Answered step by step

Verified Expert Solution

Question

1 Approved Answer

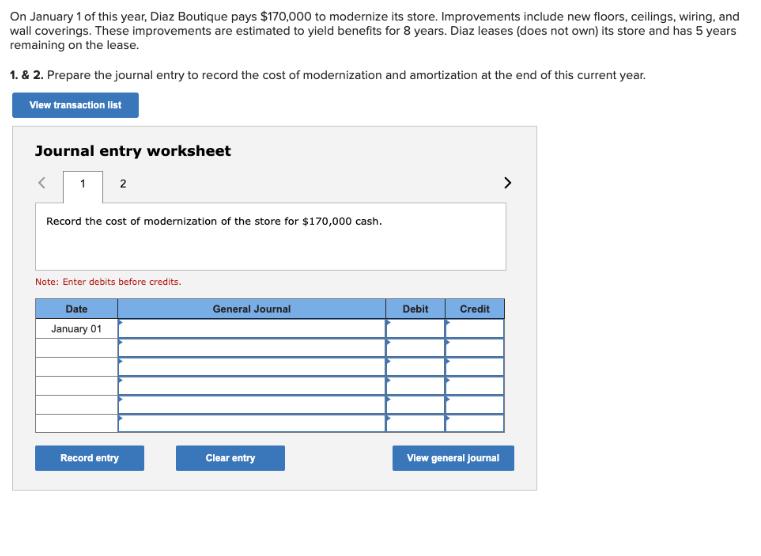

On January 1 of this year, Diaz Boutique pays $170,000 to modernize its store. Improvements include new floors, ceilings, wiring, and wall coverings. These

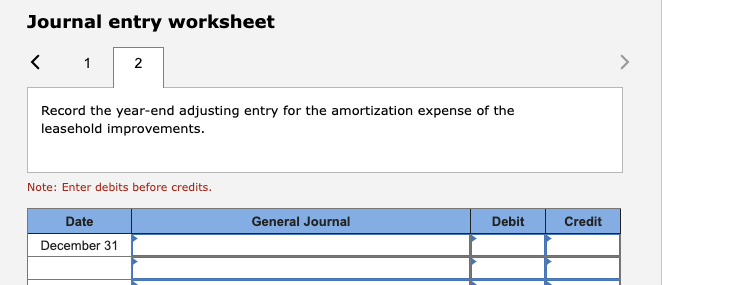

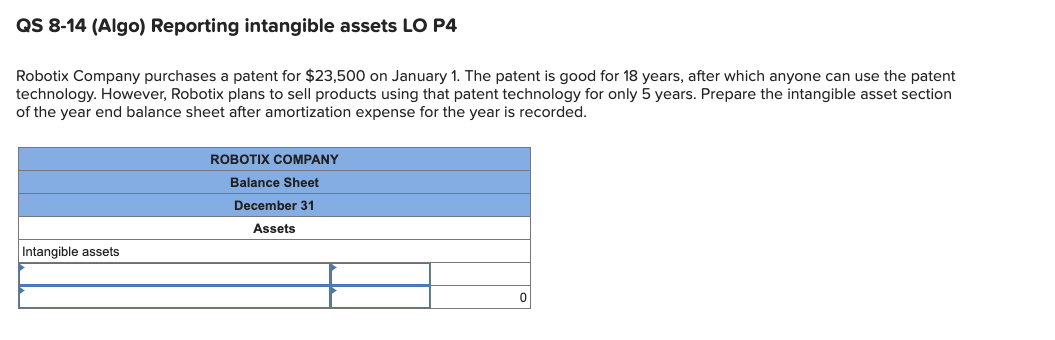

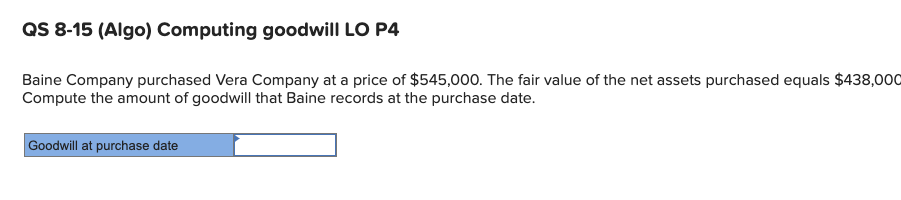

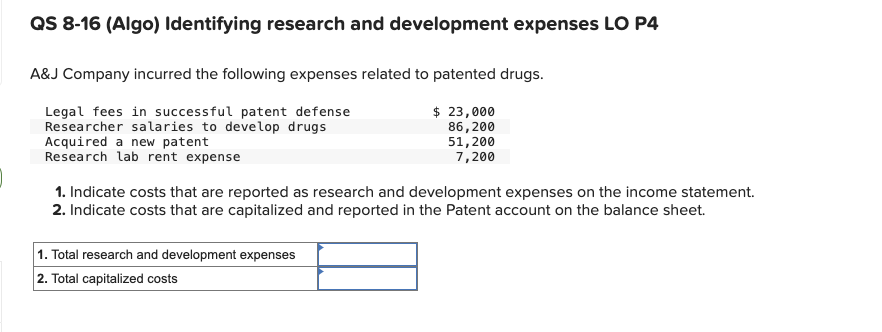

On January 1 of this year, Diaz Boutique pays $170,000 to modernize its store. Improvements include new floors, ceilings, wiring, and wall coverings. These improvements are estimated to yield benefits for 8 years. Diaz leases (does not own) its store and has 5 years remaining on the lease. 1. & 2. Prepare the journal entry to record the cost of modernization and amortization at the end of this current year. View transaction list Journal entry worksheet < 1 2 Record the cost of modernization of the store for $170,000 cash. Note: Enter debits before credits. Date January 01 General Journal Debit Credit Record entry Clear entry View general Journal > Journal entry worksheet 1 2 Record the year-end adjusting entry for the amortization expense of the leasehold improvements. Note: Enter debits before credits. Date December 31 General Journal Debit Credit QS 8-14 (Algo) Reporting intangible assets LO P4 Robotix Company purchases a patent for $23,500 on January 1. The patent is good for 18 years, after which anyone can use the patent technology. However, Robotix plans to sell products using that patent technology for only 5 years. Prepare the intangible asset section of the year end balance sheet after amortization expense for the year is recorded. Intangible assets ROBOTIX COMPANY Balance Sheet December 31 Assets 0 QS 8-15 (Algo) Computing goodwill LO P4 Baine Company purchased Vera Company at a price of $545,000. The fair value of the net assets purchased equals $438,000 Compute the amount of goodwill that Baine records at the purchase date. Goodwill at purchase date QS 8-16 (Algo) Identifying research and development expenses LO P4 A&J Company incurred the following expenses related to patented drugs. Legal fees in successful patent defense Researcher salaries to develop drugs Acquired a new patent Research lab rent expense $ 23,000 86,200 51,200 7,200 1. Indicate costs that are reported as research and development expenses on the income statement. 2. Indicate costs that are capitalized and reported in the Patent account on the balance sheet. 1. Total research and development expenses 2. Total capitalized costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entry for Modernization Cost Date January 1 Account Title Debit Credit Leasehold Imp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started