Question: On January 1 st , 2018, your first client established a portfolio with $1,000,000. They purchased the top 10 Australian shares at the time, giving

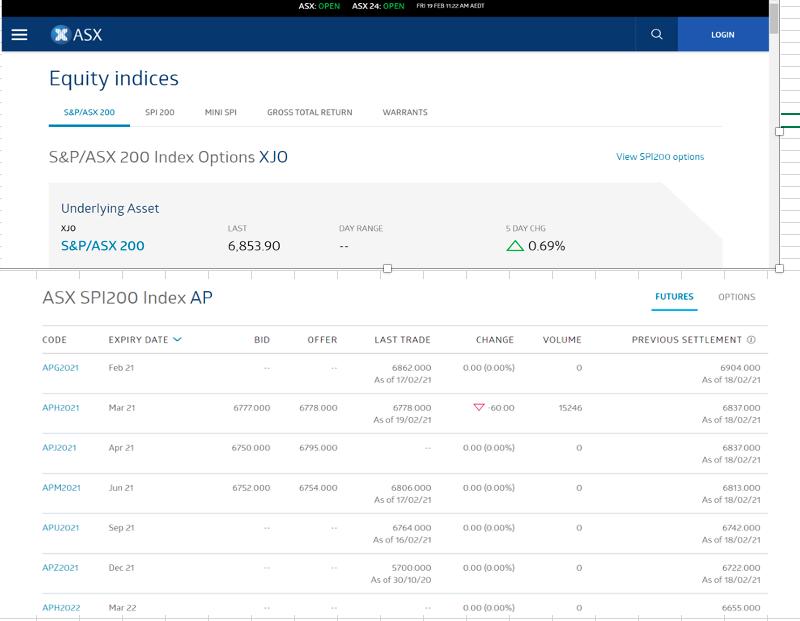

On January 1st, 2018, your first client established a portfolio with $1,000,000. They purchased the top 10 Australian shares at the time, giving them proportions according to the market capitalisation. They have recently become concerned about a potential market downturn over the next three months due to a mutated COVID strain and has asked you to set up a hedge for her using SPI200 futures contracts. The contract will be established today (19thFebruary 2021) and should be in place until at least May 19th, 2021.

Question:

which contract should be chosen and state the day of expiry for the contract? and why

what is the spot price, when calculating theoretical futures value?

ASX: OPEN ASX 24: OPEN FRI 19FEB 12z AM AEDT X ASX LOGIN Equity indices S&P/ASX 200 SPI 200 GROSS TOTAL RETURN MINI SPI WARRANTS S&P/ASX 200 Index Options XJO View SPIZ00 options Underlying Asset XJO LAST DAY RANGE 5 DAY CHG S&P/ASX 200 6,853.90 A0.69% ASX SPI200 Index AP FUTURES OPTIONS CODE EXPIRY DATE BID OFFER LAST TRADE CHANGE VOLUME PREVIOUS SETTLEMENT O APG2021 Feb 21 6862.000 0.00 (0.00%) 6904 000 As of 17/02/21 As of 18/02/21 APH2021 Mar 21 6777.000 6778.000 6778 000 V 60 00 15246 6837.000 As of 19/02/21 As of 18/02/21 API2021 Apr 21 6750.000 6795.000 0.00 (0 00%) 6837000 As of 18/02/21 APM2021 Jun 21 6752.000 6754.000 6806 000 0.00 (0.00%) 6813.000 As of 17/02/21 As of 18/02/21 APU2021 Sep 21 6764 000 0.00 (0 00%) 6742.000 As of 16/02/21 As of 18/02/21 AP22021 Dec 21 5700.000 0.00 (0.00%) 6722.000 As of 30/10/20 As of 18/02/21 APH2022 Mar 22 0.00 (0 00%) 6655 000

Step by Step Solution

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Solution The contract to be chosen is APZ2021 having an expiry date of Decem... View full answer

Get step-by-step solutions from verified subject matter experts