Question: On January 1 , 2 0 2 5 , Pepper Co . issued tert - year borids with a face value of $ 5 ,

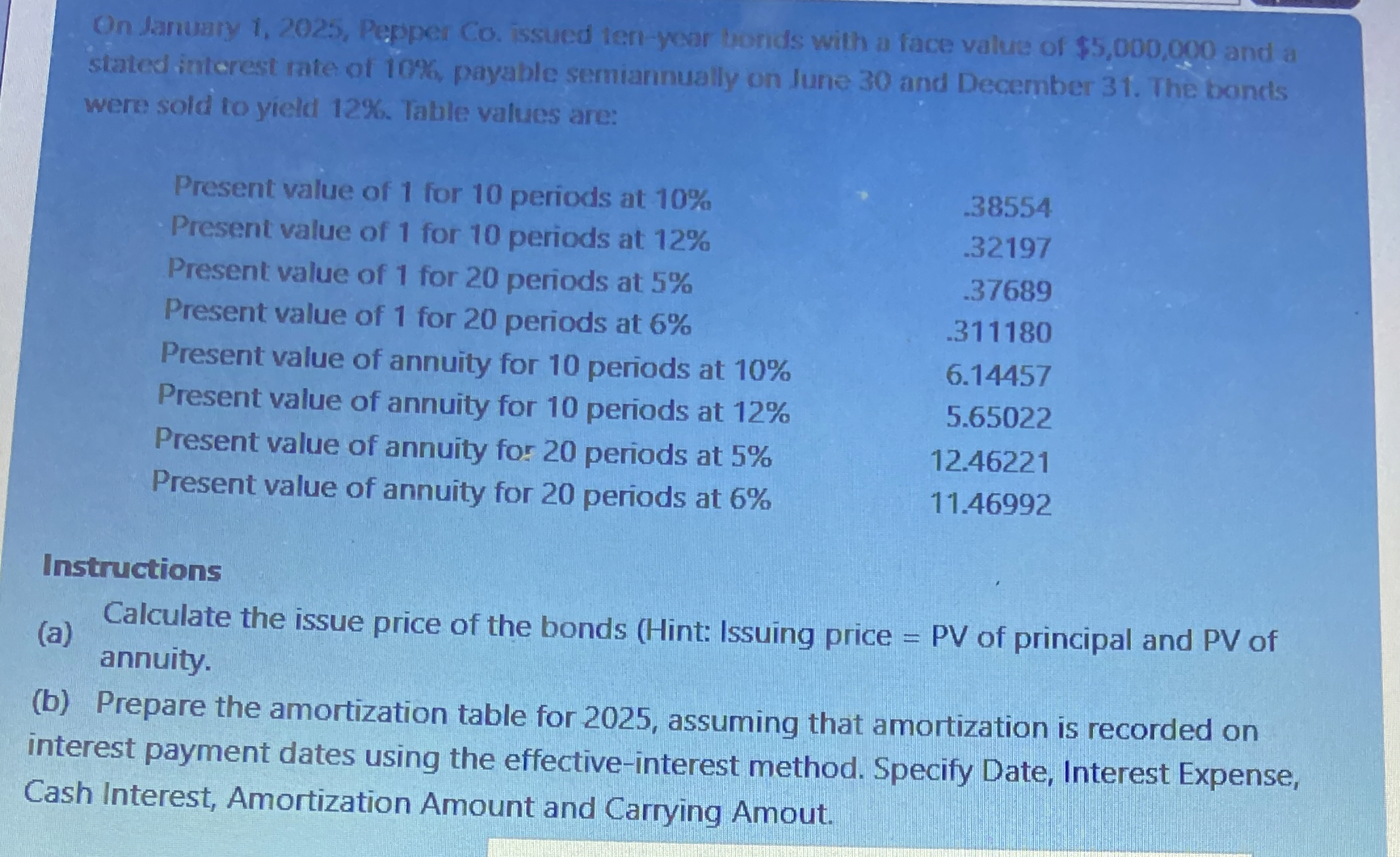

On January Pepper Co issued tertyear borids with a face value of $ and a stated intorest mate of payable semiantugly on lune and December The bonds were sold' to yield Table values are:

tablePresent value of for periods at Present value of for periods at Present value of for periods at Present value of for periods at Present value of annuity for periods at Present value of annuity for periods at Present value of annuity for periods at Present value of annuity for periods at

Instructions

a Calculate the issue price of the bonds Hint: Issuing price of principal and PV of annuity.

b Prepare the amortization table for assuming that amortization is recorded on interest payment dates using the effectiveinterest method. Specify Date, Interest Expense, Cash Interest, Amortization Amount and Carrying Amout.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock