Question: On January 1 , 2 0 2 4 , Lenore Corp. purchased 5 0 0 , 0 0 0 of ( 5 %

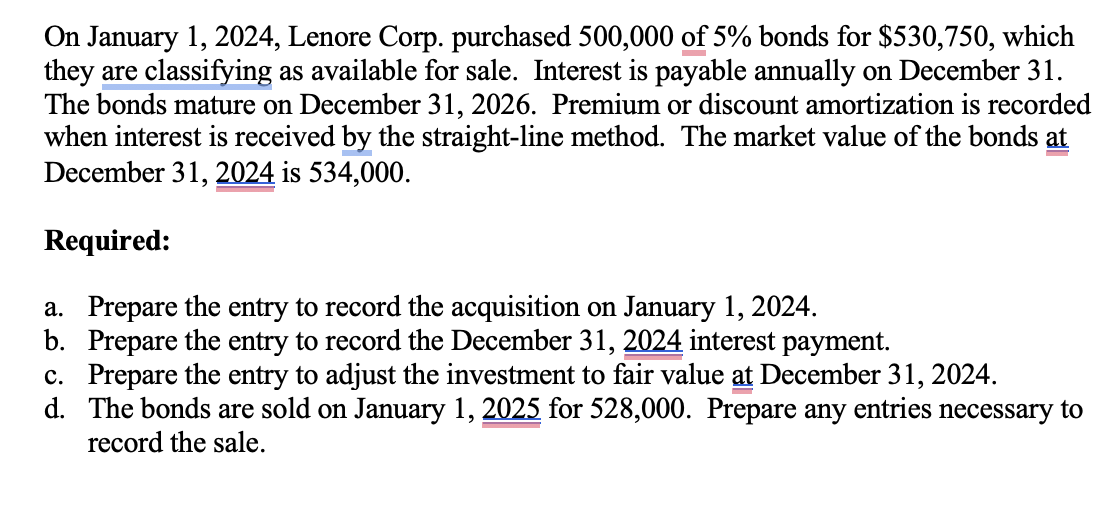

On January Lenore Corp. purchased of bonds for $ which they are classifying as available for sale. Interest is payable annually on December The bonds mature on December Premium or discount amortization is recorded when interest is received by the straightline method. The market value of the bonds at December is Required: a Prepare the entry to record the acquisition on January b Prepare the entry to record the December interest payment. c Prepare the entry to adjust the investment to fair value at December d The bonds are sold on January underlineunderline for Prepare any entries necessary to record the sale.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock