Question: On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 209,000. The goods were delivered

On June 1, Year 3, Forever Young Corp. (FYC) ordered merchandise from a supplier in Turkey for Turkish lira (TL) 209,000. The goods were delivered on September 30, with terms requiring cash on delivery. On June 2, Year 3, FYC entered a forward contract as a cash flow hedge to purchase TL 209,000 on September 30, Year 3, at a rate of $0.82. FYCs year-end is June 30.

On September 30, Year 3, FYC paid the foreign supplier in full and settled the forward contract.

Exchange rates were as follows:

| Spot Rates | Forward Rates* | |

| June 1 and 2, Year 3 | TL1 = $0.790 | TL1 = $0.820 |

| June 30, Year 3 | TL1 = $0.780 | TL1 = $0.815 |

| September 30, Year 3 | TL1 = $0.830 | TL1 = $0.830 |

*For contracts expiring on September 30, Year 3.

Required:

(a) (i) Prepare all journal entries required to record the transactions described above.

1. Record the forward contract.

2. Revalue forward contract at fair value.

3. Revalue forward contract at fair value.

4.Record the receipt of cash from bank.

5. Record the purchase of inventory.

6. Clear commitment liability or other comprehensive income.

PLEASE ONLY USE THE FOLLOWING ACCOUNTS

no journal entry requried

accounts payable

accounts receivable

bills payable

cash

due from bank

exchange gain and losses

equipment

forward contract

inventory

land

loan payable note payable

other comprehensive income - cash flow hedge

payable to bank

purchase

receivable from bank

sales

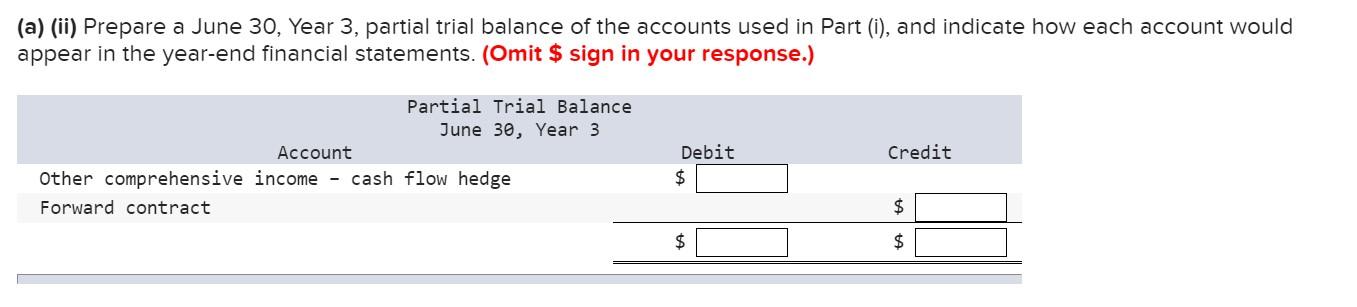

(a) (ii) Prepare a June 30, Year 3, partial trial balance of the accounts used in Part (i), and indicate how each account would appear in the year-end financial statements. (Omit $ sign in your response.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts