On January 1, Lessee Company leases equipment with a fair value of $2,000 from Lessor Company...

Fantastic news! We've Found the answer you've been seeking!

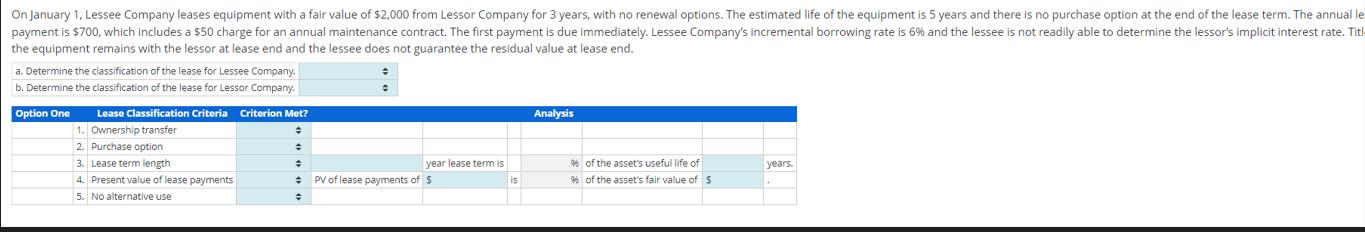

Question:

Transcribed Image Text:

On January 1, Lessee Company leases equipment with a fair value of $2,000 from Lessor Company for 3 years, with no renewal options. The estimated life of the equipment is 5 years and there is no purchase option at the end of the lease term. The annual le payment is $700, which includes a $50 charge for an annual maintenance contract. The first payment is due immediately. Lessee Company's incremental borrowing rate is 6% and the lessee is not readily able to determine the lessor's implicit interest rate. Titl the equipment remains with the lessor at lease end and the lessee does not guarantee the residual value at lease end. a. Determine the classification of the lease for Lessee Company. b. Determine the classification of the lease for Lessor Company. Lease Classification Criteria Criterion Met? Analysis Option One 1. Ownership transfer 2. Purchase option = ÷ 3. Lease term length = year lease term is % of the asset's useful life of years. 4. Present value of lease payments ÷ PV of lease payments of 5 is % of the asset's fair value of S 5. No alternative use = On January 1, Lessee Company leases equipment with a fair value of $2,000 from Lessor Company for 3 years, with no renewal options. The estimated life of the equipment is 5 years and there is no purchase option at the end of the lease term. The annual le payment is $700, which includes a $50 charge for an annual maintenance contract. The first payment is due immediately. Lessee Company's incremental borrowing rate is 6% and the lessee is not readily able to determine the lessor's implicit interest rate. Titl the equipment remains with the lessor at lease end and the lessee does not guarantee the residual value at lease end. a. Determine the classification of the lease for Lessee Company. b. Determine the classification of the lease for Lessor Company. Lease Classification Criteria Criterion Met? Analysis Option One 1. Ownership transfer 2. Purchase option = ÷ 3. Lease term length = year lease term is % of the asset's useful life of years. 4. Present value of lease payments ÷ PV of lease payments of 5 is % of the asset's fair value of S 5. No alternative use =

Expert Answer:

Answer rating: 100% (QA)

To determine the classification of the lease for both Lessee Company and Lessor Company we need to a... View the full answer

Related Book For

Intermediate accounting

ISBN: 978-0077647094

7th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson

Posted Date:

Students also viewed these accounting questions

-

The following questions are used in the Kaplan CPA Review Course to study leases while preparing for the CPA examination. Determine the response that best completes the statements or questions. 1. A...

-

The following questions are adapted from a variety of sources including questions developed by the AICPA Board of Examiners and those used in the Kaplan CPA Review Course used to study lease...

-

On January 1, 2016, Curran Manufacturing Corporation (CMC) agreed to lease a piece of heavy equipment to Oates Products, Inc. CMC paid $ 900,000 to manufacture the machine and carries it at this...

-

Life Science Incorporated (LSI) is a firm with no debt and its 20 million shares are currently trading for $16 per share. Based on the prospects for one of LSI's new drugs, management feels the true...

-

Selected information about resources for MnM Productions, which produces music on CDs, is as follows: a. Prepare an activity-based management income statement. b. Write a short report stating why...

-

When you want to "snap" a towel, the best way to wrap the towel is so that the end that you hold and shake is thick, and the far end is thin. When you shake the thick end, a wave travels down the...

-

Merit increases require a single performance number, while most incentive plans have multiple and varying performance measures. How can the PM system meet both needs?

-

Lucia, a single taxpayer, operates a florist business. She is considering either continuing the business as a sole proprietorship or reorganizing it as either a C corporation or an S corporation. Her...

-

(s,Q) Inventory Model AUtailer sells umbrellas and experiences demand that follows a normal distribution with a weekly mean of 100 umbrellas and a weekly standard deviation of 20 umbrellas. The cost...

-

List the item ID as ITEM_ID and description as ITEM_DESC for all items. The descriptions should appear in uppercase letters. Task 2: List the customer ID and first and last names for all customers...

-

Read the case study Daimler-chrysler and answer the following: Global convergence of accounting standards could eliminate the need for DC to maintain costly accounting systems under both IFRS and...

-

The short run is the length of time it takes all fixed costs to become ____.

-

A tax cut __________ supply.

-

If supply falls and demand remains the same, equilibrium price will ______, and equilibrium quantity will ________.

-

A perfectly elastic supply curve can be shown graphically as ________.

-

If you were in charge of your company, what would you tell recruiters to do or not do to enhance their recruiting efforts? Why?

-

c) d) Below is the information relating to the intangible assets of Yehia Bhd. for the year ended 31 December 2021. a) b) On 1 January 2019, Yehia Bhd. purchased a patent from Khaleed Sport Bhd, at...

-

Rewrite Programming Exercise 7.5 using streams. Display the numbers in increasing order. Data from Programming Exercise 7.5 Write a program that reads in 10 numbers and displays the number of...

-

At January 1, 2013, Transit Developments owed First City Bank Group $600,000, under an 11% note with three years remaining to maturity. Due to financial difficulties, Transit was unable to pay the...

-

The Commonwealth of Virginia filed suit in October 2011, against Northern Timber Corporation seeking civil penalties and injunctive relief for violations of environmental laws regulating forest...

-

The comparative balance sheets for 2013 and 2012 and the statement of income for 2013 are given below for Dux Company. Additional information from Duxs accounting records is provided also. Additional...

-

Which elements an agile software team must consider to attribute effort to a product?

-

Why is the rounded Fibonacci series used to assign story points instead of the natural numbers?

-

Variants and exception handlers are alternate flows for a use case. In which situations should one or the other be used?

Study smarter with the SolutionInn App