTL pays for shipping products to customers. PTL has never previously impaired (written down) its inventory. 500 units $17 per unit $28 per unit $3 per unit $6 per unit Product 2 Question 1(a): NRV on a per-unit basis Question 1(b): NRV on a total basis Question 2: Cost on a total basis Question 3: Impairment amount on a total basis 100 units $201 per unit $92 per unit REQUIRED 1. As of December 31, calculate the net realizable value (NRV) for each Product on: (a) a per-unit basis, and (b) a total basis (i.e. for all units of the Product). Insert your answers in the applicable parts of the following table. $15 per unit $11 per unit 2. As of December 31, calculate the "cost" on a total basis and insert your answers in the applicable parts of the following table. Product 1 Product 2 3. As of December 31, how much should each Product of inventory be impaired (written down) on a total basis (not per-unit)?

Step by Step Solution

★★★★★

3.42 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION STEP 1 NB NRV Expected Selling Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started