Question: On January 1 , 2 0 2 2 , Mr . Pane forms Pane in the Glass Window Company with a fiscal year end of

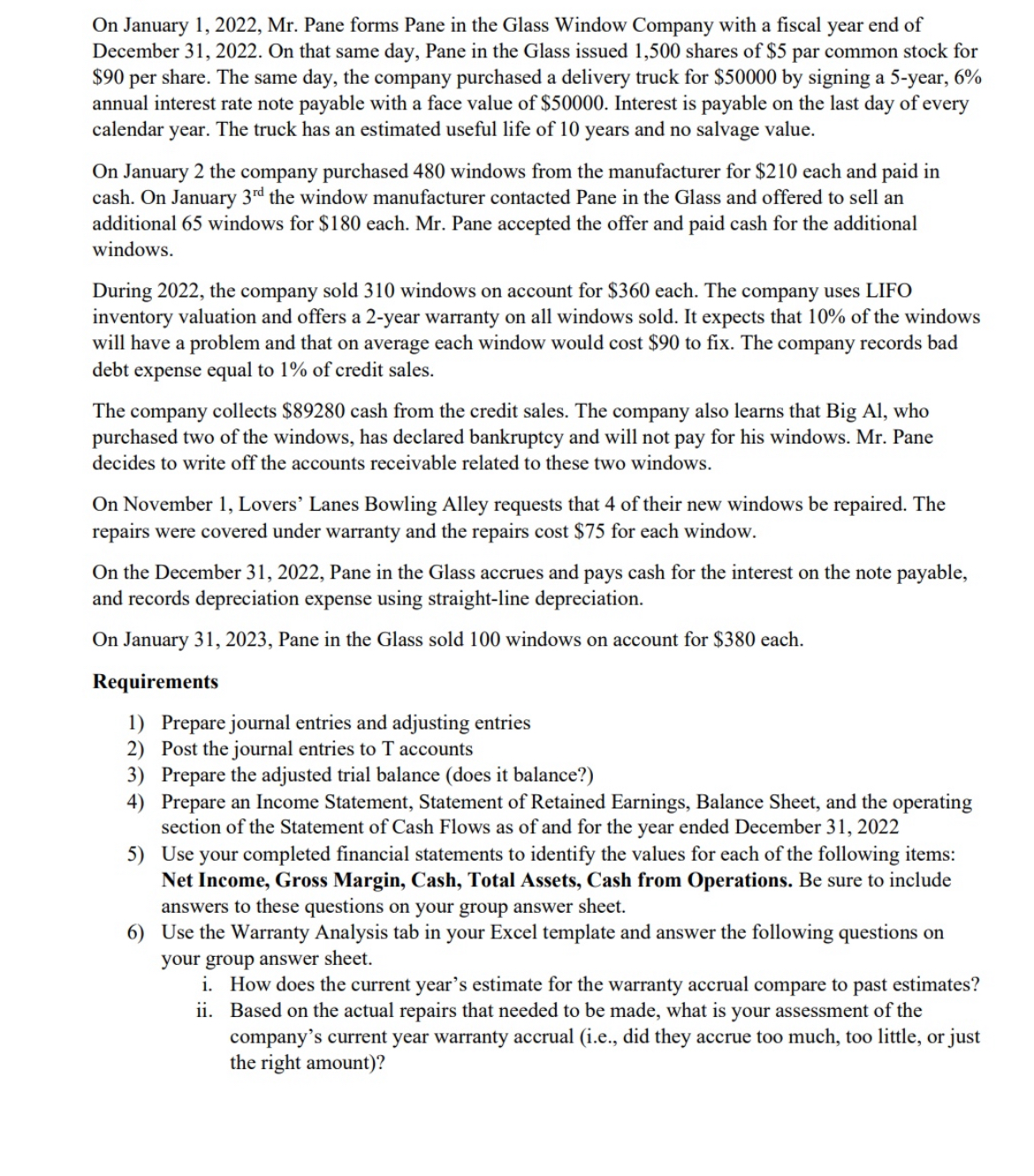

On January Mr Pane forms Pane in the Glass Window Company with a fiscal year end of December On that same day, Pane in the Glass issued shares of $ par common stock for $ per share. The same day, the company purchased a delivery truck for $ by signing a year, annual interest rate note payable with a face value of $ Interest is payable on the last day of every calendar year. The truck has an estimated useful life of years and no salvage value.

On January the company purchased windows from the manufacturer for $ each and paid in cash. On January the window manufacturer contacted Pane in the Glass and offered to sell an additional windows for $ each. Mr Pane accepted the offer and paid cash for the additional windows.

During the company sold windows on account for $ each. The company uses LIFO inventory valuation and offers a year warranty on all windows sold. It expects that of the windows will have a problem and that on average each window would cost $ to fix. The company records bad debt expense equal to of credit sales.

The company collects $ cash from the credit sales. The company also learns that Big Al who purchased two of the windows, has declared bankruptcy and will not pay for his windows. Mr Pane decides to write off the accounts receivable related to these two windows.

On November Lovers' Lanes Bowling Alley requests that of their new windows be repaired. The repairs were covered under warranty and the repairs cost $ for each window.

On the December Pane in the Glass accrues and pays cash for the interest on the note payable, and records depreciation expense using straightline depreciation.

On January Pane in the Glass sold windows on account for $ each.

Requirements

Prepare journal entries and adjusting entries

Post the journal entries to accounts

Prepare the adjusted trial balance does it balance?

Prepare an Income Statement, Statement of Retained Earnings, Balance Sheet, and the operating section of the Statement of Cash Flows as of and for the year ended December

Use your completed financial statements to identify the values for each of the following items: Net Income, Gross Margin, Cash, Total Assets, Cash from Operations. Be sure to include answers to these questions on your group answer sheet.

Use the Warranty Analysis tab in your Excel template and answer the following questions on your group answer sheet.

i How does the current year's estimate for the warranty accrual compare to past estimates?

ii Based on the actual repairs that needed to be made, what is your assessment of the company's current year warranty accrual ie did they accrue too much, too little, or just the right amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock