Question: On January 2 , 2 0 2 0 , Bridgeport Corporation issued $ 1 , 3 0 0 , 0 0 0 of 1 0

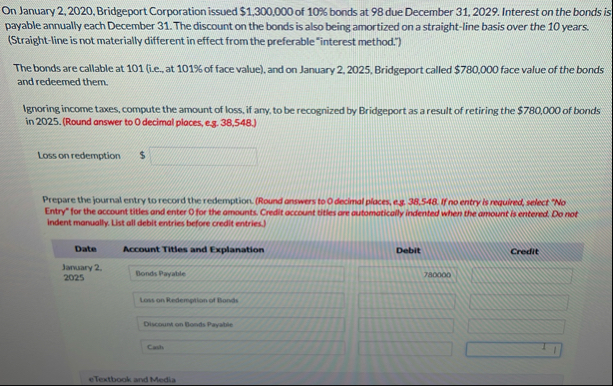

On January Bridgeport Corporation issued $ of bonds at due December Interest on the bonds is payable annually each December The discount on the bonds is also being amortized on a straightline basis over the years. Straightline is not materially different in effect from the preferable "interest method."

The bonds are callable at ie at of face value and on January Bridgeport called $ face value of the bonds and redeemed them.

Ignoring income taxes, compute the amount of loss, if any, to be recognized by Bridgeport as a result of retiring the $ of bonds in Round answer to O decimal places, es

Loss on redemption $

Prepare the journal entry to record the redemption. Round answers to decimal places, e If no entry is required, select No Entry" for the occount titles and enter for the omounts. Credit account titles are automotically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.

Date Account Titles and Explanation

Debit

Credit

Janusary

Donds Payatile

Loss on Redemption of Bonds

Discrium on Bonds Payatie

Cants

eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock