Question: Robin exchanged land with FMV of $50,000, basis $47,000 with Batman for land with FMV of $45.000 in a like-kind exchange. Batman also assumed

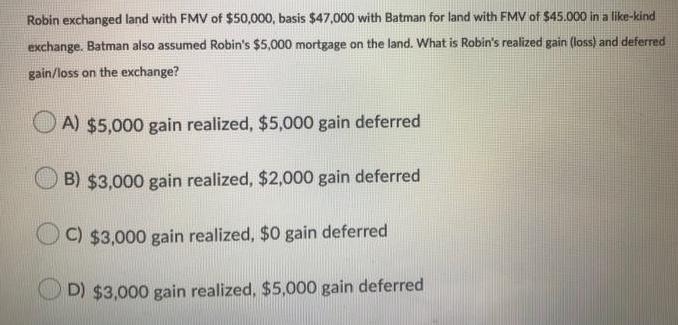

Robin exchanged land with FMV of $50,000, basis $47,000 with Batman for land with FMV of $45.000 in a like-kind exchange. Batman also assumed Robin's $5,000 mortgage on the land. What is Robin's realized gain (loss) and deferred gain/loss on the exchange? A) $5,000 gain realized, $5,000 gain deferred B) $3,000 gain realized, $2,000 gain deferred C) $3,000 gain realized, $0 gain deferred D) $3,000 gain realized, $5,000 gain deferred

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below C 3000 gain realized 0 gain deferred To ... View full answer

Get step-by-step solutions from verified subject matter experts