Question: Please answer all parts, thank you!! Problem 24-3A (Algo) Applying payback period, accounting rate of return, and net present value LO P1, P2, P3 Garcia

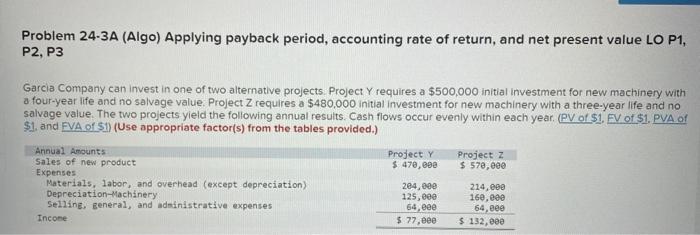

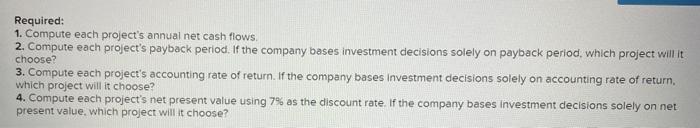

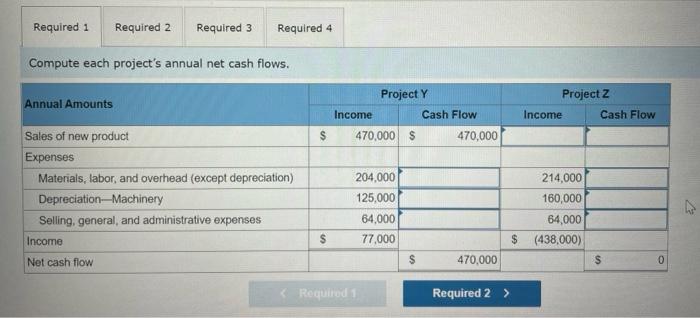

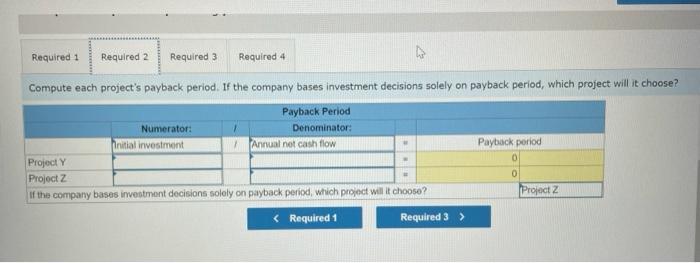

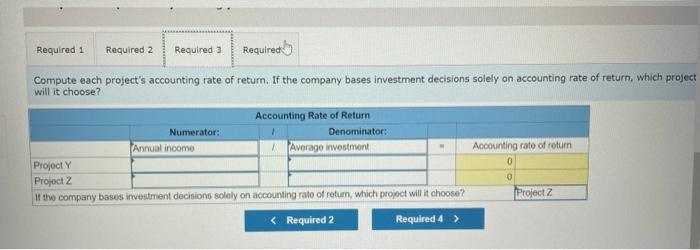

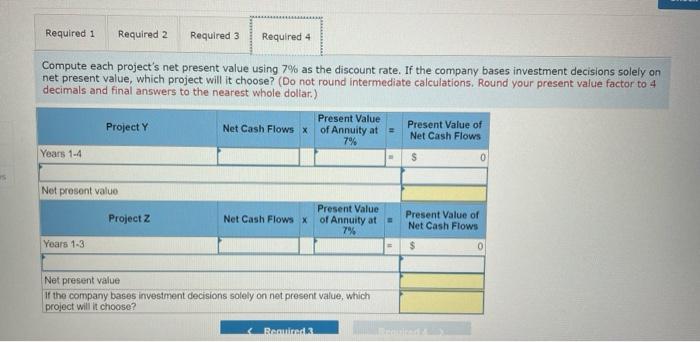

Problem 24-3A (Algo) Applying payback period, accounting rate of return, and net present value LO P1, P2, P3 Garcia Company can invest in one of two altemative projects. Project Y requires a $500,000 initial investment for new machinery with a four-year life and no salvage value. Project Z requires a $480,000 initial investment for new machinery with a three-year life and no salvage value. The two projects yield the following annual results. Cash flows occur evenly within each year. (PV of $1, EV of $1. PVA of \$1, and FVA of \$1) (Use appropriate factor(s) from the tables provided.) Required: 1. Compute each project's annual net cash flows. 2. Compute each project's payback period. If the company bases investment decisions solely on payback period, which project will it choose? 3. Compute each project's accounting rate of return. If the company bases investment decisions solely on accounting rate of return. which project will it choose? 4. Compute each project's net present value using 7% as the discount rate. If the company bases investment decisions solely on net present value. which project will it choose? Compute each project's annual net cash flows. Required 1 Required 2 Required 3 Required 4 Compute each project's payback period. If the company bases investment decisions solely on payback period, which project will it choose? Compute each project's accounting rate of retum. If the company bases investment decisions solely on accounting rate of return, which project will it choose? Compute each project's net present value using 7% as the discount rate. If the company bases investment decisions solely on net present value, which project will it choose? (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts