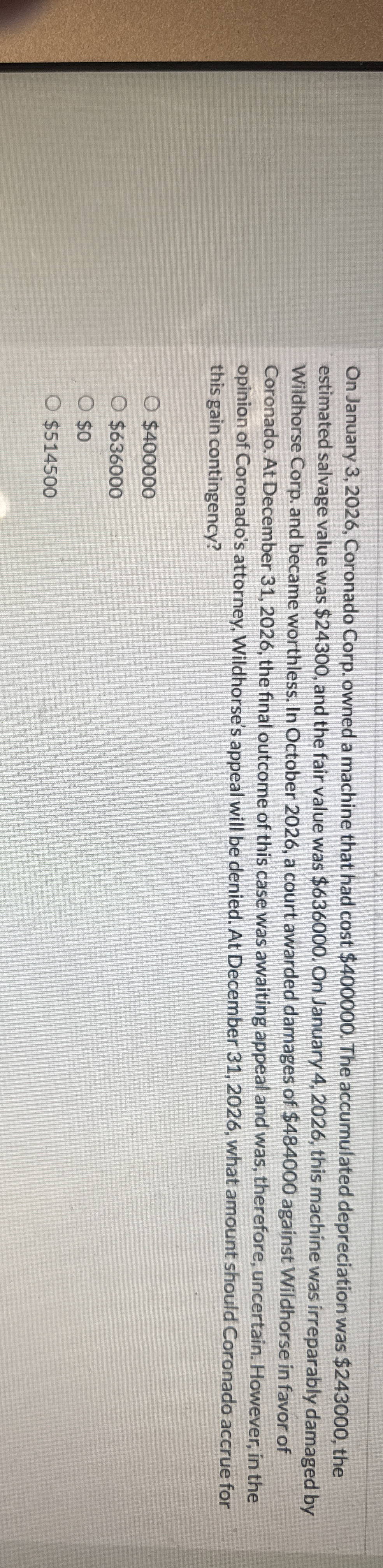

Question: On January 3 , 2 0 2 6 , Coronado Corp. owned a machine that had cost $ 4 0 0 0 0 0 .

On January Coronado Corp. owned a machine that had cost $ The accumulated depreciation was $ the estimated salvage value was $ and the fair value was $ On January this machine was irreparably damaged by Wildhorse Corp. and became worthless. In October a court awarded damages of $ against Wildhorse in favor of Coronado. At December the final outcome of this case was awaiting appeal and was, therefore, uncertain. However, in the opinion of Coronado's attorney, Wildhorse's appeal will be denied. At December what amount should Coronado accrue for this gain contingency?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock