Question: On January 1 0 , Year 2 , Box, Inc. purchased marketable debt securities of Knox, Inc, and Scot, Inc. Box classified both debt securities

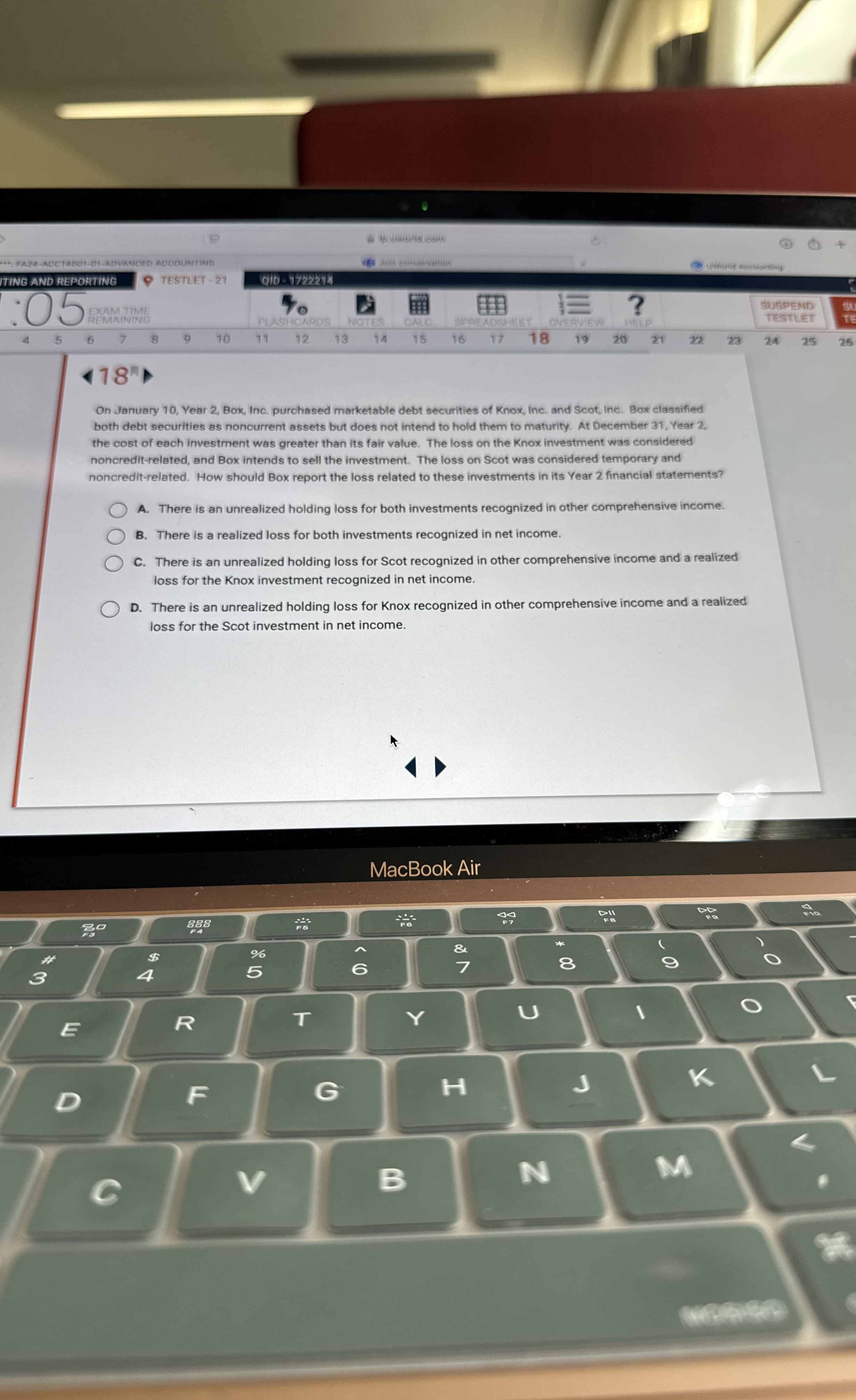

On January Year Box, Inc. purchased marketable debt securities of Knox, Inc, and Scot, Inc. Box classified both debt securities as noncurrent assets but does not intend to hold them to maturity. At December Year the cost of each investment was greater than its fair value. The loss on the Knox investment was considered noncreditrelated, and Box intends to sell the investment. The loss on Scot was considered temporary and noncreditrelated. How should Box report the loss related to these investments in its Year financial statements?

A There is an unrealized holding loss for both investments recognized in other comprehensive income.

B There is a realized loss for both investments recognized in net income.

C There is an unrealized holding loss for Scot recognized in other comprehensive income and a realized loss for the Knox investment recognized in net income.

D There is an unrealized holding loss for Knox recognized in other comprehensive income and a realized loss for the Scot investment in net income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock