Question: On January 1, a company issues bonds dated January 1 with a par value of $450,000. The bonds mature in 5 years. The contract rate

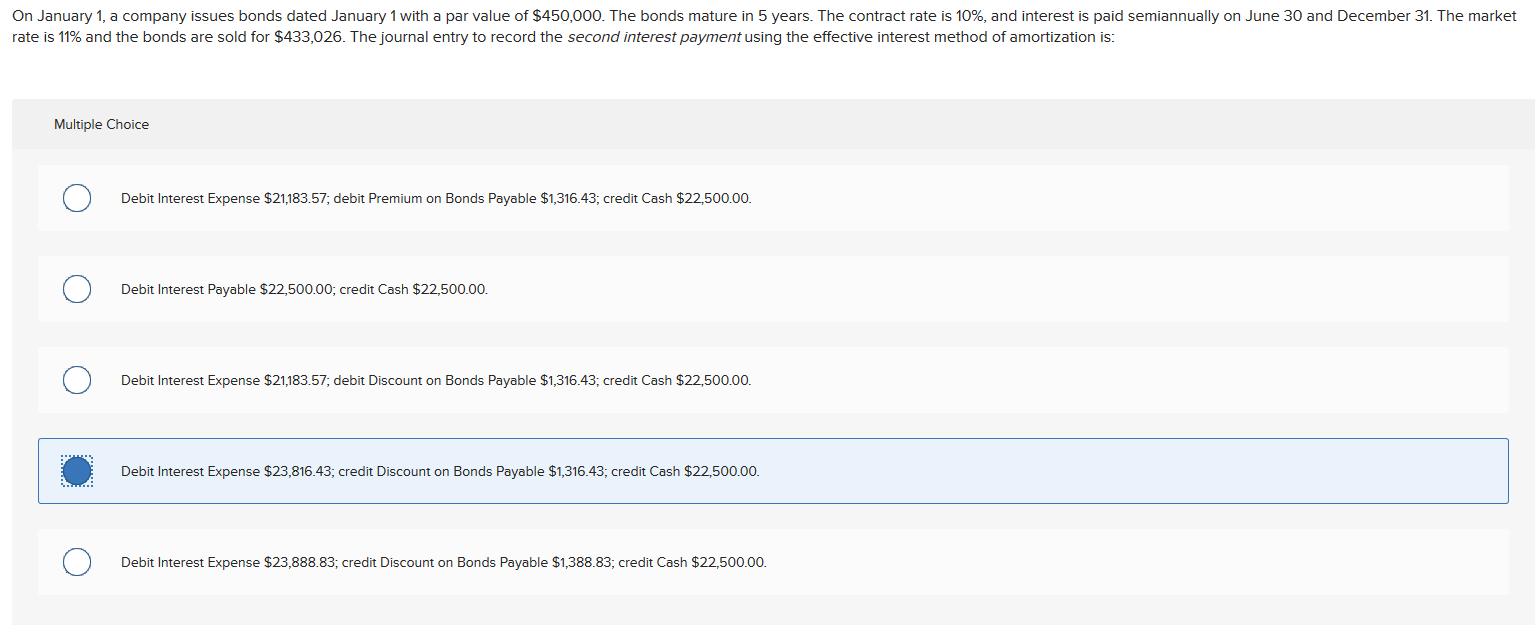

On January 1, a company issues bonds dated January 1 with a par value of $450,000. The bonds mature in 5 years. The contract rate is 10%, and interest is paid semiannually on June 30 and December 31. The market rate is 11% and the bonds are sold for $433,026. The journal entry to record the second interest payment using the effective interest method of amortization is: Multiple Choice O Debit Interest Expense $21,183.57; debit Premium on Bonds Payable $1,316.43; credit Cash $22,500.00. Debit Interest Payable $22,500.00; credit Cash $22,500.00 O Debit Interest Expense $21,183.57; debit Discount on Bonds Payable $1,316.43; credit Cash $22,500.00 Debit Interest Expense $23,816.43; credit Discount on Bonds Payable $1,316.43; credit Cash $22,500.00 Debit Interest Expense $23,888.83; credit Discount on Bonds Payable $1,388.83; credit Cash $22,500.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts