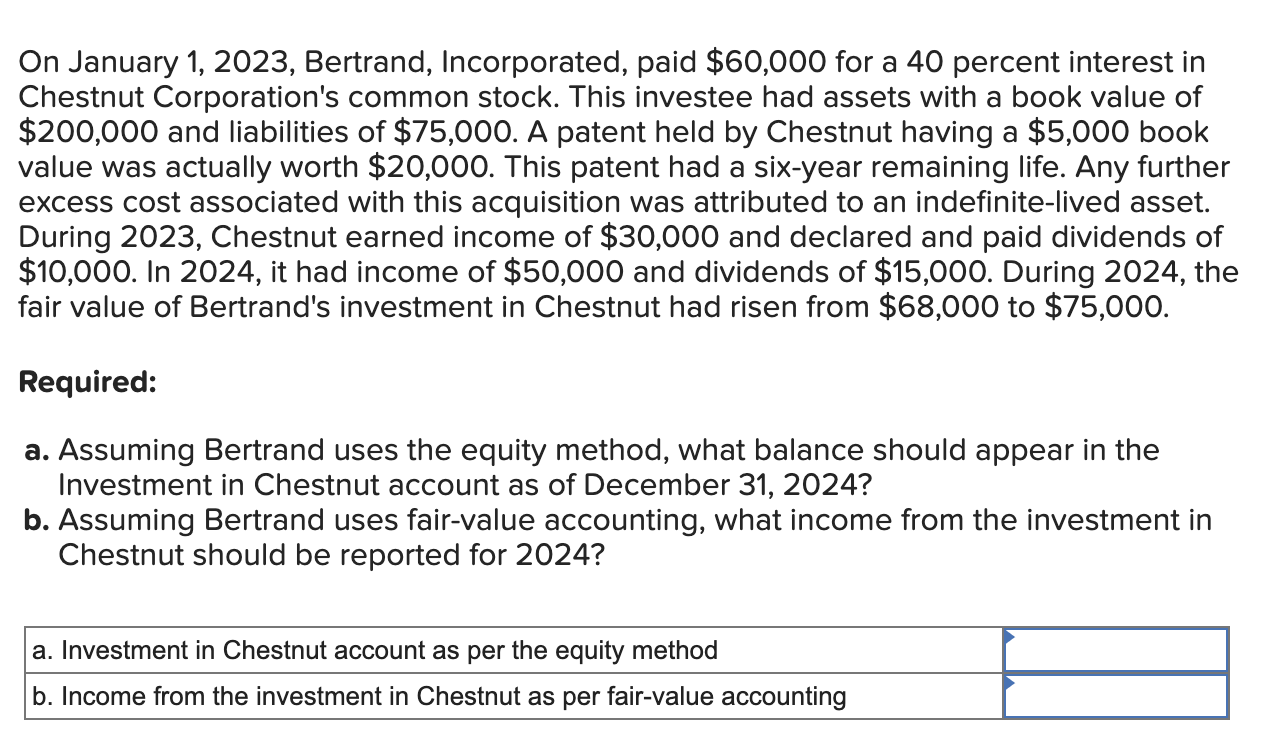

Question: On January 1 , 2 0 2 3 , Bertrand, Incorporated, paid $ 6 0 , 0 0 0 for a 4 0 percent interest

On January Bertrand, Incorporated, paid $ for a percent interest in Chestnut Corporation's common stock. This investee had assets with a book value of $ and liabilities of $ A patent held by Chestnut having a $ book value was actually worth $ This patent had a sixyear remaining life. Any further excess cost associated with this acquisition was attributed to an indefinitelived asset. During Chestnut earned income of $ and declared and paid dividends of $ In it had income of $ and dividends of $ During the fair value of Bertrand's investment in Chestnut had risen from $ to $

Required:

Assuming Bertrand uses the equity method, what balance should appear in the Investment in Chestnut account as of December

Assuming Bertrand uses fairvalue accounting, what income from the investment in Chestnut should be reported for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock