Question: On July 1 , 2 0 X 1 , Amos Corporation granted nontransferable, nonqualified stock options to certain key employees as additional compensation. The options

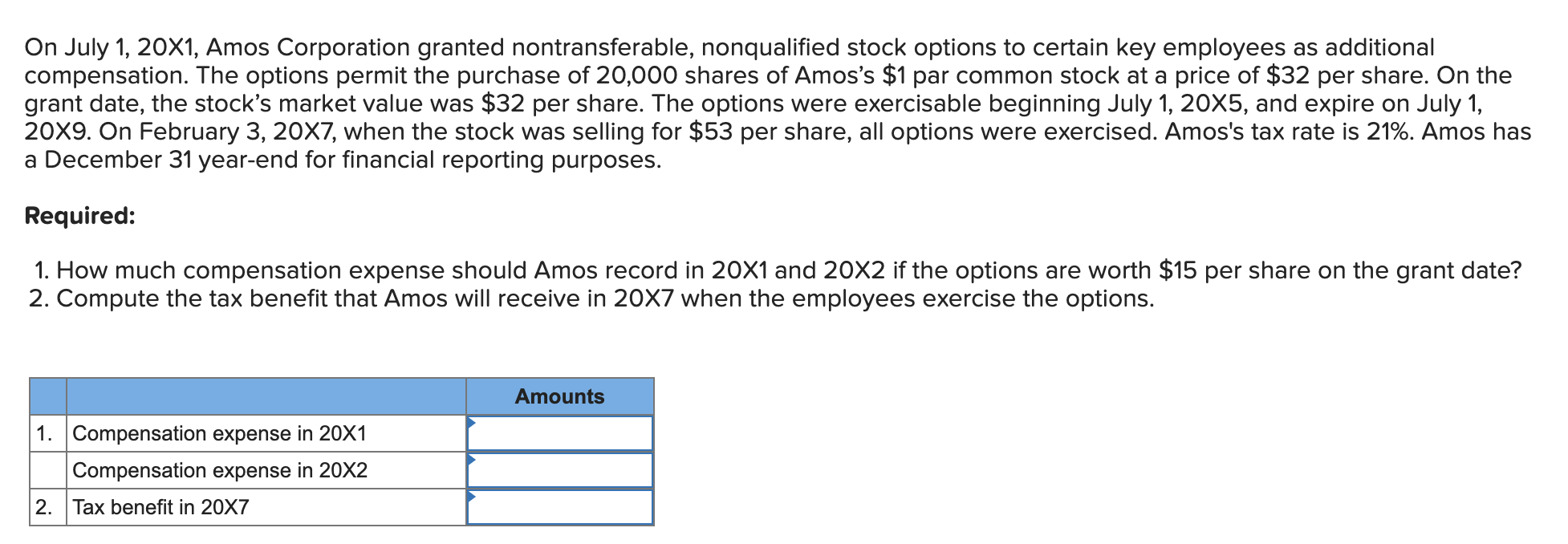

On July X Amos Corporation granted nontransferable, nonqualified stock options to certain key employees as additional compensation. The options permit the purchase of shares of Amos's $ par common stock at a price of $ per share. On the grant date, the stock's market value was $ per share. The options were exercisable beginning July X and expire on July X On February X when the stock was selling for $ per share, all options were exercised. Amos's tax rate is Amos has a December yearend for financial reporting purposes.

Required:

How much compensation expense should Amos record in times and times if the options are worth $ per share on the grant date?

Compute the tax benefit that Amos will receive in X when the employees exercise the options.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock