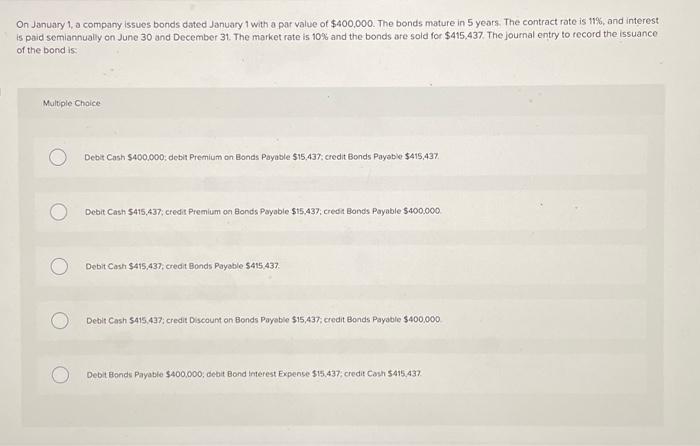

Question: On January 1 , a company issues bonds dated January 1 with a. par value of $400,000. The bonds mature in 5 years. The contract

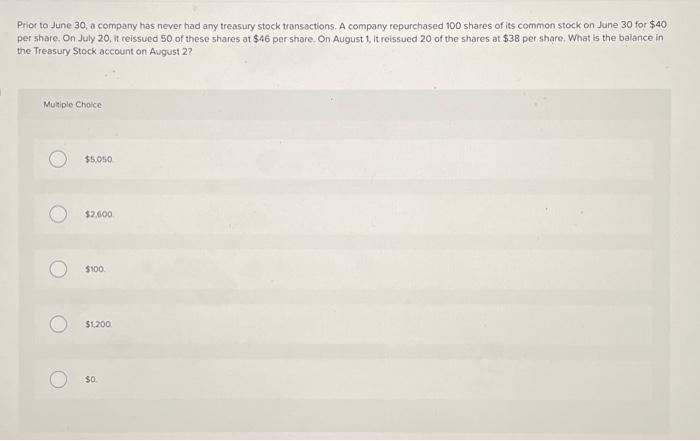

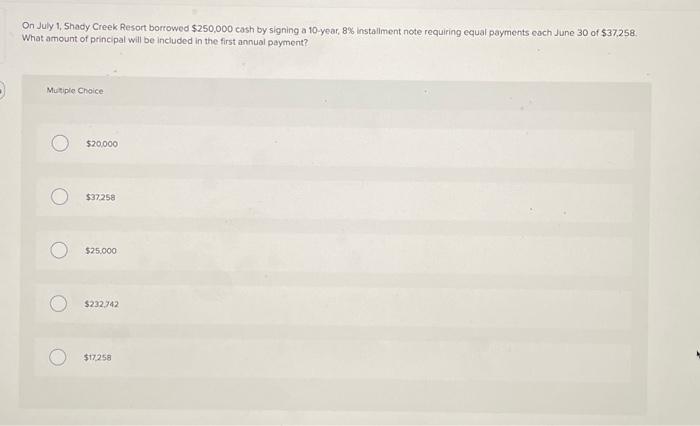

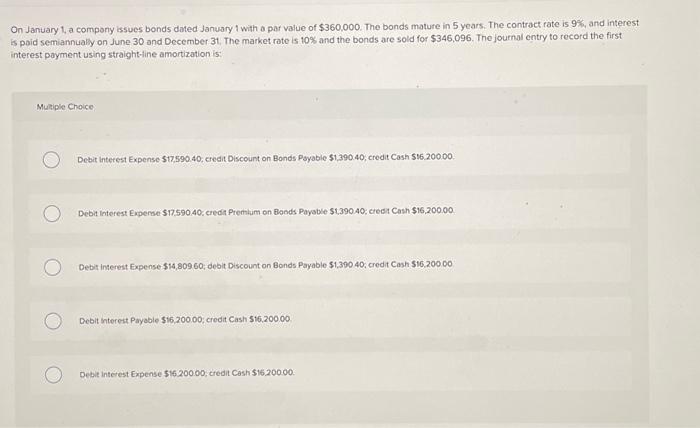

On January 1 , a company issues bonds dated January 1 with a. par value of $400,000. The bonds mature in 5 years. The contract rate is 11%, and interest is paid semiannualy on June 30 and December 31 . The market rate is 10% and the bonds are sold for $415,437. The journal entry to record the issuance of the bond is- Multiple Chaice Debit Cash $400,000 :debit Premium on Bonds Payable 515,437 , credit Bends Payable $415,437 Debit Cash 5415,437 ; credit Premlum on Bonds Payable \$15,437; credit Bonds Payable $400,000 Debit Cash \$415,437, credit Bonds Payable 5415,437. Debit Cash 5415,437; credit Discount on Bonds Payoble 515,437; credit Bonds Payable $400.000 Debit Bonds Payable \$400,000, debit Bond Interest Expense \$15,437; credit Cown 5415,437 . Prior to June 30 , a company has never had any treasury stock transactions. A company repurchased 100 shares of its common stock on June 30 for $40 per share. On July 20 , it reissued 50 of these shares at $46 per share. On August 1, it reissued 20 of the shares at $38 per share. What is the balance in the Treasury Stock account on August 2 ? Muliple Choice $5.050 $2,000 5100 $1,200 30 On July 1, Shady Creek Resort borrowed $250,000 cash by signing a 10-year, 8% installment note requiring equal payments each June 30 of $37,258. What amount of principal will be included in the first annual payment? Muipic choice. 520000 $37258 $25.000 5232.742 517258 On January 1, a compony issues bonds dated January i with a par value of $360,000. The bonds mature in 5 years. The contract rate is 9%, and interest is poid semiannually on June 30 and December 31 . The market rate is 10% and the bonds are sold for $346,096. The journal entry to record the first interest payment using straight-fine amortization is: Mutiple Chaice Debit interest Expense \$17,590.40, credit Discount on Bonds Psyabie \$1.390.40, credit Cash 516.200 .00 Debit interest Expense 517.590,40. eredi Prentim on Boods Paysble $1,390,40, credt Cash $16,200.00 Debit interest fxpense $14,80960; debit Discount on Bonds Payable $1,39040, credit Cash $16,20000 Debit interent Payable $16,200.00; credit Cash $16,200.00 Debit interest Expense $1620000, tredit Cash $15.200.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts