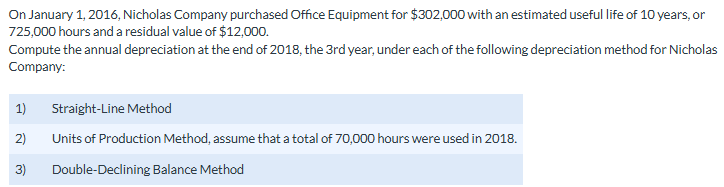

Question: On January 1 , 2 0 1 6 , Nicholas Company purchased Office Equipment for ( ) / ( ( / $ 3 0 2

On January Nicholas Company purchased Office Equipment for $ with an estimated useful life of years, or hours and a residual value of $

Compute the annual depreciation at the end of the rd year, under each of the following depreciation method for Nicholas Company:

StraightLine Method

Units of Production Method, assume that a total of hours were used in

DoubleDeclining Balance Method

commas.tableDepreciation in

answers, you must enter your answers with commas$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock