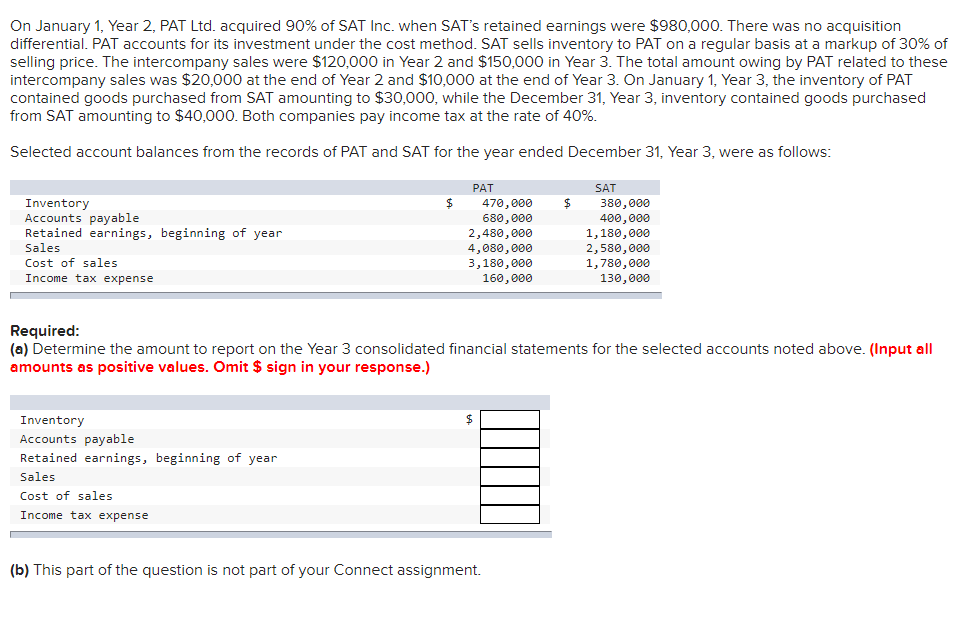

Question: On January 1 , Year 2 , PAT Ltd . acquired 9 0 % of SAT Inc. when SAT's retained earnings were $ 9 8

On January Year PAT Ltd acquired of SAT Inc. when SAT's retained earnings were $ There was no acquisition

differential. PAT accounts for its investment under the cost method. SAT sells inventory to PAT on a regular basis at a markup of of

selling price. The intercompany sales were $ in Year and $ in Year The total amount owing by PAT related to these

intercompany sales was $ at the end of Year and $ at the end of Year On January Year the inventory of PAT

contained goods purchased from SAT amounting to $ while the December Year inventory contained goods purchased

from SAT amounting to $ Both companies pay income tax at the rate of

Selected account balances from the records of PAT and SAT for the year ended December Year were as follows:

Required:

a Determine the amount to report on the Year consolidated financial statements for the selected accounts noted above. Input all

amounts as positive values. Omit $ sign in your response.

Inventory

Accounts payable

Retained earnings, beginning of year

Sales

Cost of sales

Income tax expense

$

b This part of the question is not part of your Connect assignment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock