On January 1 of Year 1, Keefe Corporation purchased equipment at a cost of $400,000. The...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

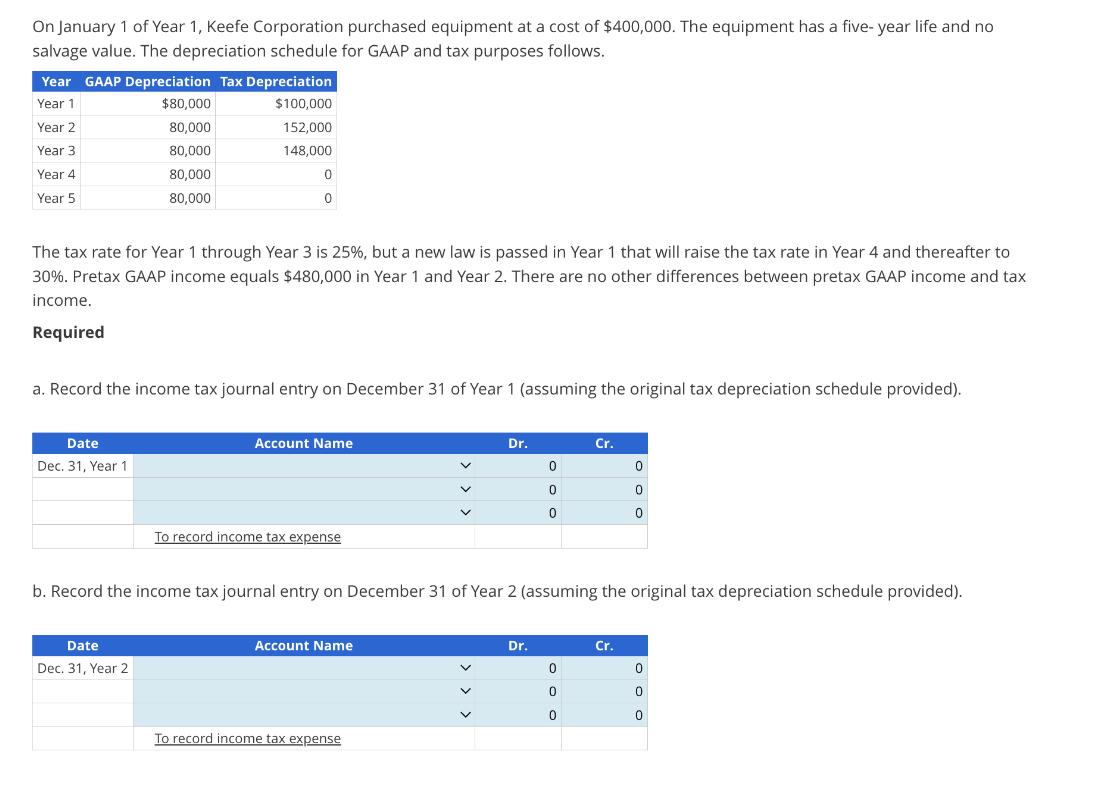

On January 1 of Year 1, Keefe Corporation purchased equipment at a cost of $400,000. The equipment has a five-year life and no salvage value. The depreciation schedule for GAAP and tax purposes follows. Year GAAP Depreciation Tax Depreciation Year 1 $100,000 Year 2 152,000 148,000 Year 3 Year 4 Year 5 $80,000 80,000 80,000 80,000 80,000 The tax rate for Year 1 through Year 3 is 25%, but a new law is passed in Year 1 that will raise the tax rate in Year 4 and thereafter to 30%. Pretax GAAP income equals $480,000 in Year 1 and Year 2. There are no other differences between pretax GAAP income and tax income. Required Date Dec. 31, Year 1 0 0 a. Record the income tax journal entry on December 31 of Year 1 (assuming the original tax depreciation schedule provided). Date Dec. 31, Year 2 Account Name To record income tax expense Account Name Dr. To record income tax expense 0 b. Record the income tax journal entry on December 31 of Year 2 (assuming the original tax depreciation schedule provided). Dr. 0 0 Cr. 0 0 0 0 0 0 Cr. 0 0 0 On January 1 of Year 1, Keefe Corporation purchased equipment at a cost of $400,000. The equipment has a five-year life and no salvage value. The depreciation schedule for GAAP and tax purposes follows. Year GAAP Depreciation Tax Depreciation Year 1 $100,000 Year 2 152,000 148,000 Year 3 Year 4 Year 5 $80,000 80,000 80,000 80,000 80,000 The tax rate for Year 1 through Year 3 is 25%, but a new law is passed in Year 1 that will raise the tax rate in Year 4 and thereafter to 30%. Pretax GAAP income equals $480,000 in Year 1 and Year 2. There are no other differences between pretax GAAP income and tax income. Required Date Dec. 31, Year 1 0 0 a. Record the income tax journal entry on December 31 of Year 1 (assuming the original tax depreciation schedule provided). Date Dec. 31, Year 2 Account Name To record income tax expense Account Name Dr. To record income tax expense 0 b. Record the income tax journal entry on December 31 of Year 2 (assuming the original tax depreciation schedule provided). Dr. 0 0 Cr. 0 0 0 0 0 0 Cr. 0 0 0 On January 1 of Year 1, Keefe Corporation purchased equipment at a cost of $400,000. The equipment has a five-year life and no salvage value. The depreciation schedule for GAAP and tax purposes follows. Year GAAP Depreciation Tax Depreciation Year 1 $100,000 Year 2 152,000 148,000 Year 3 Year 4 Year 5 $80,000 80,000 80,000 80,000 80,000 The tax rate for Year 1 through Year 3 is 25%, but a new law is passed in Year 1 that will raise the tax rate in Year 4 and thereafter to 30%. Pretax GAAP income equals $480,000 in Year 1 and Year 2. There are no other differences between pretax GAAP income and tax income. Required Date Dec. 31, Year 1 0 0 a. Record the income tax journal entry on December 31 of Year 1 (assuming the original tax depreciation schedule provided). Date Dec. 31, Year 2 Account Name To record income tax expense Account Name Dr. To record income tax expense 0 b. Record the income tax journal entry on December 31 of Year 2 (assuming the original tax depreciation schedule provided). Dr. 0 0 Cr. 0 0 0 0 0 0 Cr. 0 0 0

Expert Answer:

Related Book For

Posted Date:

Students also viewed these accounting questions

-

The Southwestern High School Class of 1982 is organizing its 35-year class reunion and is trying to pick out a band to play at the reunion. The choices are REO Speedwagon (R), Boston (B), Journey...

-

In June, Bill made several purchases to accommodate his growing business. June 2 Bill purchased a storage location for lawn care equipment, paid $45,000 for a building on 1 acre. The land is...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Which of the following would be least important in the pursuit of a time-based strategy? A) flexible technology B) operational agility C) reduced complaint resolution times D) quick changeover times...

-

Does Monsanto maintain an ethical culture that can effectively respond to various stakeholders ? The original Monsanto was very different from the current company. It was started by John F. Queeny in...

-

Two metal spheres are suspended from ropes. In equilibrium, they are at the same height, as shown in figure 1.35. The distance between the spheres is 5.75 cm when q1 = -300 nC and q2 = -200 nC....

-

Jo, John and Jack are three generations of the one family involved for nearly 50 years in providing legal services. The firm is preparing its fees budget for the year ending 30 June 2025. It budgets...

-

Over-the-Rhine Company used 5,500 board feet of raw materials with a standard cost of $6.00 per board foot to make 400 tables. The companys standard is 14 board feet per table. Calculate the companys...

-

Outback Outfitters sells recreational equipment. One of the company's products, a small camp stove, sells for $110 per unit. Variable expenses are $77 per stove, and fixed expenses associated with...

-

1 [6-d-1] On January 2, 2019, the Street Improvement Bond Debt Service Fund (DS) budget for 2019 was legally adopted. The budget provides for estimated property tax revenue of $900,000, of which...

-

A benchmark is a typical program which accurately predicts the performance of all other applications. [5 marks] (c) Complex instruction set computers minimise the semantic gap between machine code...

-

Imagine you are working for an organisation with an older audience, mainly digital immigrants. Write 500 words explaining the key changes in traditional to digital marketing and what this means to...

-

A large regional car distributor with outlets in the Midlands is planning to introduce the telephone into its acquisition and retention programme. Draw up a proposal that explains: the possible use...

-

Compare and contrast the relative merits of door drops and inserts. Which would be the probable better bet for a pizza delivery firm advertising in a small town?

-

Interflora is a flower delivery network that allows you to call one florist and get flowers delivered by another in the network. They have agreed flower ranges and set processes, which are methods of...

-

Outline what creative principles an international distress charity should take into account before emailing prospective donors.

-

What is the total variance of the following portfolio including 2 assets invested in the ratio of: 3:1. Asset A: E(r) = 0.3, s = 0.6 Asset B: E(r) = 0.4, s = 0.8 Correlation: 0.8 rf = 0.1.

-

Modify the CYK algorithm so that it applies to any CFG, not just those in CNF.

-

Table Corporation purchased Chairs Unlimited for $10 million. The fair market value of Chairs net assets at the time was $8 million, so Table Corporation recorded $2 million of good will. Also...

-

The transactions for Safe Harbor Daycare, Inc., for the month of October 2012 are posted in the following T-accounts. Requirements 1. Calculate account balances at October 31, 2012. 2. Prepare the...

-

The transactions for Grinko, Inc., for the month of June 2012 have been posted to the accounts as follows: Requirements 1. Prepare the journal entries that served as the sources for the six...

-

Who is currently in your own network that you could use for prospecting? How might you add to your network?

-

Pick any three of the sources of prospects discussed in the chapter and pick a product or service you like. Develop several ideas for how you would use each source to locate leads for the product or...

-

Why do you think a salesperson might experience call reluctance? How can it be overcome?

Study smarter with the SolutionInn App