Question: On HW#5, Problem #1 Parts A and C ask for a calculation of Net Present Value. A discount factor of 7% and 1% are included

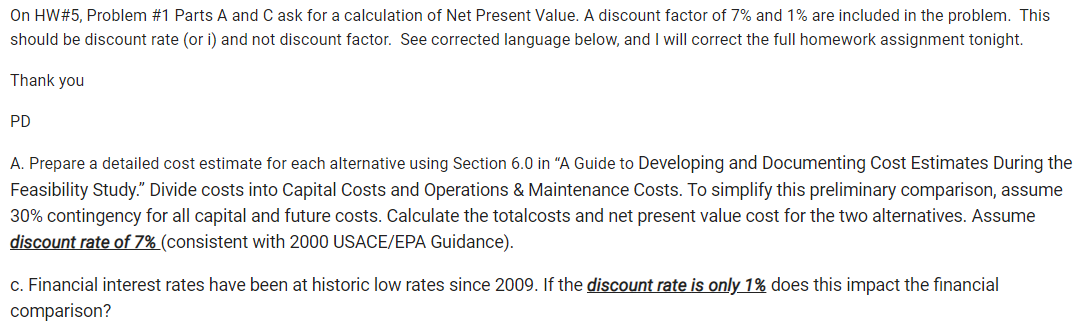

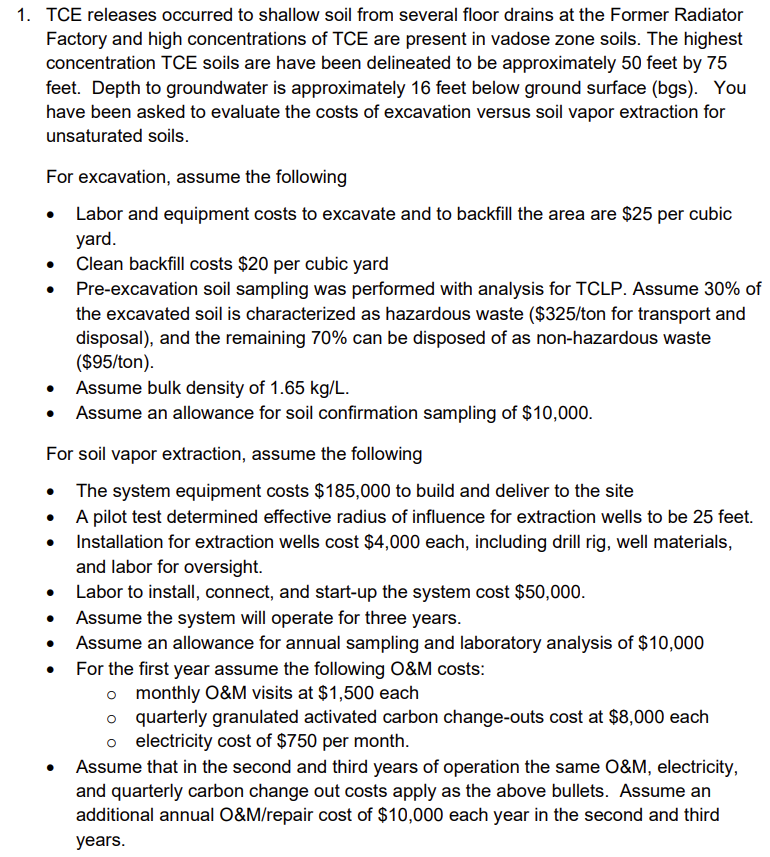

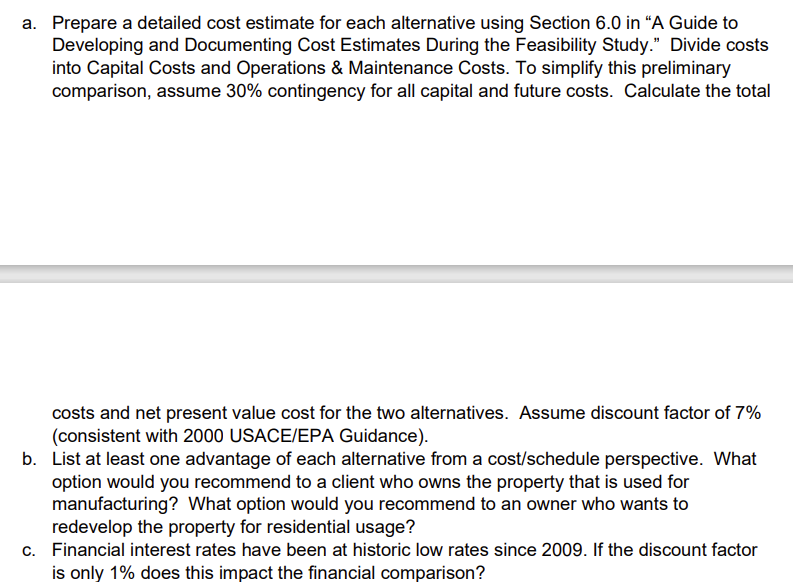

On HW#5, Problem #1 Parts A and C ask for a calculation of Net Present Value. A discount factor of 7% and 1% are included in the problem. This should be discount rate (or i) and not discount factor. See corrected language below, and I will correct the full homework assignment tonight. Thank you PD A. Prepare a detailed cost estimate for each alternative using Section 6.0 in "A Guide to Developing and Documenting Cost Estimates During the Feasibility Study. Divide costs into Capital Costs and Operations & Maintenance Costs. To simplify this preliminary comparison, assume 30% contingency for all capital and future costs. Calculate the totalcosts and net present value cost for the two alternatives. Assume discount rate of 7% (consistent with 2000 USACE/EPA Guidance). c. Financial interest rates have been at historic low rates since 2009. If the discount rate is only 1% does this impact the financial comparison? . . . 1. TCE releases occurred to shallow soil from several floor drains at the Former Radiator Factory and high concentrations of TCE are present in vadose zone soils. The highest concentration TCE soils are have been delineated to be approximately 50 feet by 75 feet. Depth to groundwater is approximately 16 feet below ground surface (bgs). You have been asked to evaluate the costs of excavation versus soil vapor extraction for unsaturated soils. For excavation, assume the following Labor and equipment costs to excavate and to backfill the area are $25 per cubic yard. Clean backfill costs $20 per cubic yard Pre-excavation soil sampling was performed with analysis for TCLP. Assume 30% of the excavated soil is characterized as hazardous waste ($325/ton for transport and disposal), and the remaining 70% can be disposed of as non-hazardous waste ($95/ton). Assume bulk density of 1.65 kg/L. Assume an allowance for soil confirmation sampling of $10,000. For soil vapor extraction, assume the following The system equipment costs $185,000 to build and deliver to the site A pilot test determined effective radius of influence for extraction wells to be 25 feet. Installation for extraction wells cost $4,000 each, including drill rig, well materials, and labor for oversight. Labor to install, connect, and start-up the system cost $50,000. Assume the system will operate for three years. Assume an allowance for annual sampling and laboratory analysis of $10,000 For the first year assume the following O&M costs: o monthly O&M visits at $1,500 each o quarterly granulated activated carbon change-outs cost at $8,000 each o electricity cost of $750 per month. Assume that in the second and third years of operation the same O&M, electricity, and quarterly carbon change out costs apply as the above bullets. Assume an additional annual O&M/repair cost of $10,000 each year in the second and third years. . . a. Prepare a detailed cost estimate for each alternative using Section 6.0 in A Guide to Developing and Documenting Cost Estimates During the Feasibility Study." Divide costs into Capital Costs and Operations & Maintenance Costs. To simplify this preliminary comparison, assume 30% contingency for all capital and future costs. Calculate the total costs and net present value cost for the two alternatives. Assume discount factor of 7% (consistent with 2000 USACE/EPA Guidance). b. List at least one advantage of each alternative from a cost/schedule perspective. What option would you recommend to a client who owns the property that is used for manufacturing? What option would you recommend to an owner who wants to redevelop the property for residential usage? C. Financial interest rates have been at historic low rates since 2009. If the discount factor is only 1% does this impact the financial comparison? On HW#5, Problem #1 Parts A and C ask for a calculation of Net Present Value. A discount factor of 7% and 1% are included in the problem. This should be discount rate (or i) and not discount factor. See corrected language below, and I will correct the full homework assignment tonight. Thank you PD A. Prepare a detailed cost estimate for each alternative using Section 6.0 in "A Guide to Developing and Documenting Cost Estimates During the Feasibility Study. Divide costs into Capital Costs and Operations & Maintenance Costs. To simplify this preliminary comparison, assume 30% contingency for all capital and future costs. Calculate the totalcosts and net present value cost for the two alternatives. Assume discount rate of 7% (consistent with 2000 USACE/EPA Guidance). c. Financial interest rates have been at historic low rates since 2009. If the discount rate is only 1% does this impact the financial comparison? . . . 1. TCE releases occurred to shallow soil from several floor drains at the Former Radiator Factory and high concentrations of TCE are present in vadose zone soils. The highest concentration TCE soils are have been delineated to be approximately 50 feet by 75 feet. Depth to groundwater is approximately 16 feet below ground surface (bgs). You have been asked to evaluate the costs of excavation versus soil vapor extraction for unsaturated soils. For excavation, assume the following Labor and equipment costs to excavate and to backfill the area are $25 per cubic yard. Clean backfill costs $20 per cubic yard Pre-excavation soil sampling was performed with analysis for TCLP. Assume 30% of the excavated soil is characterized as hazardous waste ($325/ton for transport and disposal), and the remaining 70% can be disposed of as non-hazardous waste ($95/ton). Assume bulk density of 1.65 kg/L. Assume an allowance for soil confirmation sampling of $10,000. For soil vapor extraction, assume the following The system equipment costs $185,000 to build and deliver to the site A pilot test determined effective radius of influence for extraction wells to be 25 feet. Installation for extraction wells cost $4,000 each, including drill rig, well materials, and labor for oversight. Labor to install, connect, and start-up the system cost $50,000. Assume the system will operate for three years. Assume an allowance for annual sampling and laboratory analysis of $10,000 For the first year assume the following O&M costs: o monthly O&M visits at $1,500 each o quarterly granulated activated carbon change-outs cost at $8,000 each o electricity cost of $750 per month. Assume that in the second and third years of operation the same O&M, electricity, and quarterly carbon change out costs apply as the above bullets. Assume an additional annual O&M/repair cost of $10,000 each year in the second and third years. . . a. Prepare a detailed cost estimate for each alternative using Section 6.0 in A Guide to Developing and Documenting Cost Estimates During the Feasibility Study." Divide costs into Capital Costs and Operations & Maintenance Costs. To simplify this preliminary comparison, assume 30% contingency for all capital and future costs. Calculate the total costs and net present value cost for the two alternatives. Assume discount factor of 7% (consistent with 2000 USACE/EPA Guidance). b. List at least one advantage of each alternative from a cost/schedule perspective. What option would you recommend to a client who owns the property that is used for manufacturing? What option would you recommend to an owner who wants to redevelop the property for residential usage? C. Financial interest rates have been at historic low rates since 2009. If the discount factor is only 1% does this impact the financial comparison

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts