Question: Task 1 (5 marks): On 1st October, 2021 an entity N made payment in amount of 1,800 euro for an insurance policy covering one year,

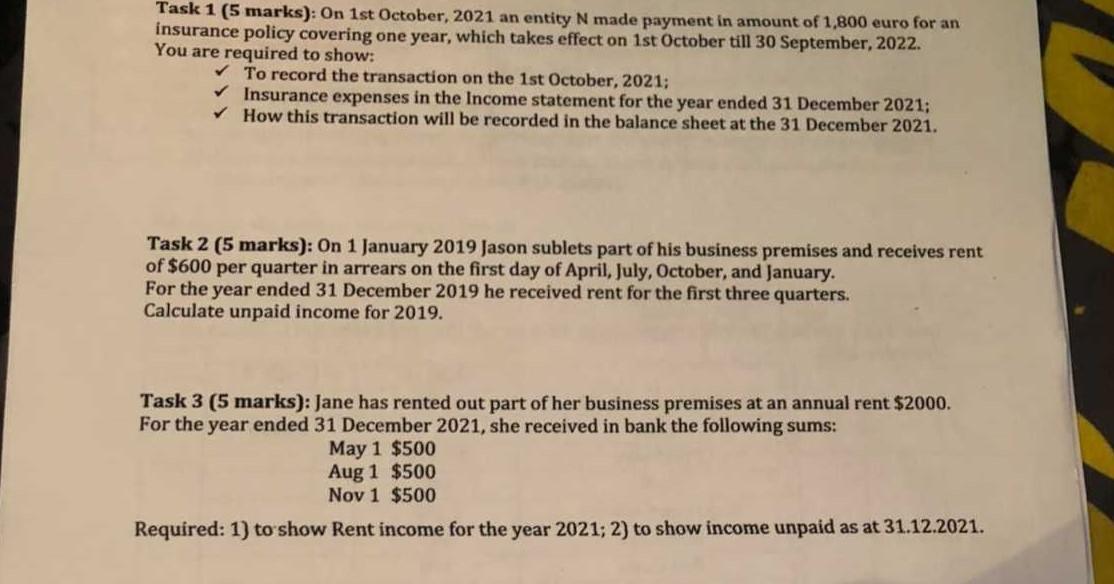

Task 1 (5 marks): On 1st October, 2021 an entity N made payment in amount of 1,800 euro for an insurance policy covering one year, which takes effect on 1st October till 30 September, 2022. You are required to show: To record the transaction on the 1st October, 2021; Insurance expenses in the Income statement for the year ended 31 December 2021; How this transaction will be recorded in the balance sheet at the 31 December 2021 . Task 2 ( 5 marks): On 1 January 2019 Jason sublets part of his business premises and receives rent of $600 per quarter in arrears on the first day of April, July, October, and January. For the year ended 31 December 2019 he received rent for the first three quarters. Calculate unpaid income for 2019. Task 3 ( 5 marks): Jane has rented out part of her business premises at an annual rent $2000. For the year ended 31 December 2021, she received in bank the following sums: May 1$500 Aug 1$500 Nov 1$500 Required: 1) to show Rent income for the year 2021;2 ) to show income unpaid as at 31.12.2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts