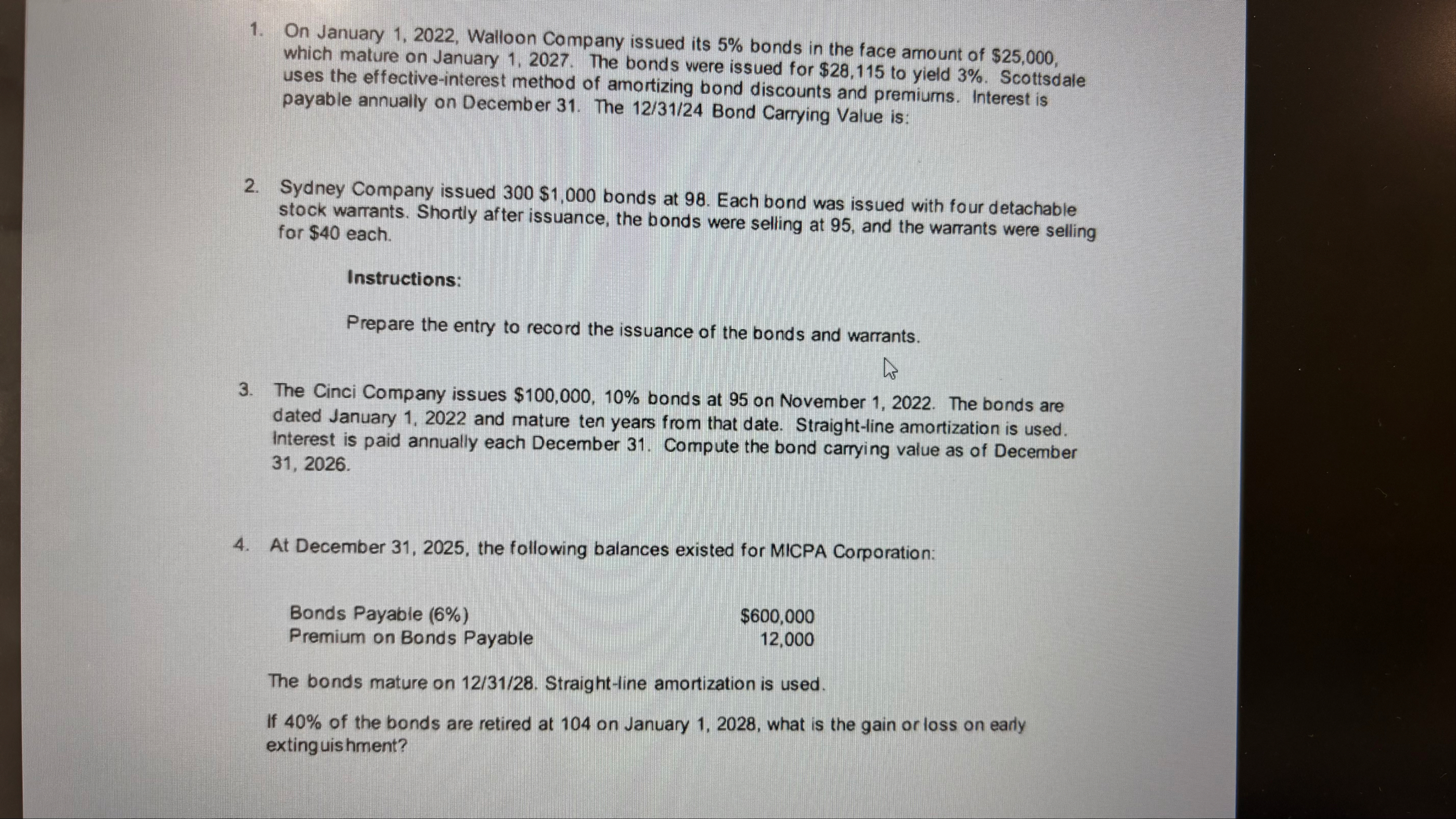

Question: On January 1 , 2 0 2 2 , Walloon Company issued its 5 % bonds in the face amount of $ 2 5 ,

On January Walloon Company issued its bonds in the face amount of $ which mature on January The bonds were issued for $ to yield Scottsdale uses the effectiveinterest method of amortizing bond discounts and premiums. Interest is payable annually on December The Bond Carrying Value is:

Sydney Company issued $ bonds at Each bond was issued with four detachable stock warrants. Shortly after issuance, the bonds were selling at and the warrants were selling for $ each.

Instructions:

Prepare the entry to record the issuance of the bonds and warrants.

The Cinci Company issues $ bonds at on November The bonds are dated January and mature ten years from that date. Straightline amortization is used. Interest is paid annually each December Compute the bond carrying value as of December

At December the following balances existed for MICPA Corporation:

tableBonds Payable $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock