Question: On January 1 , 2 0 2 3 , Cayce Corporation acquired 1 0 0 percent of Simbel Company for consideration transferred with a fair

On January Cayce Corporation acquired percent of Simbel Company for consideration transferred with a fair value of $ Cayce is a USbased company headquartered in Buffalo, New York, and Simbel is in Cairo, Egypt. Cayce accounts for its investment in Simbel under the initial value method. Any excess of fair value of consideration transferred over book value is attributable to undervalued land on Simbels books. Simbel had no retained earnings at the date of acquisition. The following are the financial statements for the two operations. Information for Cayce and for Simbel is in US dollars $ and Egyptian pounds E respectively. tableCAYCE CORPORATION,,Consolidation Worksheet,,

Prev

of

Next

Cayce Corporation Simbel Company

Sales $ E

Cost of goods sold

Salary expense

Rent expense

Other expenses

Dividend incomefrom Simbel

Gain on sale of building,

Net income $ E

Retained earnings, $ E

Net income

Dividends

Retained earnings, $ E

Cash and receivables $ E

Inventory

Prepaid expenses

Investment in Simbel initial value

Property, plant, and equipment net

Total assets $ E

Accounts payable $ E

Notes payabledue in

Common stock

Additional paidin capital

Retained earnings,

Total liabilities and equities $ E

Additional Information

During the first year of joint operation, Simbel reported income of E earned evenly throughout the year. Simbel declared a dividend of E to Cayce on June of that year. Simbel also declared the dividend on June

On December Simbel classified a E expenditure as a rent expense, although this payment related to prepayment of rent for the first few months of

The exchange rates for E are as follows:

January $

June

Weighted average rate for

December

June

October

Weighted average rate for

December

Required:

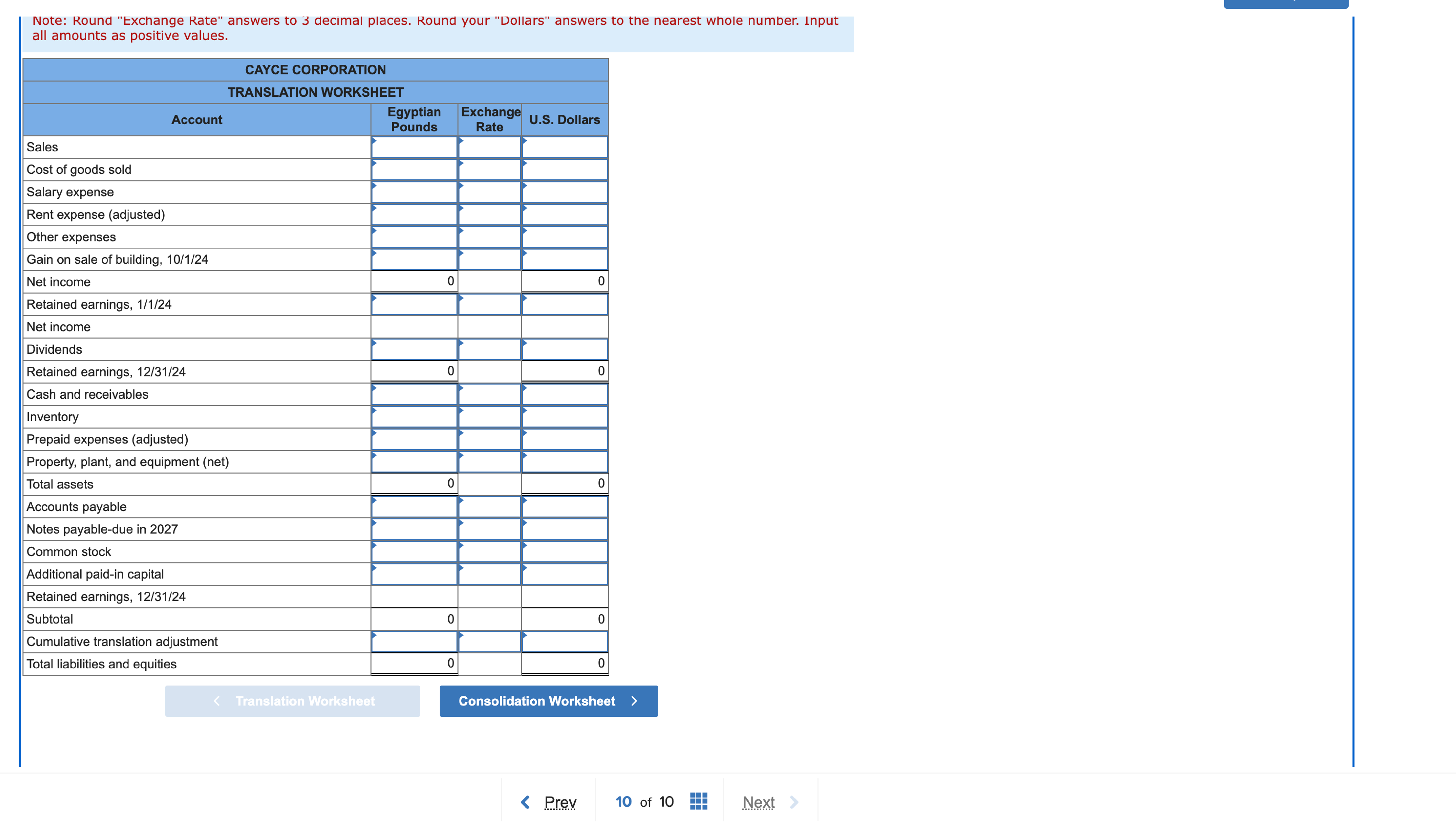

Translate Simbels financial statements into US dollars and prepare a consolidation worksheet for Cayce and its Egyptian subsidiary. Assume that the Egyptian pound is the subsidiarys functional currency.Note: Round "Exchange Rate" answers to decimal places. Round your "Dollars" answers to the nearest whole number. Input all amounts as positive values.

tableCAYCE CORPORATIONTRANSLATION WORKSHEETAccounttableEgyptianPoundstableExchangeRateUS DollarsSalesCost of goods soldSalary expenseRent expense adjustedOther expensesGain on sale of building, Net income,Retained earnings, Net incomeDividendsRetained earnings, Cash and receivablesInventoryPrepaid expenses adjustedProperty plant, and equipment netTotal assets,Accounts payableNotes payabledue in Common stockAdditional paidin capitalRetained earnings, SubtotaltableCumulative translation adjustmentTotal liabilities and equities,

Please answer part A and B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock